US stock index futures are showing green figures after yesterday's sell-off. The fall was driven by the fact that the Fed and other major central banks saw no reason to suspend their rate hikes. Futures on the S&P 500 index rose by 0.4%, while the NASDAQ index added 0.7%. The Dow Jones Industrial Average index gained 0.2%.

European stock indices also showed gains but they were close to breaking a four-week rising streak.

Yesterday, St. Louis Fed President James Bullard made hawkish statements about the need to raise interest rates to at least 5%-5.25% to curb inflation, which led to another decline in the US stock market. Treasury yields little changed, strengthening slightly on Thursday on the back of the same Bullard speech. Bullard also said that while inflation was easing and falling from multi-year highs, more policy tightening was needed to ease the price pressures trying to take root in the economy. As for now, investors have changed their expectations about when US rates might peak and have reconsidered the likelihood of a rate cut next year.

We have heard many times that inflation has peaked and the Fed sees no reason to reverse its policy and start cutting interest rates. That is what Federal Reserve Chairman Jerome Powell keeps saying. The fundamental gap that still exists between the Fed and the market will continue to force the committee to raise the key rate.

There are also growing fears that steadily rising interest rates will hit economic growth, with the critical segment of the Treasury yield curve remaining quite high for the past four decades. Historically, this curve inversion has indicated a recession in the world's largest economy.

However, there are also those who believe that if the Fed continues to raise rates at the current pace, the key rate may be considerably higher than needed by the time they get the information that they have significantly harmed the country's economic growth and slowed down inflation.

Hong Kong's Hang Seng index rose for the third week in a row, thanks to China's steps to support the real estate sector and the easing of its Zero Covid policy. Bitcoin still tries to grow, though its prospects are rather dire as the collapse of Sam Bankman-Fried's FTX empire continues to devastate the cryptocurrency market.

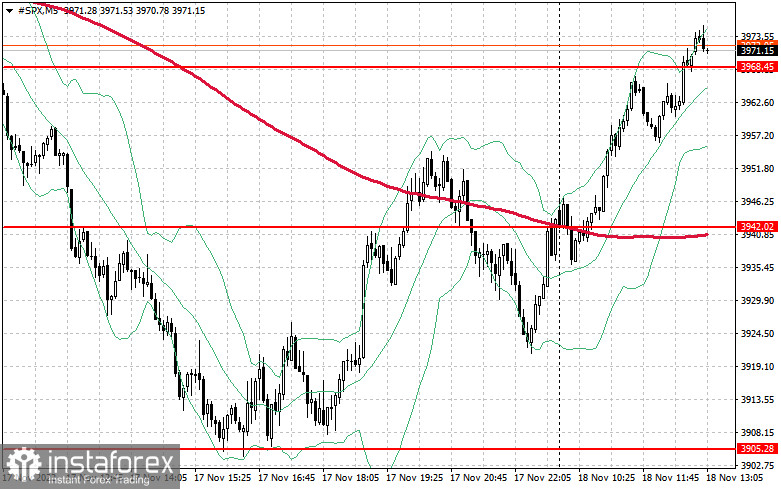

As for the S&P 500 index, after yesterday's collapse and today's sharp growth, the situation in the market has slightly stabilized. Bulls need to protect the support level of $3,942. As long as the index is trading above this level, the demand for risky assets is likely to persist. This may strengthen the trading instrument and return the levels of $3,968 and $4,003 under control. If the price pierces $4,038, it may strengthen the quotes and push the price to the resistance level of $4,064. The next target is located in the area of $4,091. If the index declines, bulls will have to be active near $3,942. If this level is broken through, the trading instrument may drop to $3,905. It is likely to reach a new support level of $3,861.