Long-term outlook.

The GBP/USD currency pair has risen by only 30 points in the current week. Remember that a week ago, the increase was 500 points. As you can see, traders ignored the report on American inflation, which caused the dollar to fall sharply in recent weeks. Rather than inflation, the decrease in the likelihood of aggressive tightening of the Fed's monetary policy is to blame. But remember that this was known even before the inflation figures were released because the Fed cannot keep raising interest rates indefinitely. It is currently 4%, with a maximum level of 5% considered. As a result, a "slowdown" had to occur in any case, and the market had to be prepared for it.

Another issue is the Bank of England and the British pound. Sincerely speaking, traders have no interest in the work being done in Britain by the regulator. Remember that at least seven of the BA's eight rate hikes went unheeded, and this week the UK's inflation rate updated a record set 40 years prior without causing the pound to make a significant rise or decline. The report on British inflation is generally identical to the report on American inflation. If the consumer price index continues to rise, the Central Bank's aggressive monetary policy will be more likely to be maintained. There was justification for the pound to increase this week. In the end, neither the first nor the second occurred. As a result, this report was ignored by the market.

The same is true of the budget proposal that UK Treasury Chief Jeremy Hunt unveiled on November 17. Taxes won't significantly increase, but the cutoff points for applying various tax rates will be adjusted. In other words, because their annual incomes are now considered higher than before, those who previously paid at a lower rate will now pay a higher rate. Additionally, it was revealed that Liz Truss had underestimated the amount of money given to the British people as compensation for their electricity bills. Even so, this news did not significantly impact the pair's movement.

Technically speaking, the pound and the euro are trading almost identically once again and continue to have the same chances of growth.

COT evaluation.

The "bearish" sentiment continued to weaken, according to the most recent COT report on the British pound. The non-commercial group closed 1,900 buy contracts and 8,800 sell contracts for the week. As a result, non-commercial traders' net position increased by 7,000. The net position indicator has been gradually increasing over the past few months. However, the major players' outlook is still "bearish," and despite the pound's recent rise, it is not yet clear that it is getting ready for a protracted upward trend. Furthermore, if the situation with the euro is anything to go by, it is improbable that the pair will experience significant growth based on COT reports. The market is waiting for new geopolitical shocks to return to dollar purchases, as demand for the US currency remains very high. The non-commercial group has now opened 67,500 sales contracts and 34,500 purchase contracts. As we can see, the difference is still significant. Remember that the euro cannot show strong growth while major players are "bullish." In terms of the total number of open buy and sell positions, the bulls have a 17-thousand-position advantage. However, as we can see, this indicator only helps the pound a little. Despite technical grounds for doing so, we remain skeptical of the British currency's long-term growth.

Fundamental event analysis

This week, several significant reports were released in the UK. Naturally, the inflation report comes first. It has already increased to 11.1% y/y and should, in theory, cause a significant market response. Additionally, there were reports on average wages (+6%), retail sales (+0.6% m/m in October), and unemployment (growth to 3.6%). The other reports, on the other hand, were even less likely to elicit a response if inflation did not. The growth potential of the pound sterling has been reached at this point. We stated a week ago that all technical indicators supported the pair's medium-term growth, but now we require a slight downward correction. The outcome is unchanged as of right now.

Trading strategy for the week of November 21–25:

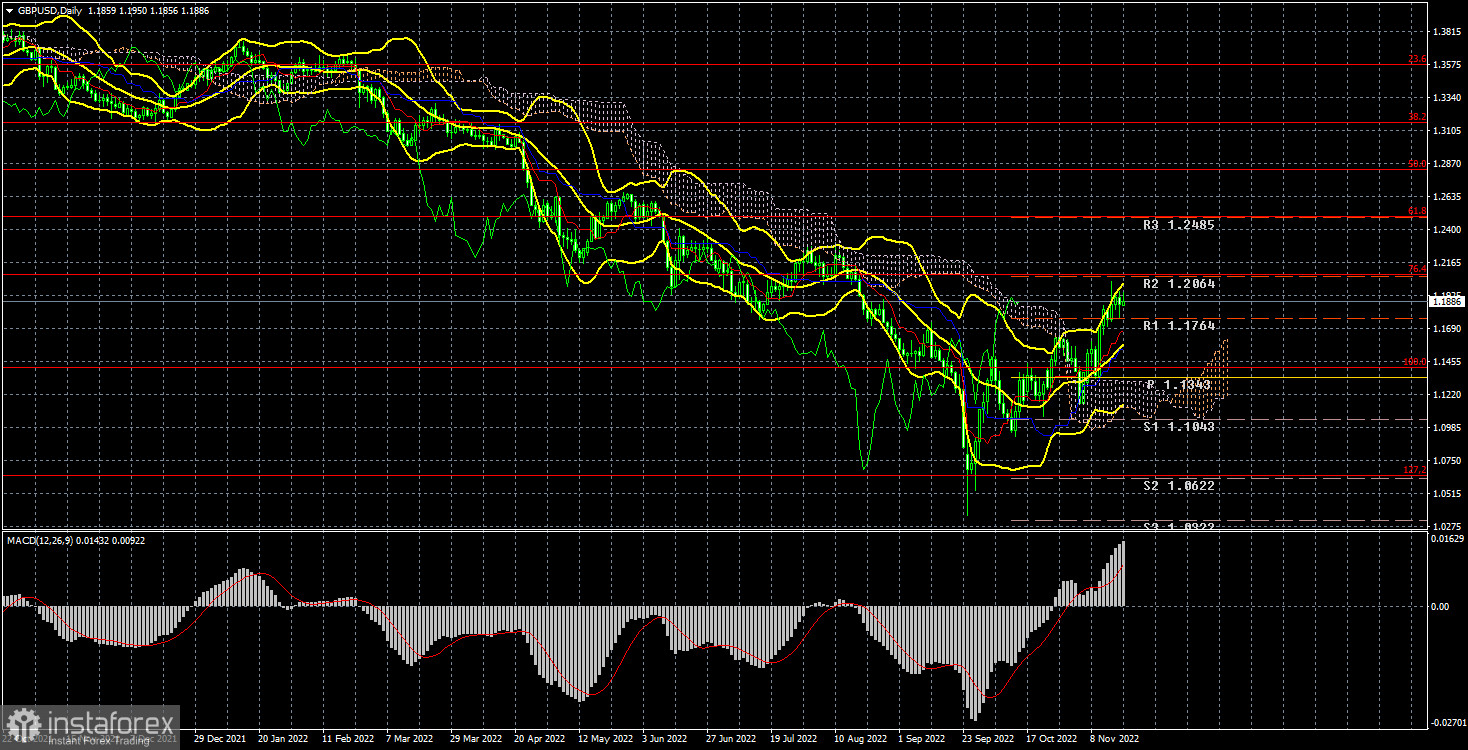

1) The pound/dollar pair has broken through the Ichimoku indicator's key lines, giving it the technical support necessary to establish a new long-term upward trend. We continue to be dubious about this possibility because we must see clear fundamental and geopolitical justifications. Still, we also understand that the couple can survive on nothing but technology. 1.2080 and 1.2824 are the closest targets;

2) The pound has advanced significantly, but it is still challenging to wait for rapid growth. The pair's decline can resume with targets in the range of 1.0632-1.0357 if the price fixes back below the Kijun-sen line. Sales, though, are no longer important.

Explanations of the illustrations:

Price levels of support and resistance (resistance and support), Fibonacci levels – target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

The net position size of each trading category is represented by Indicator 1 on the COT charts.

The net position size for the "Non-commercial" group is indicated by indicator 2 on the COT charts.