EUR/USD

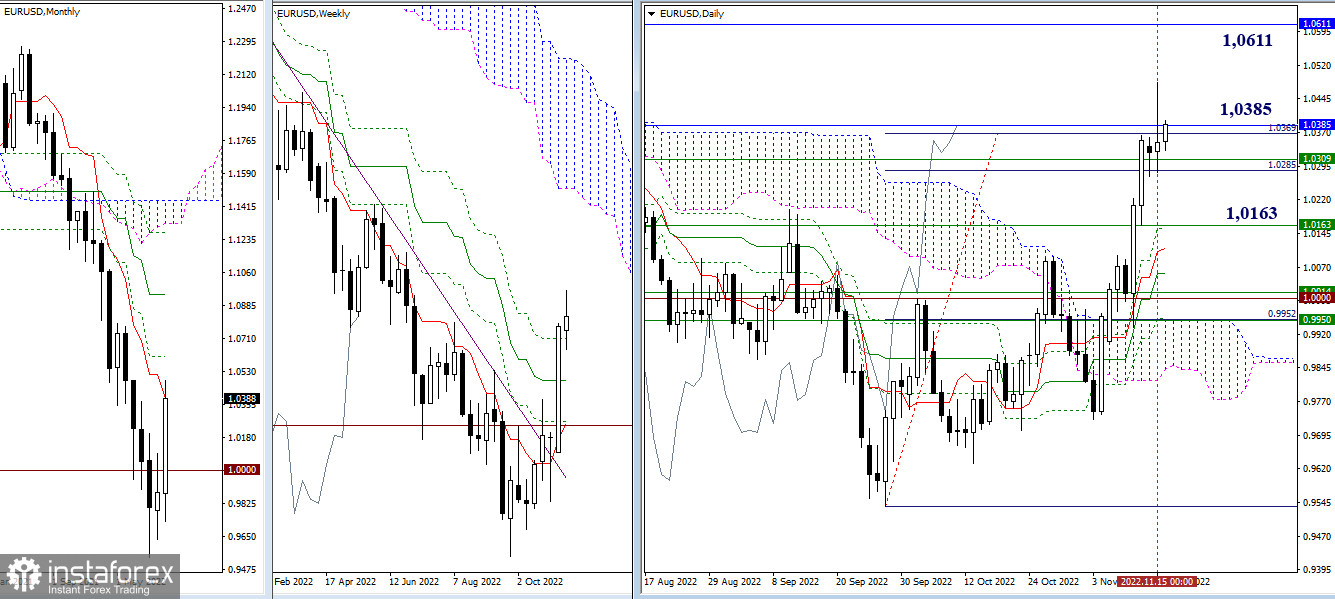

Higher timeframes

Yesterday's attempt to go beyond the zone of resistance and attraction was not successful, a long rising shadow was formed on the daily candle. Today we can say that the tasks of the bulls are still going beyond the zone 1.0285 - 1.0309 - 1.0369 - 1.0385 (final levels of the weekly Ichimoku cross + monthly short-term trend + target for the breakdown of the daily cloud) and secure consolidation above. After that, the next upside target will be weekly resistance at 1.0611.

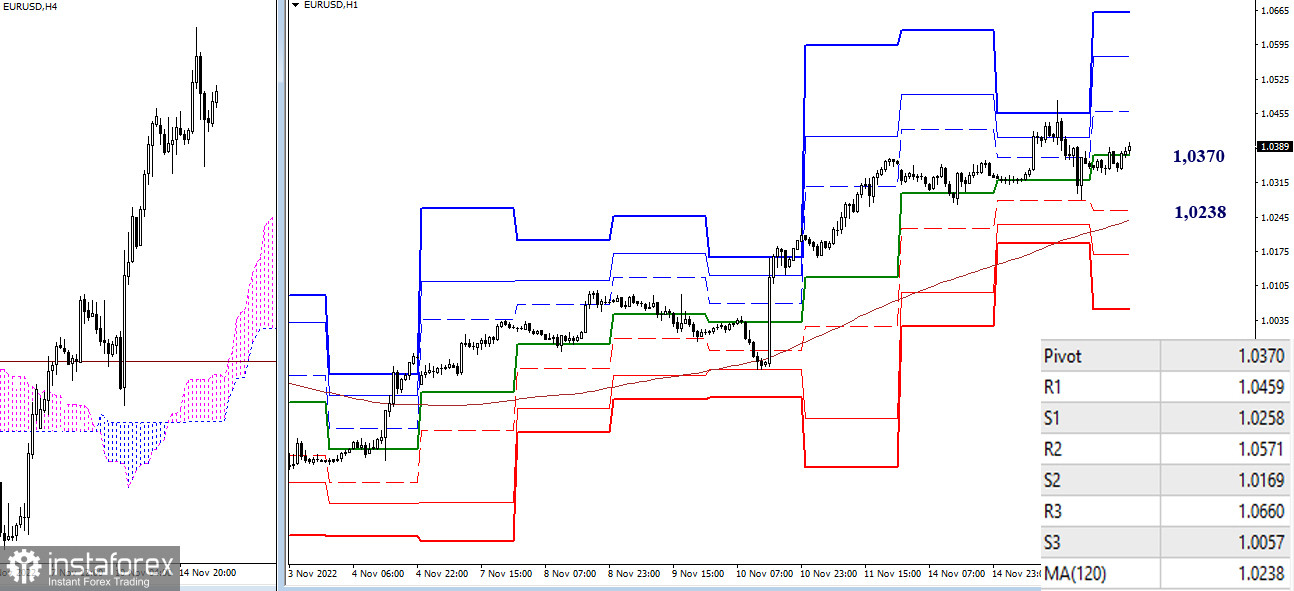

H4 – H1

As of writing, the pair is in the correction zone, where 1.0370 support (central pivot point of the day) is being tested. The next benchmark for the development of the correction is the support of the weekly long-term trend (1.0238). Consolidation below and reversal of the moving average will change the current balance of power. If the correction is completed, the bulls' attention within the day will be directed to the resistance of the classic pivot points, located at 1.0459 – 1.0571 – 1.0660.

***

GBP/USD

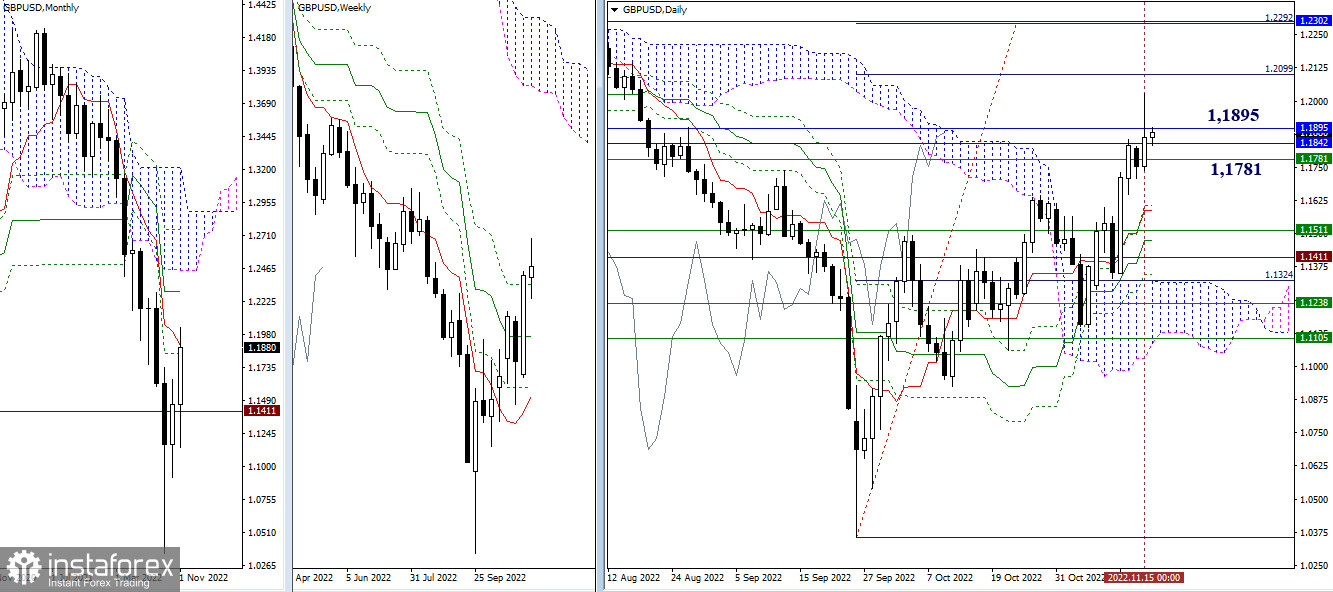

Higher timeframes

Yesterday, it was not possible to go beyond the zone of attraction and resistance. The pair remains in the zone of attraction 1.1895 – 1.1781 (weekly and monthly levels). The following upward benchmarks can be noted at 1.2099 – 1.2292 (the daily target for the breakdown of the cloud), with an increase from the monthly medium-term trend (1.2302). The nearest supports for the higher timeframes are 1.1587 – 1.1511 – 1.1411.

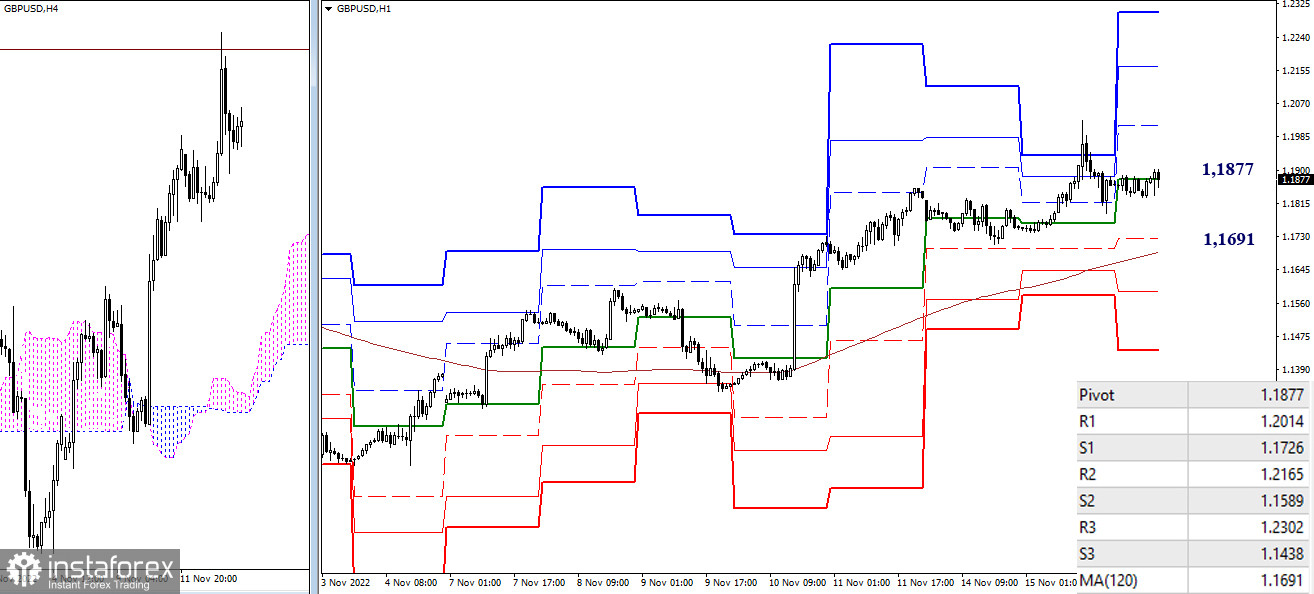

H4 – H1

On the lower timeframes, the pair is in the correction zone, but the main advantage continues to be on the side of the bulls. As of writing, consolidation is observed on H1, near the central pivot point of the day (1.1877). Further, if the decline continues, the weekly long-term trend (1.1691) will serve as support. This level is responsible for the current balance of power. Its breakdown and reversal will change the distribution and preponderance of forces. Benchmarks for the continuation of the rise today can be noted at the resistance of the classic pivot points (1.2014 - 1.2165 - 1.2302).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)