Today, inflation in the UK greatly surpassed expectations of economists, with all components of the CPI exceeding forecasts. The published data allowed GBP/USD bulls to approach 1.2000 after yesterday's unsuccessful test. Furthermore, the US dollar continues to be under significant pressure in the market. However, bullish traders have not yet been able to overcome the resistance level of 1.1950, the upper band of the Bollinger Bands indicator on the daily chart. If the pair settles above it, then a breakout above 1.2000 will only be a matter of time.

The inflation data was truly unexpected, despite the already bold forecasts.

The consumer price index rose by 2.0% m/m, above a forecasted increase of 1.7% and 0.5% reported in the previous month. Year-over-year, the index surged to 11.1% from 10.1% in the n the previous month. Inflation reached the highest level since 1981. Similarly, core CPI jumped to 6.5%. In addition, the producer price index climbed in October, both m/m (0.6%) and y/y (19.2%). The retail price index immediately jumped by 14% y/y as well.

According to the data release, inflation was primarily driven by higher food and energy prices. Last month, gas prices soared by almost 37%, while electricity prices rose by almost 17%. Prices for food and drinks increased by 2% in a month.

At the same time, wages in Britain have so far lagged behind rising prices, leading to lower living standards and putting additional political pressure on the newly formed government of Rishi Sunak. By the way, rumors are actively circulating in the press that the Rishi Sunak's cabinet will reduce energy bill support for UK households. Amid such rumors, more and more people are concerned that inflation would demonstrate another breakthrough in 2023 and become entrenched above 10%.

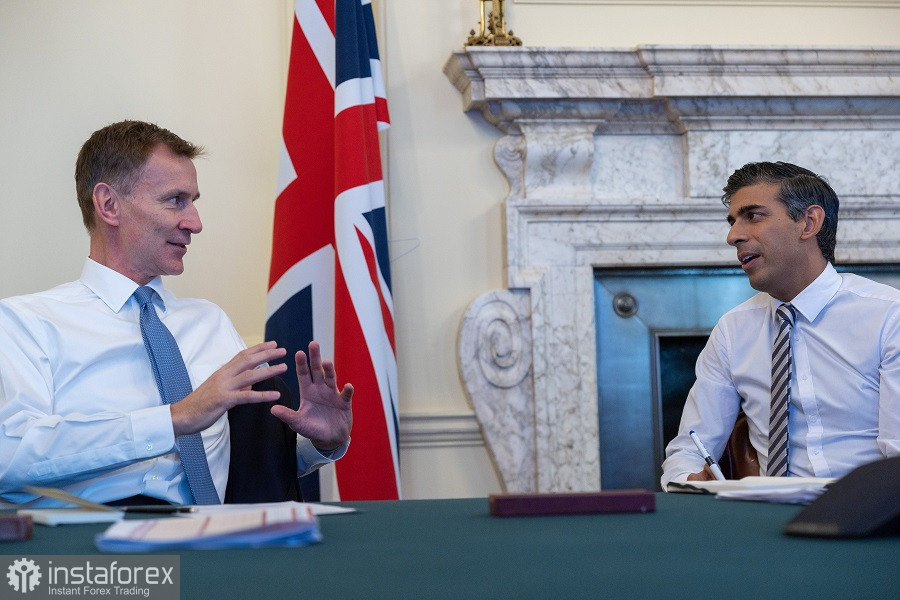

In the context of these rumors, tomorrow's speech by UK Chancellor of the Exchequer Jeremy Hunt is particularly important. According to preliminary information, he should announce new budget measures, which should include state subsidies for electricity after the end of the current support package.

According to Credit Suisse, Hunt's new program will combine spending cuts and increased taxes. The minister is expected to announce spending cuts of around £35 billion and plans to raise taxes by £20 billion. That being said, Hunt is expected to enact much of the projected fiscal tightening next year or even in 2025 due to the "political necessity" (elections are due in early 2025). On the other hand, Jeremy Hunt commented quite unambiguously on today's inflation data. In response to the UK CPI report, he said that "tough but necessary" solutions are needed to combat rising prices. There is still some uncertainty here, which is probably why GBP/USD bulls behave so indecisively amid the rapid rise in inflation.

However, this indecision is due to other factors. At the last meeting, the Bank of England published a rather gloomy forecast, warning of very difficult prospects for the country's economy, which is entering a recession. Now the British regulator has two options: either more aggressive interest rate hikes to bring down inflation and send the economy into recession, or to soften its stance, allowing CPI to rise somewhat and hoping that GDP will rise, or at least stay unchanged.

Therefore, hot inflation data failed to trigger a GBP/USD rally, despite USD retreating against other currencies. In general, the pair's failure to consolidate above the 1.1950 resistance level (the upper line of the Bollinger Bands indicator on the daily chart) suggests that going long on GBP/USD is risky. It is advisable to open long positions only after the pair settles above this target, with the next target being 1.2050. However, it is too early to go short on the pound sterling. Here it is necessary to monitor the US dollar index's performance. As soon as demand for USD increases, GBP/USD will slide down to at least 1.1600, the Tenkan-sen line on the D1 chart because the pound sterling will not be able to rise further on its own.