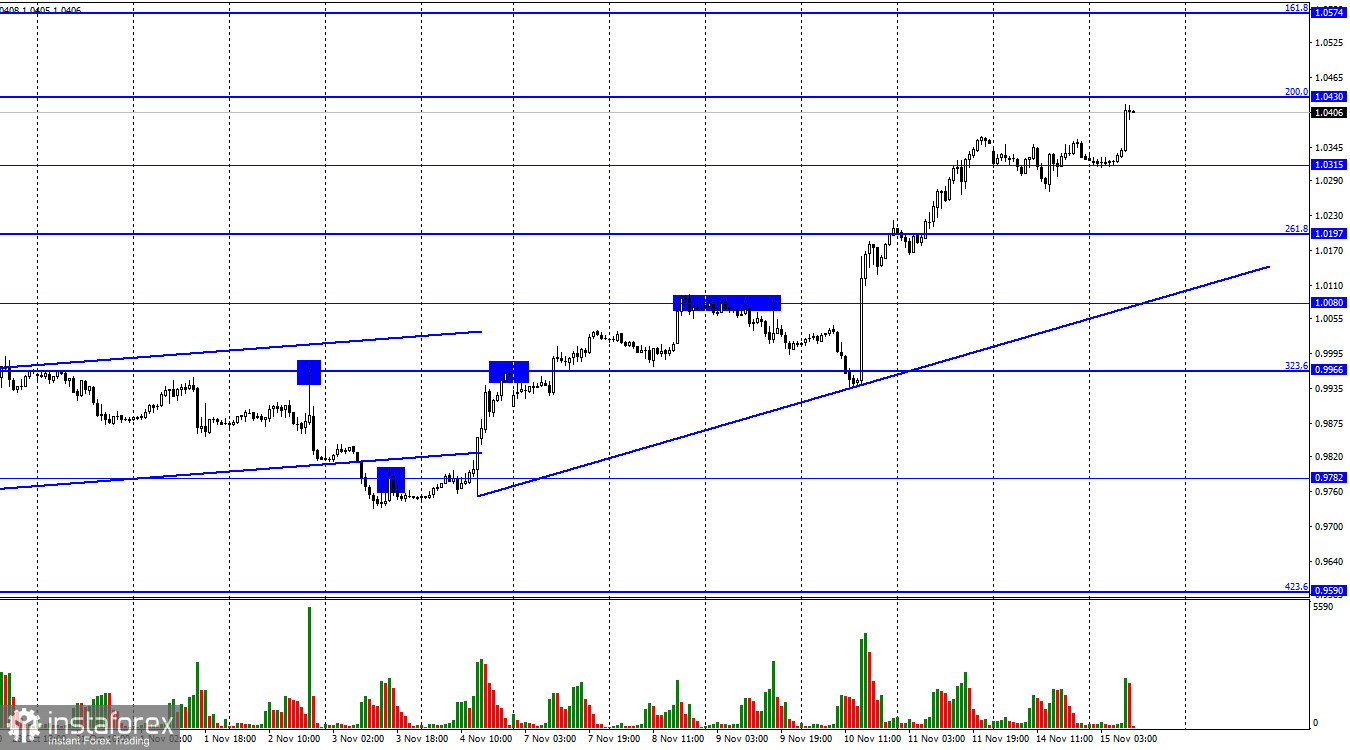

The EUR/USD pair did not show any interesting movements on Monday, but on Tuesday morning, it already managed to grow by 100 points and continued the growth towards the corrective level of 200.0% (1.0430). The rebound of quotes from this level will favor the US currency and fall in the direction of 1.0315. Consolidation above 1.0430 will increase the probability of further growth towards the next Fibo level of 161.8% (1.0574).

Today, the European Union will release a rather important and interesting report on GDP. However, traders did not even wait for this report and continued buying the euro. On Monday, the information background was zero. Thus, for two weeks now, traders have been strenuously buying the euro currency, although not every day, there are reasons and relevant factors for this. Such a movement as it is now, although it is a trend, is very difficult to predict. If earlier I could say that the difficult geopolitical situation in the world and the "hawkish" monetary policy of the Fed could cause the dollar to rise almost every day, now I cannot say the same about the euro currency. The ECB also raises the rate quite quickly, but at the same time, the Fed continues to tighten the PEPP. Therefore, I need help understanding the strong growth of the European currency.

The GDP report for the third quarter is likely to show an increase of 0.2% q/q, which is still very good. In the US, two out of three quarters this year turned out to be negative, and in the UK, the economy has already lost 0.2% in the third quarter. The European economy shows the best stability. The growth is small, but every quarter without serious falls. There will be other important events and reports this week, but why do traders need them if they clearly understand what to do without them? The rising trend line proves this.

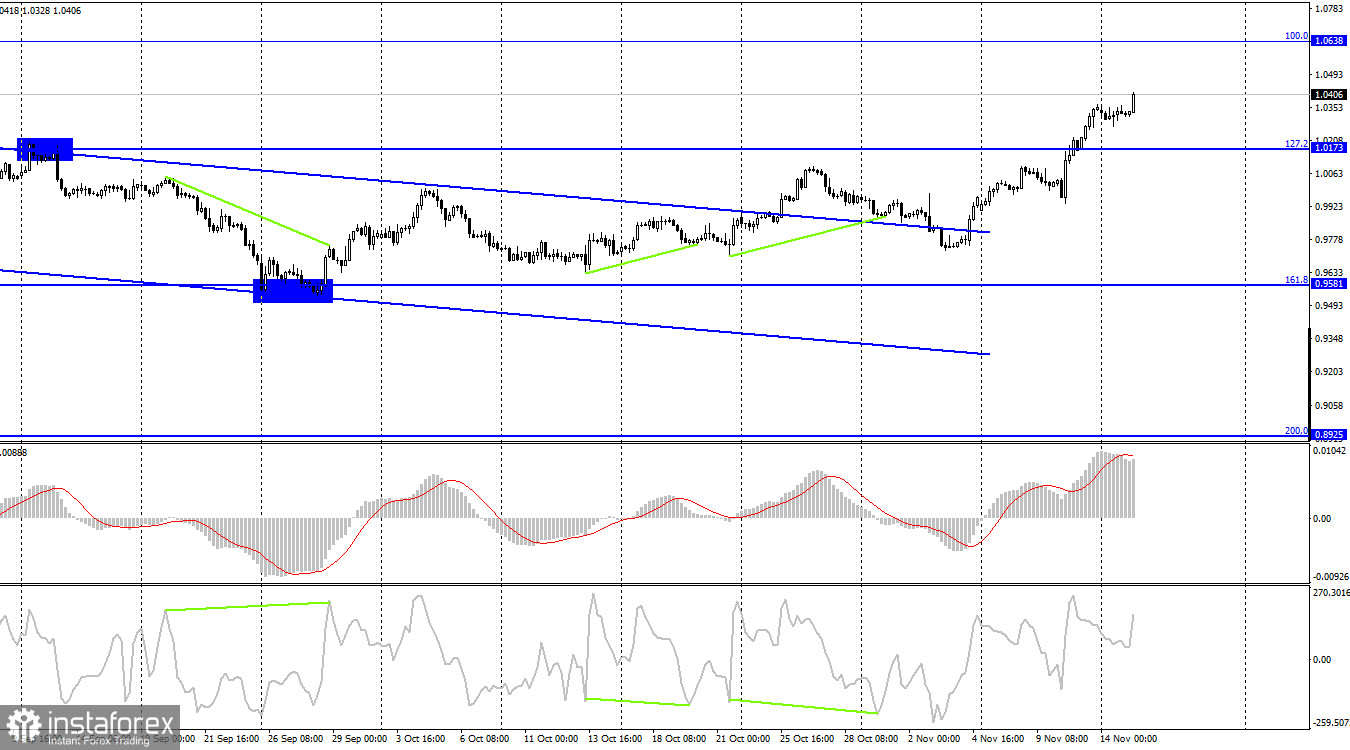

On the 4-hour chart, the pair secured above the corrective level of 127.2% (1.0173). Thus, the growth process can be continued toward the next Fibo level of 100.0% (1.0638). Emerging divergences are not observed in any indicator today. Closing the pair's quotes at 1.0173 will work in favor of the US currency and some fall.

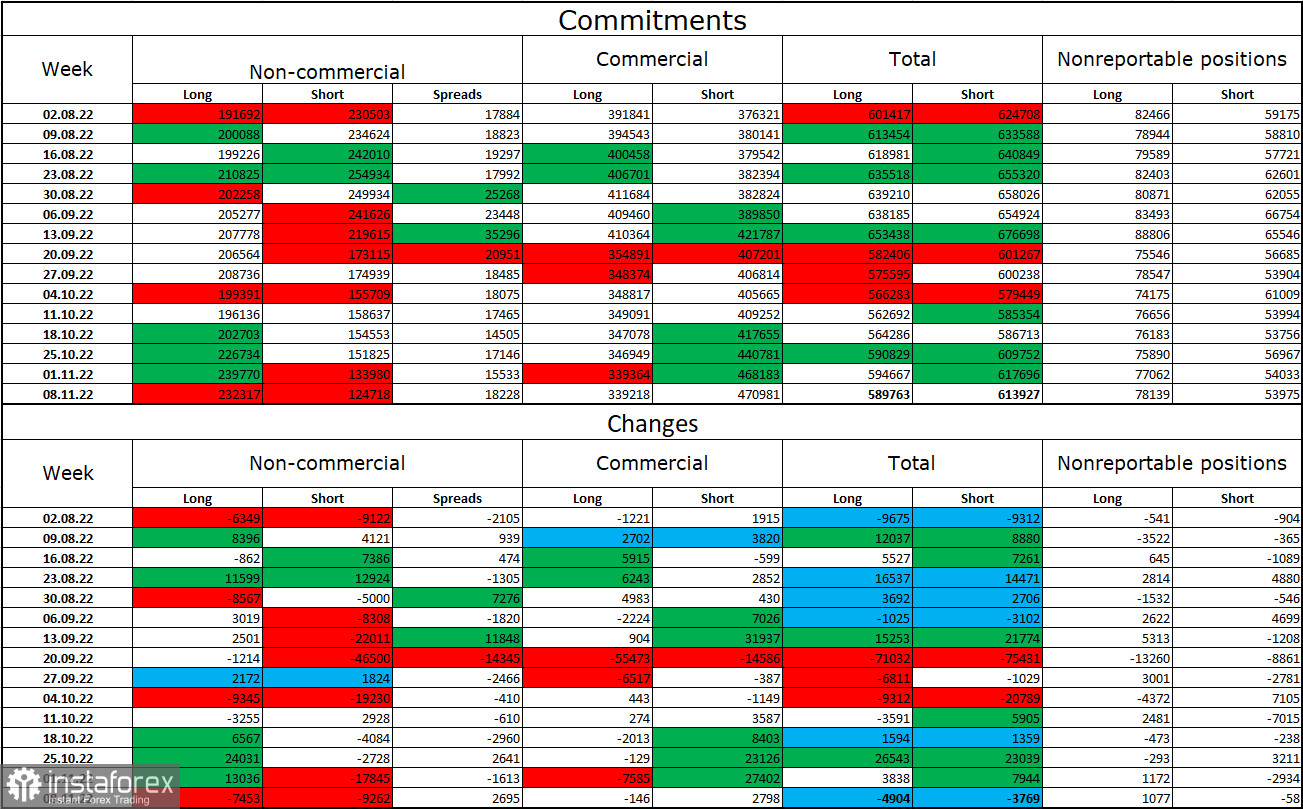

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 7,453 long contracts and 9,262 short contracts. This means that the mood of large traders has become a little more "bullish" than before. The total number of long contracts concentrated in the hands of speculators now amounts to 232 thousand, and short contracts – 124 thousand. And for the first time in a long time, I can say that the European currency is growing, which corresponds to the COT reports. In the last few weeks, the chances of the euro currency's growth have been increasing, but traders were not ready to completely abandon purchases of the US dollar. Now the situation is changing in favor of the euro currency. I will also note the descending corridor on the 4-hour chart, over which it was still possible to close. Accordingly, we can see the continuation of the growth of the euro currency, which is very difficult to explain if we consider and analyze the information background.

News calendar for the USA and the European Union:

EU – GDP in the third quarter (10:00 UTC).

USA - Producer Price Index (PPI) (13:30 UTC).

On November 15, the calendars of economic events of the European Union and the United States contain one entry each. However, the pair is trading very actively even without these reports. The influence of the information background on the mood of traders today will be weak.

EUR/USD forecast and recommendations to traders:

I recommend selling the pair when fixing quotes under the trend line on the hourly chart with a target of 0.9782. I recommended buying the euro currency when rebounding from the 0.9966 level on the hourly chart with a target of 1.0080. The plan has been exceeded twice, and now it is possible to hold these positions with the goals of 1.0315 and 1.0430.