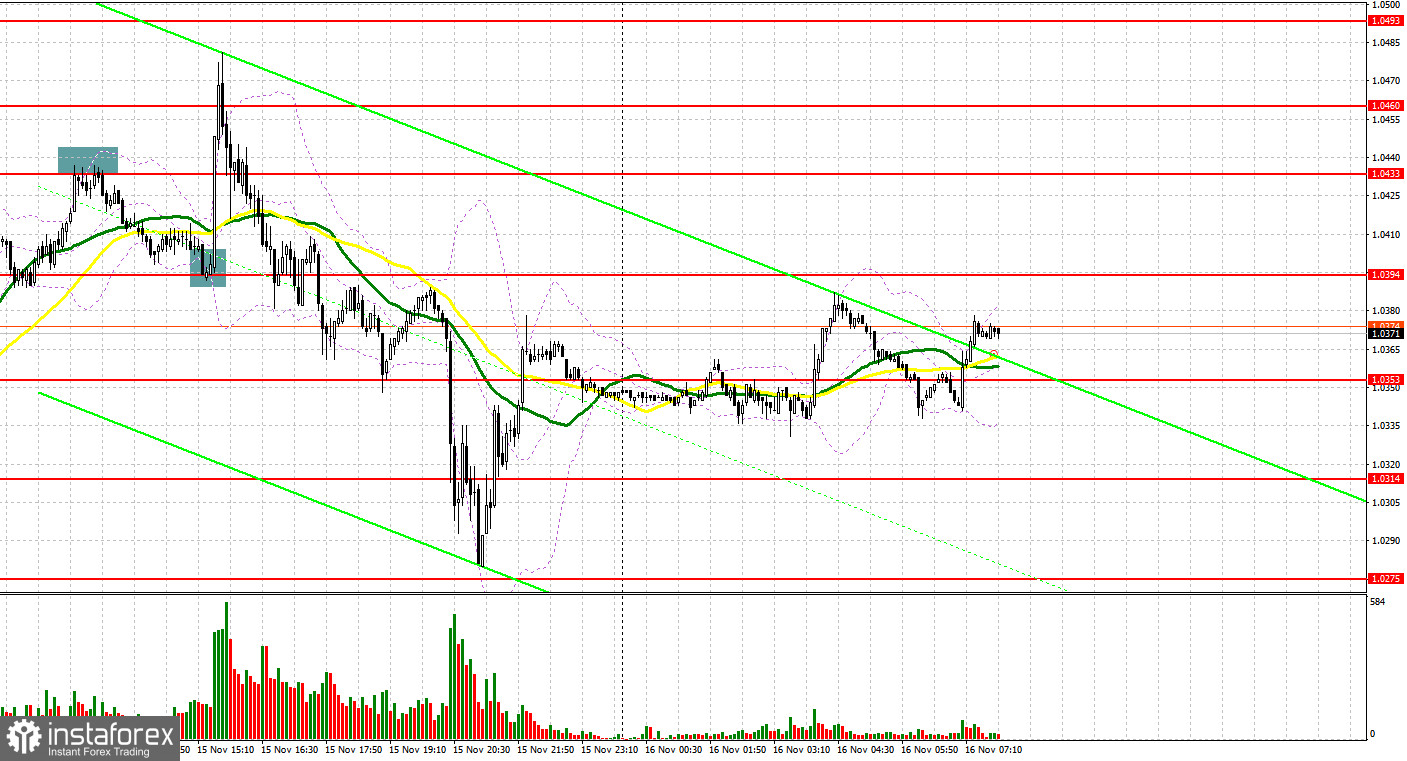

Yesterday, we got several good trading signals. Let's analyze the pair on the 5-minute chart. In my morning review, I mentioned the level of 1.0359 and recommended entering the market from there. The pair quickly reached this level in the first half of the day. Then, it broke through this line without retesting it. That is why we could not get a good entry point to buy the euro. In the North American session, a false breakout at 1.0433 generated a sell signal which resulted in a drop to 1.0394. This allowed us to gain profit of 40 pips. A failed attempt to break through the 1.0394 level and an emerging sell signal made the euro jump by 80 pips.

For long positions on EUR/USD:

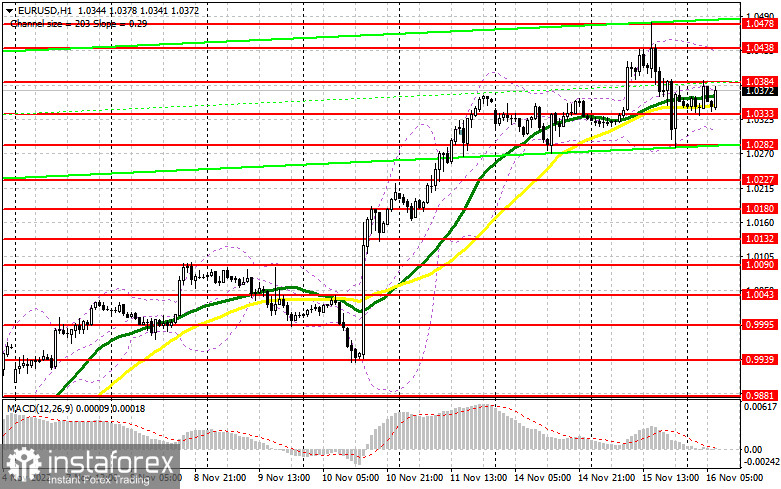

As the US PPI declined way more than expected, the euro surged against the US dollar. Closer to the middle of the New York session, it was reported that two missiles fell in Poland, leaving two people dead. This news sent shockwaves through the market and triggered a sell-off in risk assets. So, the euro retreated against this backdrop. At the moment, the situation has somewhat stabilized. However, I think that the further upside potential of the pair is limited. No important fundamental reports are expected in the EU. So, market participants will focus on the speech by ECB President Christine Lagarde. If she hints that the regulator is going to ease its policy in the near future, the pressure on the euro will increase. This will result in a deep downside correction. The best moment to open long positions will be a decline in the pair and a false breakout at the nearest support of 1.0333. The moving averages that support the bullish trend are located at this level. This will confirm the presence of large market players who are betting on the further rise of the euro. If so, the pair may return to the level of 1.0384. A breakout and a downward retest of this range will pave the way to the high of 1.0438 as well as yesterday's high of 1.0478. If the pair manages to break through this level, this will trigger stop-loss orders set by the bears. If so, another buy signal will emerge with a possible rise to the area of 1.0525. Such a scenario will confirm the bullish trend for this week. If EUR/USD declines and buyers are idle at 1.0333, the euro will come under pressure and may drop to the next support of 1.0282. This level may serve as a lower boundary of the sideways channel that may appear soon. Going long at this point is recommended only after a false breakout. Buying EUR/USD after a rebound is possible at 1.0227 or 1.0180, bearing in mind an upside correction of 30-35 pips within the day.

For short positions on EUR/USD:

Bears are putting pressure on the euro/dollar pair amid the news coming from Poland. A pause that happened during the Asian session may take longer, at least until the publication of the key macroeconomic data from the US. We will discuss this in my afternoon review. That is why I expect the euro to develop a downward correction in the short term. Today, bears can only hope for a false breakout at the nearest resistance of 1.0384. This will create a good entry point and will allow the pair to move lower to the support of 1.0333. The pair may settle below this level only in case the ECB President makes dovish comments about the monetary policy. An upward retest of 1.0333 will serve as a sell signal and will trigger stop-loss orders set by the bulls. If so, the pair may extend its fall to the area of 1.0282 where the euro buyers will step in to win back previous losses. The level of 1.0227 will act as the lowest target where I recommend profit taking. In case EUR/USD rises in the course of the European session and bears are idle at 1.0384, the demand for the pair will increase. As a result, the pair will continue its bullish trend and may retest the level of 1.0438. If this happens, I wouldn't recommend selling the pair at least until a false breakout is formed. Selling EUR/USD right after a rebound is possible at the high of 1.0478 or 1.0525, keeping in mind a downward intraday correction of 30-35 pips.

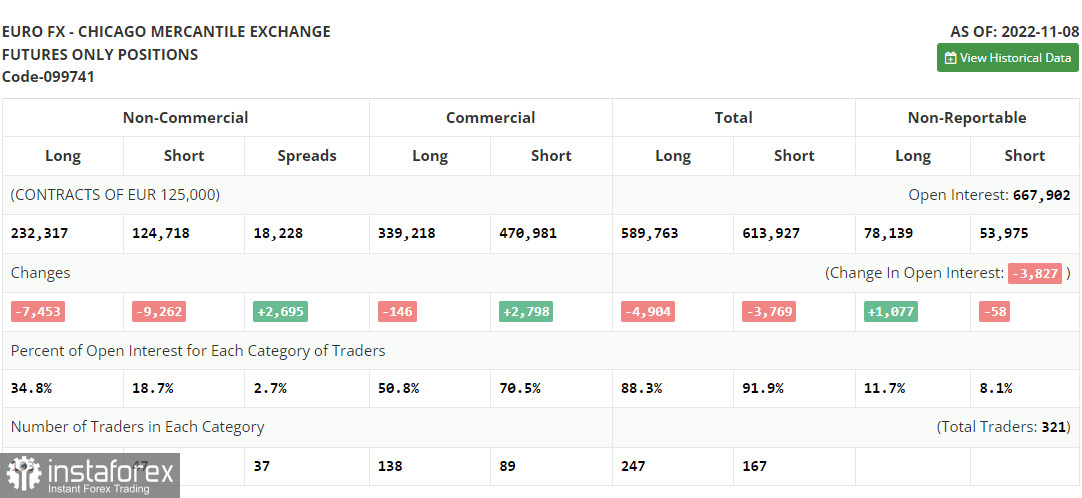

COT report

The Commitments of Traders report for November 8 showed a drop in both short and long positions. This report does not reflect the reaction to the recent US CPI data, so it should not be fully trusted. Despite a slowdown in US consumer prices, and we are talking about a slowdown and not a proper decline, the US Federal Reserve will continue to hike rates. It is expected that the rate increase in December will be between 0.5% and 0.75%. As for the euro, the demand for risk assets has indeed increased. Apart from speculations that the Fed is going to ease the pace of monetary tightening, the euro is driven by the ECB's plan to maintain the rate-hiking cycle. More and more EU officials are saying that borrowing costs should be increased further in order to tackle rising inflation. However, if the EU economy continues to contract at a rapid pace, the regulator may give up the idea of aggressive monetary policy. This will definitely limit the upside potential of the pair in the medium term. According to the COT report, long positions of the non-commercial group of traders dropped by 7,453 to 232,317 while short positions declined by 9,262 to 124,718. The non-commercial net position remained positive at 107,599 versus 105,790 a week earlier. This indicates that investors are taking advantage of a cheaper euro and continue to buy it while it is holding below the parity level. They might also be accumulating long positions in hope that the pair will start to recover sooner or later. The weekly closing price advanced to 1.0104 from 0.9918.

Indicator signals:

Moving Averages

Trading above the 30- and 50-day moving averages indicates that the pair is trading in the bull market.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair advances, the upper band of the indicator at 1.0438 will act as resistance. In case of a downward movement, the lower band of the indicator at 1.0330 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.