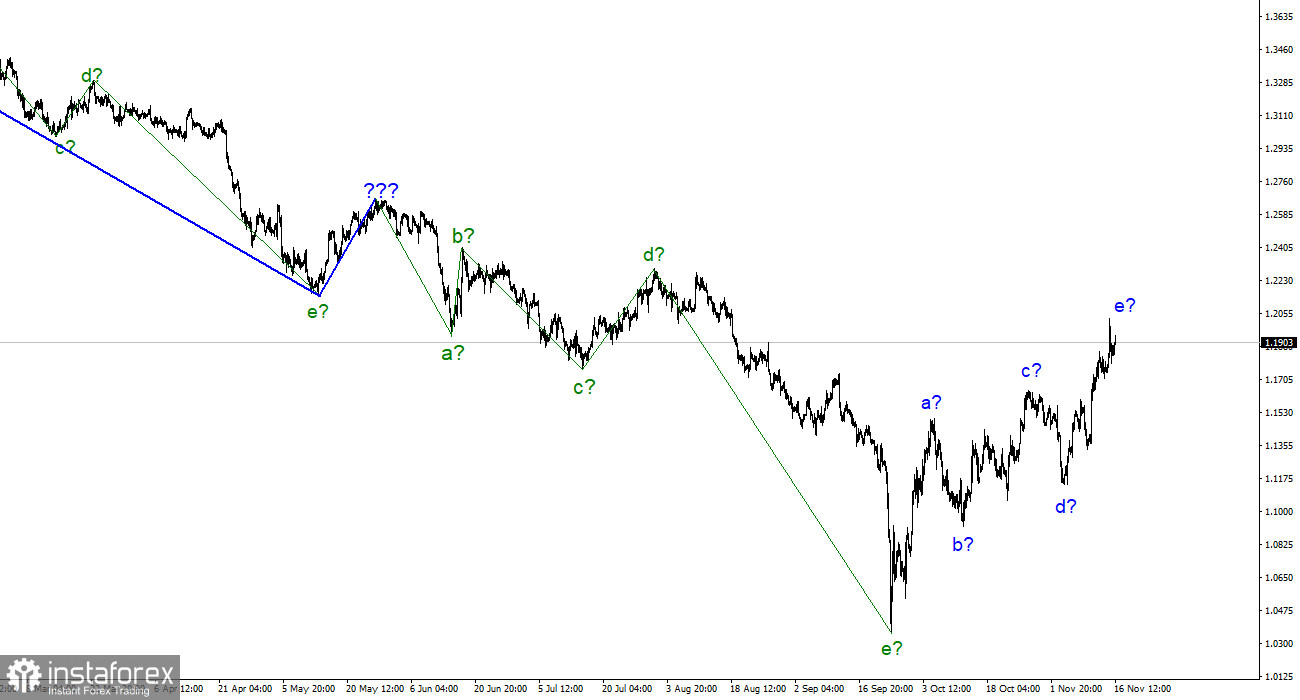

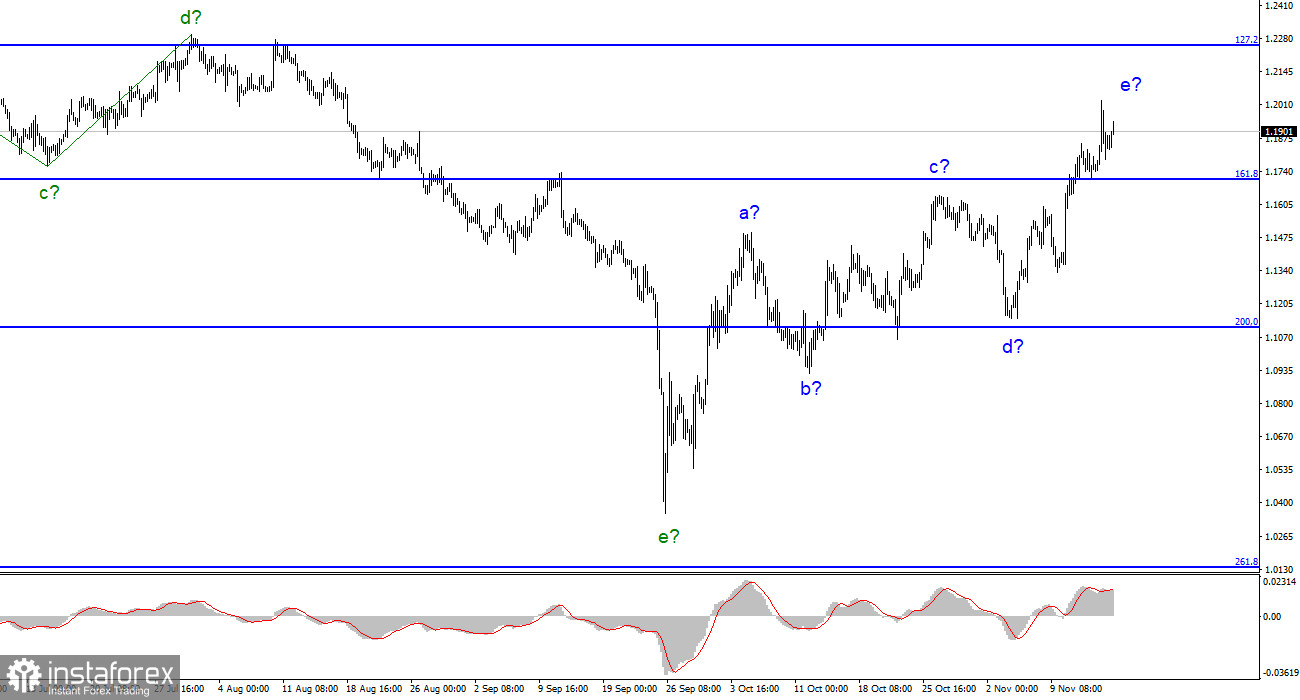

For the pound/dollar instrument, the wave marking looks quite complicated at the moment but does not require any clarifications. We have a supposedly completed downward trend segment consisting of five waves a-b-c-d-e. We also have a five-wave upward trend section, which took the form a-b-c-d-e. Thus, the increase in the quotes of the instrument may continue for some time, but it will be a wave of growth and is unlikely to be long. The news background could be interpreted in any direction recently, as both central banks raised their interest rates. The Friday before last, we saw the dollar fall against the news background, which could lead to its new growth (Nonfarm Payrolls report). All this leads me to believe that the market has decided to complete a full-fledged five-wave structure, after which it will decide on building a new downward trend section. A successful attempt to break through the 1.1704 mark, which equates to 161.8% by Fibonacci, indicates the incompleteness of the upward trend section, but in general, the wave structure looks fully equipped.

Inflation in the UK exceeded 11%.

The exchange rate of the pound/dollar instrument changed slightly on November 17. Yesterday, a report on British inflation was released, which directly affects the monetary policy of the Bank of England. And the Bank of England is now receiving the most attention since it is unclear how much and at what pace it is ready to raise the interest rate further. The rise in inflation to 11.1% suggests that the Bank of England will have to raise the rate in December by another 75 basis points. Perhaps it will be so. But what will the regulator do if the inflation report shows an acceleration in December? Will the Bank of England be able to raise the rate as long as it takes for inflation to return to 2% in the future two years?

There is a strong opinion in the foreign exchange market that the Bank of England will raise the rate to 4.75%. But now, it is already equal to 3%, and next month it may be 3.75%. At the same time, inflation does not hint at slowing down. If the rate rises to 4.75%, as most expect now, but inflation slows down to 9%, what will it give? Thus, the British will not be able to complicate the upward section of the trend that is currently available. Perhaps the demand for the pound will grow for another day or two, but then a correction structure of at least three waves should be built. The British economy is currently the most concerned since the recession has already begun and may be deep and long-term. It is still being determined how the new British government will cover the budget deficit and what the market's reaction will be to the tax increase, which has already been announced by Jeremy Hunt, the new British Finance minister. Hunt's financial plan is due to be made public today.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of a new downward trend segment, but it may start a little later (if it starts at all). I can't advise buying the instrument since the wave marking allows the beginning of the construction of a downward trend section. The demand for the pound is still growing, but the wave e will not take on too long a form.

The picture is very similar to the Euro/Dollar instrument at the higher wave scale, which is good since both instruments should move similarly. At this time, the upward correction section of the trend is nearing completion. If this is the case, we will soon be building a new downward trend.