The cryptocurrency market is going through the most volatile and difficult period of the current bear market. The FTX situation has become a catalyst for the mass withdrawal of funds from centralized crypto exchanges to "cold wallets."

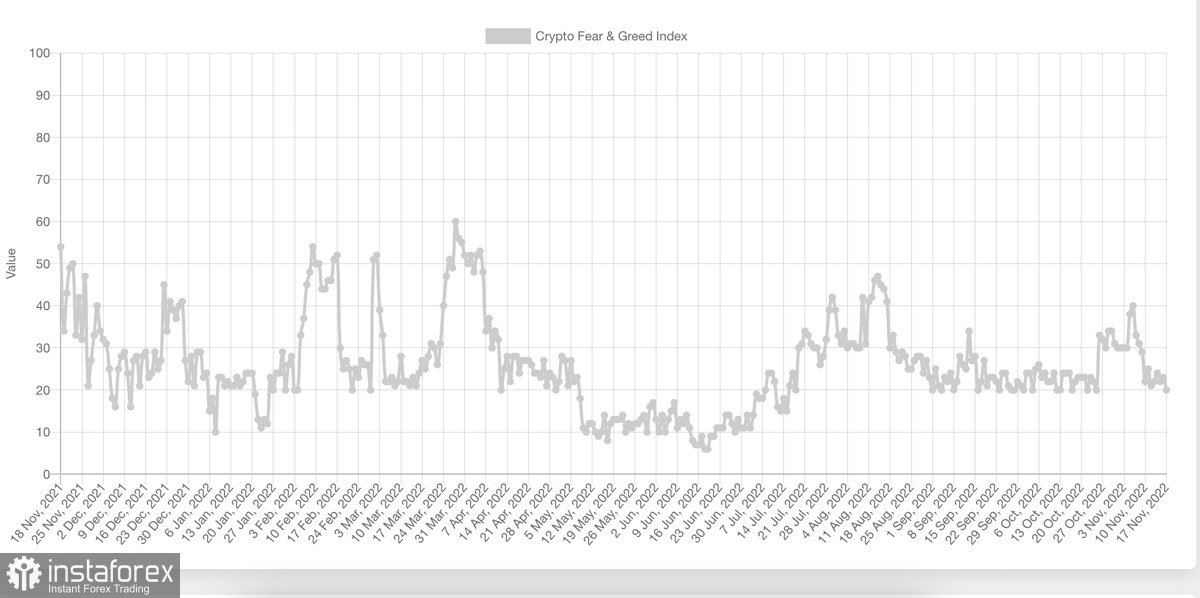

At the same time, the fear and greed index is near the level of 20, which did not correspond to the previous stages of the formation of the local bottom. In other words, the current situation has negatively affected investors' interest in the crypto market at a fundamental level.

First of all, this affected long-term holders, who find it more profitable to store cryptocurrency on a "cold wallet." This is a negative event for BTC/USD quotes since the collapse of FTX gave the bears complete superiority in technical terms. Given the further weakening of the bulls' positions, we can assume that the bottom of the market hasn't yet formed.

Cyclicity

If we consider the current situation from a historical point of view, we will come to the conclusion that the market capitalization has already reached the local bottom of the last cycle, near the level of $730 billion. As of November 17, with Bitcoin trading below $18k, the market capitalization reaches $830 billion.

This could mean another plunge to the bottom, where the market capitalization will update its low below $730 billion. The same goes for Bitcoin, whose downside potential reaches the $12k–$15k area.

The historical context says that during previous bear markets, the price of BTC lost up to 85%. As of November 17, Bitcoin has lost 77% of its capitalization, which indicates the likelihood of a further fall.

Forecasts

Pantera Capital CEO Dan Morehead noted that Bitcoin is likely to update the local bottom in November, after which it will move to the stage of protracted consolidation. The entrepreneur argued that the bottom of BTC is formed in 477–480 days. The end of November is the end of this period, and therefore Bitcoin has time to update the local bottom.

Recall that JPMorgan analysts also expect Bitcoin to fall to $13k–$15k. Adds fuel to the fire of the liquidity problems of Genesis and Gemini. Massive outflow of funds and panic threaten the existence of large crypto companies.

Additional factors

At the same time, active sales of BTC/USD to mining market players continue. More than 7,500 BTC coins were sold last week, and there is every reason to believe that sales this week will be even higher.

Analysts at Morgan Stanley say that a real recession in the global economy will begin after the completion of rate hike cycles. Recall that the Fed saw progress in the fight against inflation but aren't yet ready to change policy. The peak rate was raised to 4.75%–5.25%.

The preservation of the current monetary policy and the deteriorating situation with liquidity in the crypto market will have a negative impact on the prospects for the recovery of BTC/USD quotes. Given this, we should expect a long-term consolidation.

It is also worth taking stock of the long history of the "relationship" between Bitcoin and the stock market. The obvious conclusion is that the correlation between cryptocurrencies and stock indicators was strengthening during the downward trend of the instruments. The current rally in stocks shows that the correlation with Bitcoin was a situational phenomenon.

BTC/USD Analysis

On the daily chart of Bitcoin, there is a gradual tightening of the price and the formation of a triangle pattern. This is fraught with a surge in volatility and a breakout of the price of the current range. At the same time, technical metrics continue to move boringly sideways.

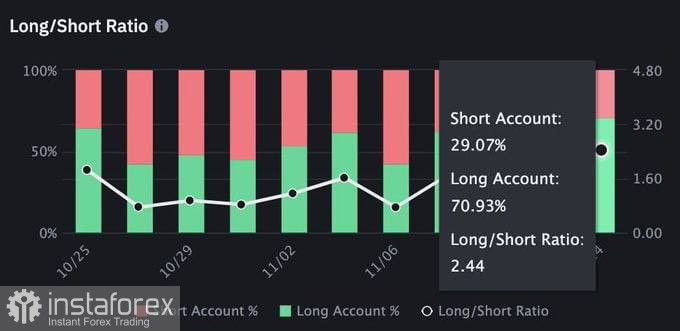

It is worth paying attention to market sentiment on the largest crypto exchange. In the futures market, long volumes reached 70%, which indicates that players believe in further price increases. A clear imbalance in favor of long positions may indicate a downward breakdown of the emerging triangle.

Also, a divergence between the price movement and the RSI index is formed on the weekly chart. A similar pattern was formed during the 2015 bear market, and it marked the final formation of the local bottom. There is no need to talk about the identity of situations, since the pattern of 2022 has just begun to form.

Results

Bitcoin and the cryptocurrency market are entering the final stage of the current bear market. The macroeconomic situation and turmoil within the industry itself point to the likelihood of a final takeaway. The final target for the bears will be the $12k–$15.8k area, and it is likely that it will complete the phase of the current downward cycle.