No matter how fast the market moves, there is always a place to stop. After the rapid rally of the euro, which surprised many investors, EURUSD is trading near the 1.035 mark for the third day in a row, having failed to break above 1.05. The pause allows you to reflect on the near and medium-term prospects of the pair, which large banks and investment companies have not failed to do.

Deutsche Bank believes that the euro can rise to $1.1 by the end of 2023, the highest level since the beginning of the armed conflict in Ukraine, for two independent reasons. Firstly, amid a decrease in geopolitical risks due to success in the negotiation process between Moscow and Kyiv. Secondly, because of the Fed's mistake, which, fearing a recession, will move too soon from tightening monetary policy to loosening it. The ECB, meanwhile, will continue to raise rates towards their current ceiling of 3%, expected by the futures market.

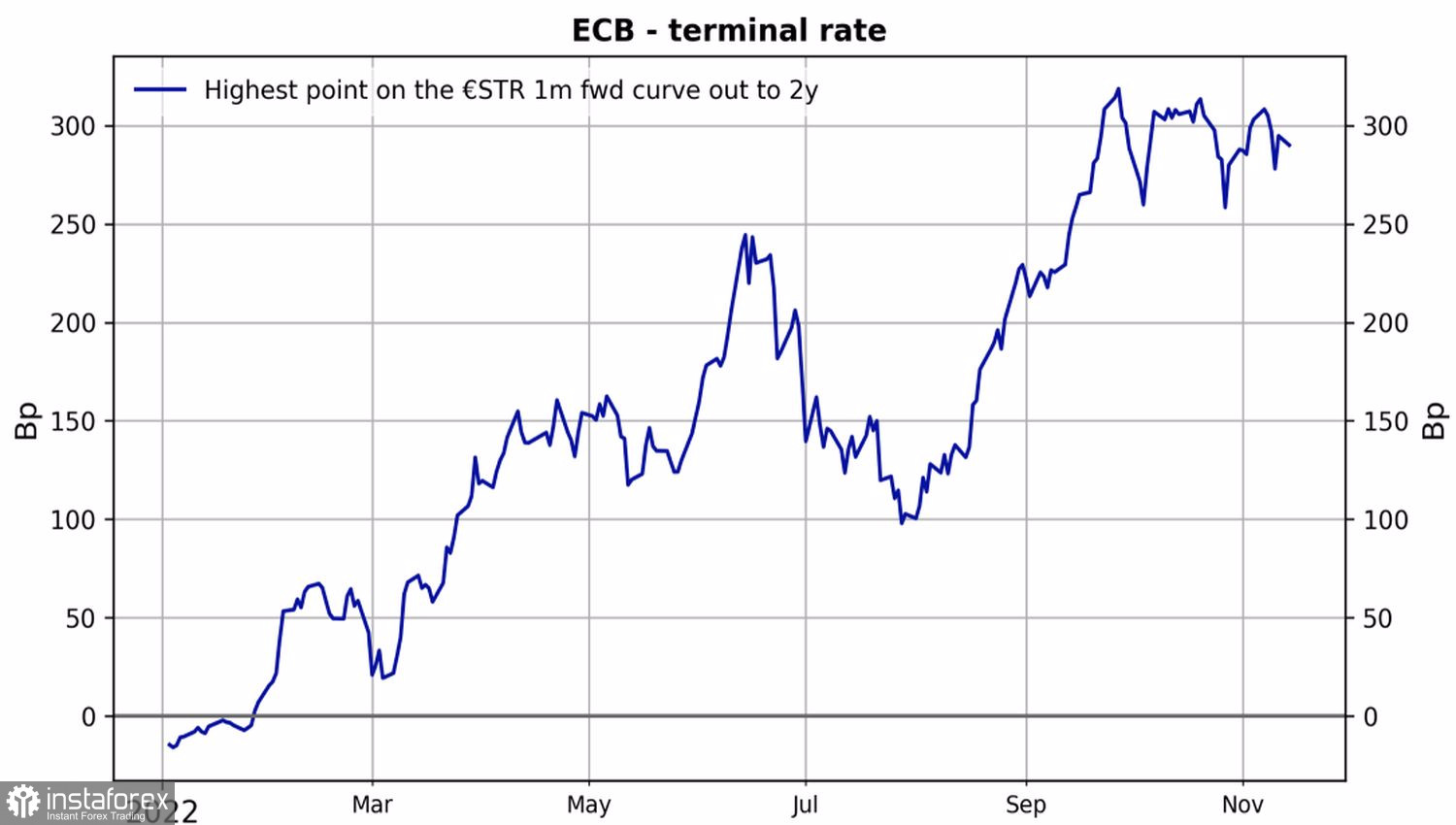

Dynamics of the expected peak in the ECB deposit rate

On the contrary, UBS Global Wealth Management, Russell Investments and Insight Investment consider the EURUSD rally excessive and exhausted its potential. The pair's peak in response to the rocket that crashed on Poland shows how vulnerable the euro is in terms of increasing geopolitical risks. The fall in gas prices can provide some support to the main currency pair, but eventually its quotes will decrease against the background of a slowdown in the ECB's monetary restriction rate.

Indeed, judging by Bloomberg's insider information, members of the Governing Council are talking about an increase in the cost of borrowings, not by the 75 bps expected by the market in December, but by 50 bps. There are several reasons. They say rates are already close to the restrictive level, which will slow down the eurozone economy. As monetary policy tightens further, recession risks are rising by leaps and bounds. There is a chance that the pressure on consumer prices will ease on its own. Finally, you need to unwind the balance, which can also be considered a monetary restriction.

If we add to this the Fed, which remembered its "hawkish" position, then the risks of a fall in EURUSD quotes emerge quite clearly. Thus, FOMC member Christopher Waller believes that one inflation report is not enough to claim that prices have reached the ceiling. And his colleague, New York Fed President John Williams, argues that the Central Bank should not be led by the financial markets.

Thus, despite the fact that the macro background has changed, transactions to hedge stagflationary risks are not as relevant as before, which indicates a break in the long-term downward trend for the main currency pair—a pullback to the current rally cannot be avoided.

Technically, there is an inside bar on the EURUSD daily chart. A break of its lower border near the pivot point at 1.033 is fraught with quotes falling to 1.022 and below. It will also serve as a basis for the formation of short-term shorts with a subsequent transition to medium-term long positions in the euro against the US dollar.