Dashing trouble began. After Jerome Powell's fiery speech about a higher peak federal funds rate, who would have thought that gold would not just bounce back but return to 3-month highs? In fact, the slowdown in the rate of tightening of the Fed's monetary policy is a bullish driver for XAUUSD. If inflation remains at elevated levels for a long time, and the Central Bank slows monetary restrictions and eventually pauses, real yields on Treasury bonds will fall, allowing the precious metal to rise above $1,800 an ounce.

The main catalysts of the 9.5% November gold rally were the releases of data on consumer prices and producer prices. Both indicators slowed down more than Bloomberg experts predicted, which gave rise to talk that the Fed is doing its job well and can afford less aggression. In the end, the tightening of monetary policy affects the economy with a time lag, rates are already at restrictive levels, so you can not go as fast as before.

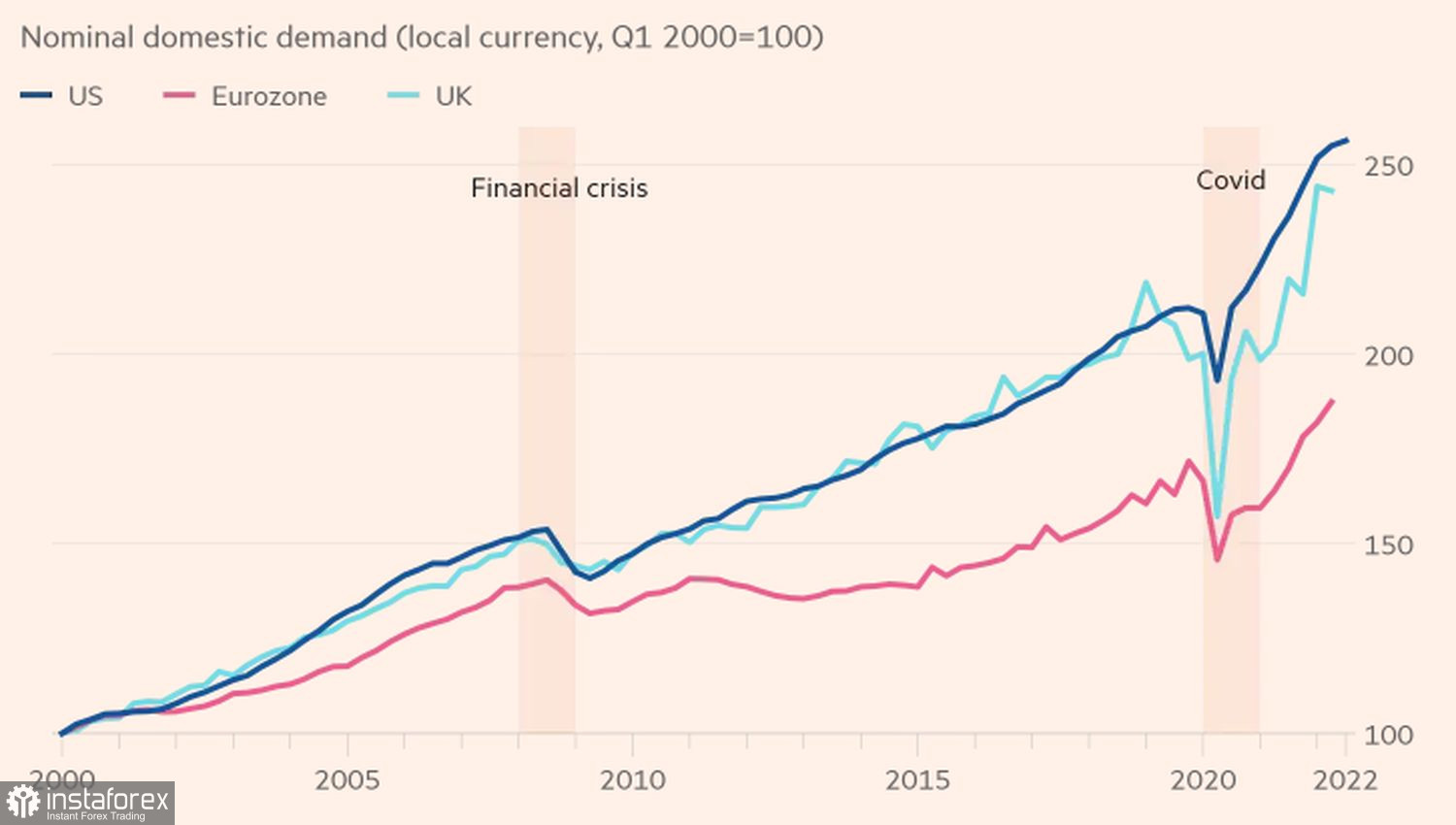

However, in order to defeat inflation, you need to understand its causes well. The Fed and the White House have gone too far with stimulus in response to the pandemic. As a result, domestic demand grew by 21.4% in the three years to the end of the second quarter of 2022, which is equivalent to an annual GDP growth of 6.7%. No wonder inflation is so high and the job market is strong as a bull. Americans sitting on a mountain of dollars are in no hurry to return to work.

Dynamics of domestic demand in the US, Britain and the Eurozone

Sooner or later, the money runs out, which will lead to a slowdown in consumer prices in the US by itself. The Fed's aggressive monetary restriction can strengthen their decline. There will be a risk of deflation on the horizon, as in Japan. Ark Invest agrees with this scenario. The company sets the example of the beginning of the 20th century, which was overshadowed by the First World War and the Spanish flu epidemic. Inflation in 1920 in the United States exceeded 20%, but thanks to an aggressive increase in the federal funds rate from 4.6% to 7%, it fell to -15% in 2021.

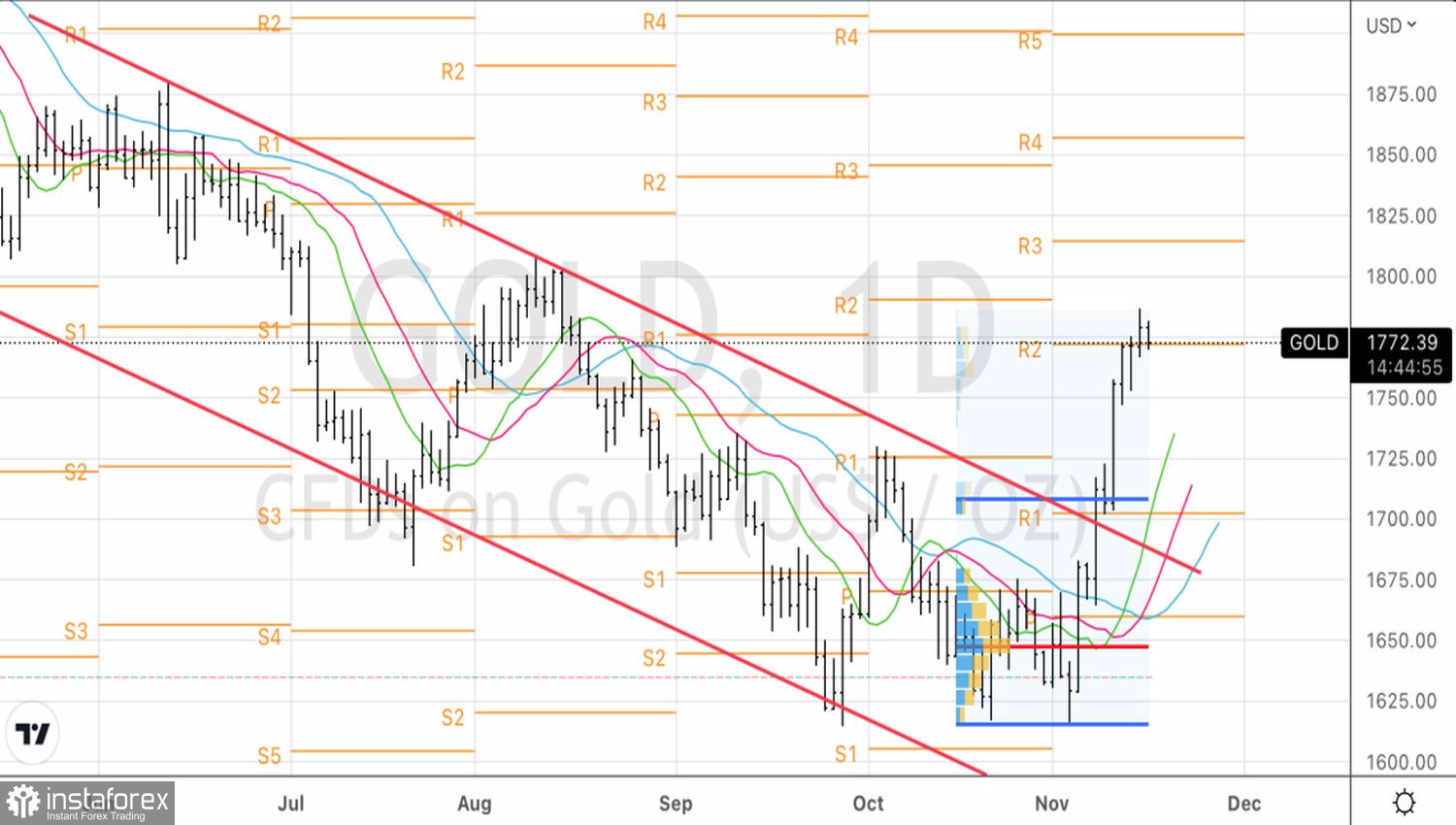

Current conditions have much in common with the period of a hundred years ago. The same scenario of the development of events is not excluded, but in my opinion, it is unlikely. Its implementation would be disastrous for gold, returning its quotes to $1,610 per ounce.

On the contrary, a scenario where the Fed slows down and eventually pauses while inflation remains at elevated levels creates a tailwind for the precious metal. Simultaneously with the fall in real yields of Treasury bonds, the US dollar is also weakening.

Technically, on the daily chart of gold, due to the implementation of the triple bottom pattern the long-term bearish trend was broken. Quotes have gone beyond the descending trading channel and are moving away from the moving averages. I recommend holding the longs formed on the decline to the support at $1,702 and periodically increasing on pullbacks. The targets are $1,790 and $1,815 per ounce.