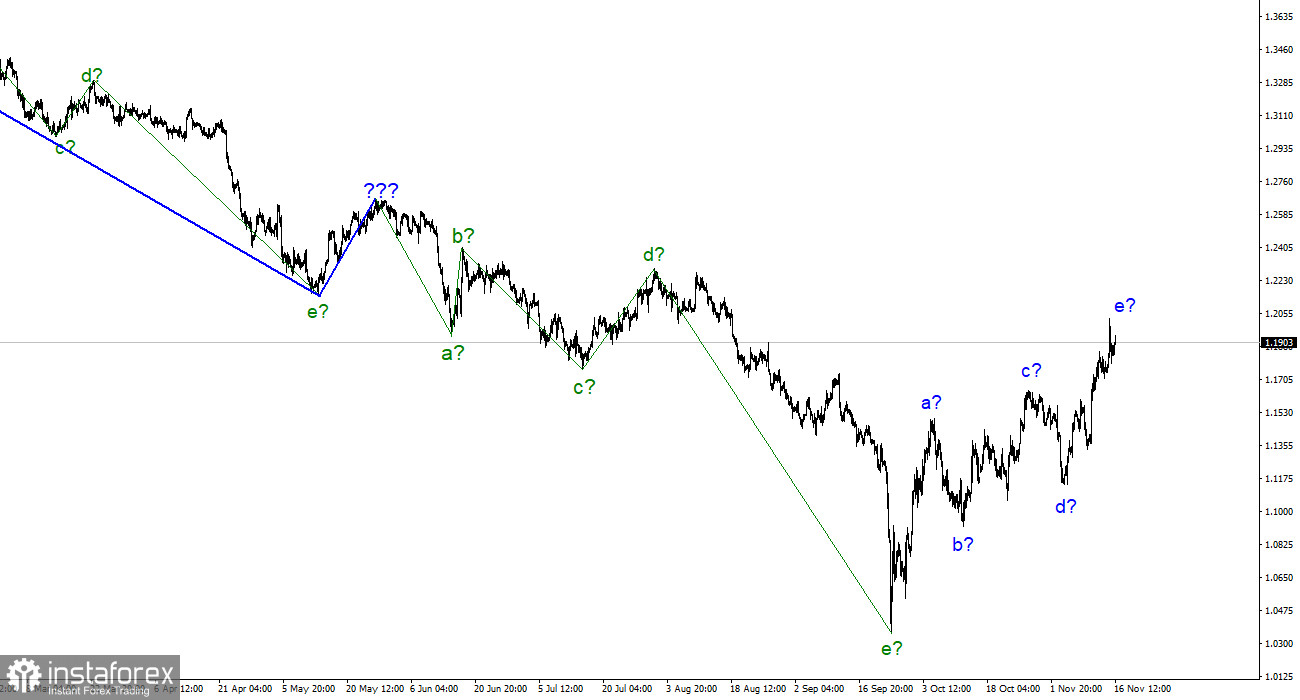

The wave pattern for the pound/dollar instrument currently appears quite confusing, but it still needs to be clarified. Five waves, a–b–c–d–e, make up the so-called "completed downward trend segment" that we are currently in. We also have a five-wave upward trend section that goes a-b-c-d-e. As a result, although the instrument's quote growth may continue for a while, it won't likely last very long. Since both central banks recently increased interest rates, the news backdrop could have been interpreted differently. The previous Friday, we witnessed a decline in the dollar's value relative to the news backdrop, which may have contributed to its potential new growth. All of this makes me think that the market has decided to finish a full five-wave structure before starting a new downward trend section. The upward trend section isn't complete until a successful attempt to break through the 1.1704 level, which corresponds to Fibonacci's 161.8%, is made, but the wave structure appears to be well-equipped overall.

Retail sales in the UK exceeded expectations.

On November 18, the pound/dollar exchange rate fluctuated a little. At least two important pieces of news for the pound sterling were released this week. In Parliament, Jeremy Hunt laid out his "financial plan," which calls for less financial aid to the British and more tax revenue for the Treasury. And the UK's inflation rate increased to 11.1%. Strangely, the market displayed a relatively low amplitude during the days of these reports, even though the demand for the pound had been increasing quickly before that. Since the current wave marking indicates a decline in the instrument, the market is no longer eager to increase demand for the pound. I had anticipated that work on the downward trend section would start this week, but we will have to wait a little longer.

A report on retail trade volumes in the UK was released today, and it was stronger than the market anticipated. Retail sales rose by 0.6% monthly in October, exceeding forecasts of +0.1–0.2%. When fuel sales were excluded, the indicator increased by 0.3%, but the range of expectations was much wider in this case. The report came out quite well, but in the past 18 months, only three reports consistently show increased sales volumes over the prior month. As a result, the trend is still downward. Furthermore, it is unlikely that demand for the pound would increase given this trend.

We will also see a few significant events next week. Even "non-economic" events like the US elections or the UK's publication of the "financial plan" had little to no effect on the market's mood. Next week, there won't be any similar events. Now is still an excellent time to increase demand for US currency to recoup the wave markup.

Conclusions in general.

The pound/dollar instrument's wave pattern predicts the formation of a new downward trend segment, but it may begin later. I no longer recommend purchasing the instrument because the wave marking allows the construction of a downward trend section to start immediately. For the time being, demand for the pound remains high, and I don't believe the wave e will last long.

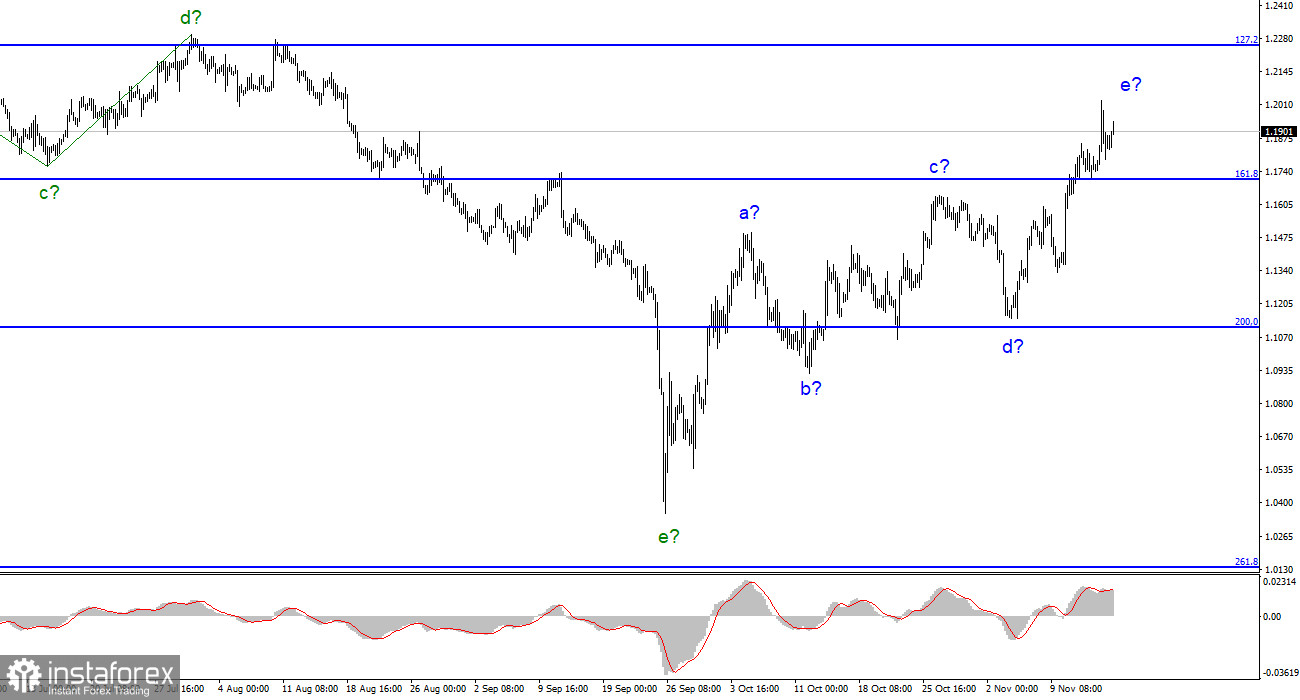

The euro/dollar instrument and the picture look very similar at the larger wave scale, which is good because both instruments should move similarly. The upward correction portion of the trend is currently almost finished. If this is the case, a new downward trend will soon develop.