The dollar-yen pair earlier this week updated a three-month price low, reaching 137.70. However, the USD/JPY bears failed to settle in the area of the 137th figure - dollar bulls stopped the downward momentum and turned the pair 180 degrees.

In general, the trajectory of the pair's movement correlates with the trajectory of the US dollar index. Once again, we are convinced that the yen is not an independent player against the greenback. The Japanese currency certainly has its trump card, but it rather serves as a "stop tap". We are talking about a currency intervention, the risk of which increases along with the USD/JPY rate. In this context, we can say that the Japanese government controls the upper limit of the price range within which the pair is traded. According to most analysts, this limit is in the area of the 150.00 mark: exceeding this target is fraught with consequences. As for the lower limit of the conditional price range, everything depends on the "well-being" of the US currency. USD/JPY bears are forced to follow the greenback, which determines the end point of any downward surge. The yen has no arguments of its own to strengthen – primarily due to the divergence of the Federal Reserve and the Bank of Japan rates.

The events of the last days serve as evidence of this. They eloquently illustrated the stated disposition, the essence of which boils down to an uncomplicated conclusion: the downtrend ends exactly where the dollar recovery begins.

As you know, the US currency significantly sank throughout the market after the release of the latest data on the growth of inflation in the United States. The market started talking about the fact that the Fed will slow down the pace of monetary policy tightening at the next meeting, which will be held in December. A little later, these assumptions were confirmed by many representatives of the Fed: according to them, the central bank can afford to reduce the speed, while maintaining the final goal at the same level (that is, above the 5.0% mark).

At first, traders mostly focused their attention directly on the fact of slowing down the pace of tightening of the monetary policy. But then they "listened" to the signals from the Fed representatives, who made it clear that no one was going to curtail the hawkish course – only the speed of achieving the goal slows down. In particular, Christopher Waller, a member of the Board of Governors, said that the markets should now pay attention to the "end point" of the rate hike, and not to the pace of its achievement. At the same time, he noted that the end point is probably "still very far away." Some of his colleagues also stated that, firstly, inflation in the United States is still at too high a level; secondly, it is impossible to make any long-term organizational conclusions based on only one report.

Such messages eased the pressure on the dollar, and, accordingly, cooled the ardor of bears of the USD/JPY pair. Turning to the upside, the pair gradually began to gain momentum, rising by 250 points in two days. At the same time, traders ignore Japanese statistics, even when it comes to the inflation report.

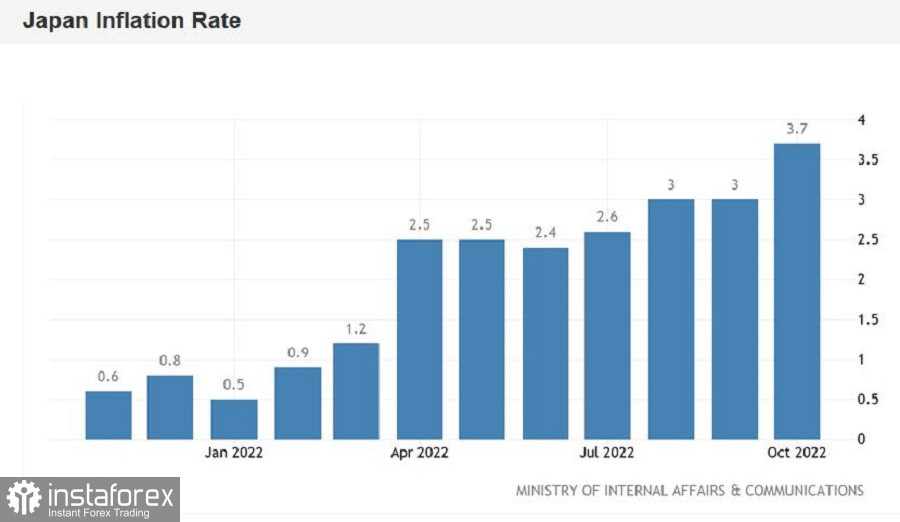

Key data on the growth of inflation in Japan was published during the Asian session on Friday. The report reflected a record growth of key indicators. For example, the overall consumer price index rose by 3.7% in October, which is the strongest growth rate of the indicator since 1982. The core CPI, which does not include fresh food, but includes energy prices (petroleum products), also updated the 40-year record. The consumer price index, excluding food and energy prices, jumped 2.5% year-on-year in October.

All components of the above report came out in the green zone, significantly exceeding the forecast levels. It is worth noting that inflation has been exceeding the BOJ's 2% target for seven months, but at the same time BOJ Governor Haruhiko Kuroda continues to "hold the line", maintaining a soft monetary policy. This, in fact, explains such a phlegmatic reaction of USD/JPY traders to the report published today. Market participants reasonably doubt that Kuroda will toughen his rhetoric in response to the published figures.

Thus, the fate of the USD/JPY downward trend depends solely on the behavior of the US currency, which is gradually beginning to "come to its senses". After all, even taking into account the slowdown in the rate hike, the Fed continues to act as an ally of the greenback, and even more so in tandem with another, which cannot count on the support of the BOJ. In my opinion, the rhetoric of the Fed representatives will only tighten ahead of the December meeting (at least in the context of determining the upper limit of the current cycle), while Kuroda will once again ignore the inflation report, declaring the preservation of the accommodative policy.

All this suggests that the USD/JPY pair may demonstrate a more confident growth in the near future – at least to the Tenkan-sen line on the daily chart, which corresponds to the 142.40 mark. If we talk about the medium term, the main target here is 145.50: at this price point, the upper line of the Bollinger Bands indicator coincides with the upper limit of the Kumo cloud on the D1 timeframe.