It seems that markets' attempts to extend growth begin to fail amid hopes that a slowdown in US inflation may urge the Federal Reserve to reduce the pace of tightening.

What is the reason behind negative sentiment in markets?

Investors seem tired of the strong influence that comes from a prolonged bear market, which has lasted for more than a year, and are looking for any excuse to buy shares. Unfortunately, the stance of some Fed members does not allow them to relax as it indicates that the regulator has strong advocates for further aggressive tightening. This factor is still weighing on markets.

The interest rate forecast made by the chief of the Federal Reserve Bank of St. Louis, James Bullard, on Thursday, caused concern in the market. He emphasized the need for hiking rates further as all the moves that had been done before had only a limited impact on inflation. In the wake of the disappointing earnings season, his words had a bombshell effect. He said that interest rates should be raised to 5.00-5.25% at least. In other words, the Federal Reserve's decision on interest rates will not be based on the latest inflation data. The regulator is committed to bringing inflation to the 2% target. This means we may see another 0.75% rate increase in December, and the dynamic of federal fund futures, which illustrates such a possibility, confirms that. It remains to be seen how things will unfold. However, the hawkish stance of some Fed officials has somewhat shattered optimism in the market.

In lite of increased uncertainty, the market is unable to achieve a consensus on what to expect. Therefore, there are risks of turbulence in the stock and commodity markets. Meanwhile, foreign exchange markets are likely to show no movement at all.

As for the USD pairs and the commodity market, there is a high probability of a sideways trend. The equity market is expected to trade under the influence of earnings reports as well as news and macroeconomic statistics.

Daily outlook:

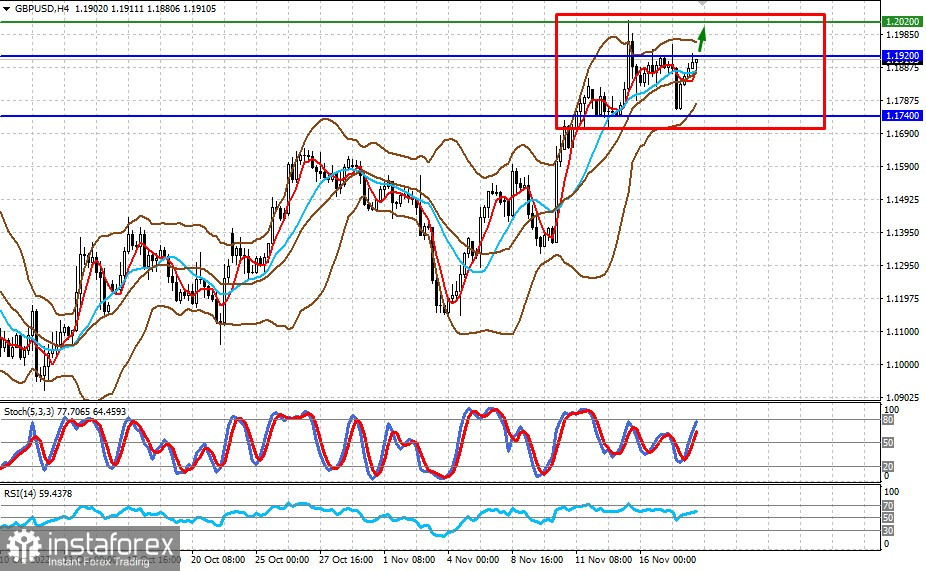

GBP/USD

The pair is trading in the range of 1.1740-1.1920. If the price goes above 1.1920, there is a possibility of growth to 1.2020.

USD/JPY

The pair is consolidating in the range of 138.50-140.75. It is highly likely to remain within this range today. However, should negative sentiment on markets prevail again, the pair may leave the range and fall to 137.60.