Positive sentiment surged on Tuesday, thanks to the latest data in the US, which confirmed the overall inflation dynamics in October both in monthly and yearly terms. According to the report, producer prices rose 0.2% m/m and 8.0% y/y, while the previous value was revised down to 8.4%. This allowed investors to believe again that the Fed would start considering the gradual decrease of interest rate hikes, if not stop it completely.

But even though equity markets in both Europe and the US benefited from the news, the reaction in the forex market was rather weak. The reason could be the stabilization of Treasury yields before the release of data on US retail sales. Forecasts say the core retail sales index will show a 0.5% increase in October, while retail sales will rise by 0.9%.

If the figures turn out to be no worse than the forecast or exceed it, another growth in stocks will be seen. In this case, Treasury yields may resume their decline, which should also put pressure on dollar. That will push the ICE dollar index down below 106 points, towards 105 points.

Forecasts for today:

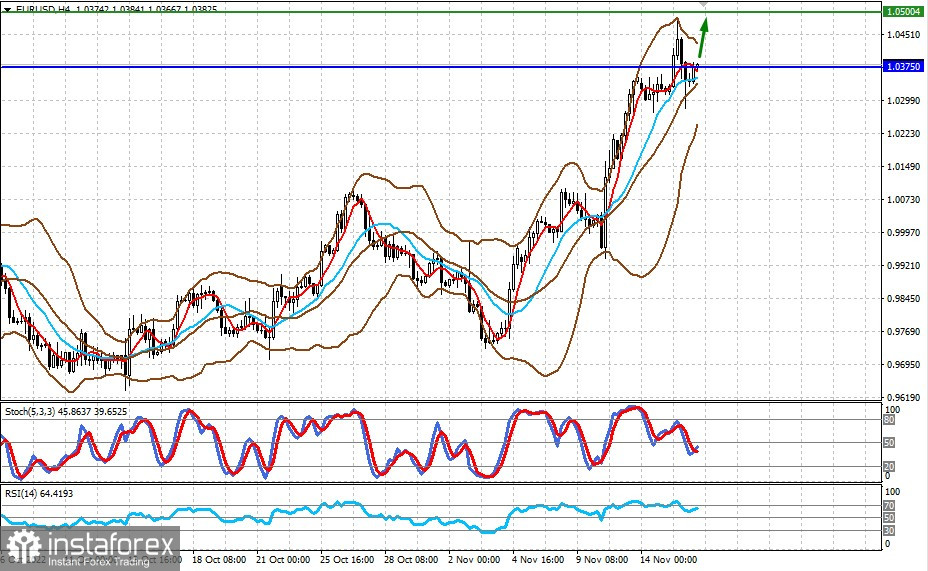

EUR/USD

The pair is trading near the strong resistance level of 1.0375. Positive data from the UScould push it towards 1.0500.

GBP/USD

The pair is below the level of 1.1900. If data from the US does not disappoint or turns out to be higher than expected, pound will resume growth to 1.2000, and then to 1.2020.