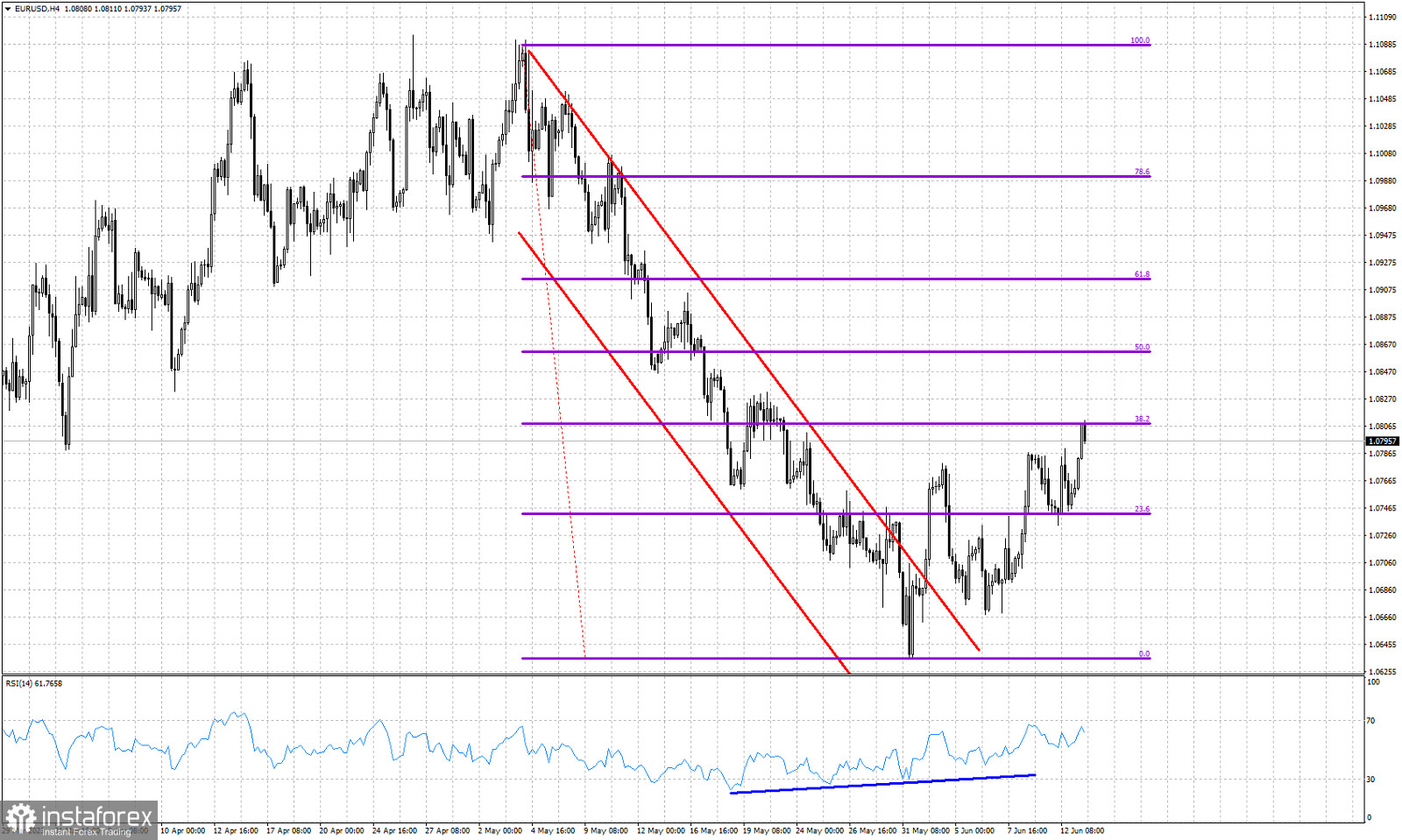

Violet lines- Fibonacci retracement level

Red lines- bearish channel (broken)

Blue line- bullish RSI divergence

In previous posts using the Ichimoku cloud indicator we noted the change in short-term trend from bearish to bullish. Technically we got the same message when price broke out of the bearish channel it was in. After the break out, price pulled back to form a higher low at 1.0667. Price continues making higher highs and higher lows. Short-term trend technically remains bullish. Price reached earlier today the 38% Fibonacci retracement level. This is short-term resistance. The rejection at 1.08 was justified. The RSI is making higher highs and higher lows and has still not reached overbought levels. Despite the pause in the advance, I expect EURUSD to continue higher over the coming sessions.