Trading recommendations

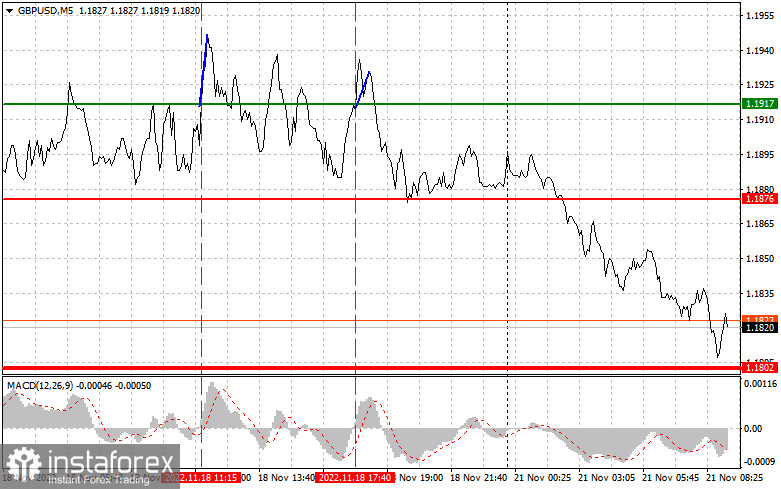

The price tested 1.1917 when the MACD indicator started moving upwards from zero. This fact proved that the entry point was right. As a result, the pair climbed by about 30 pips. In the second part of the day, the price also tested 1.1917, thus providing a buy signal. However, the result was even worse. Trades only managed to close positions without losses.

Data on the UK retail sales exceeded forecasts, thus boosting the pound sterling in the first part of the day. However, the pair failed to maintain the bullish trend. Strong data on the US existing home sales returned pressure on the British pound and boosted the greenback. Today, traders may pay attention only to the speech that will be provided by BoE MPC Member Cunliffe. Thus, buyers of the pound sterling are likely to keep control over the market. In the second part of the day, only data on Chicago Fed National Activity will be disclosed. Thus, the market volatility is expected to be low.

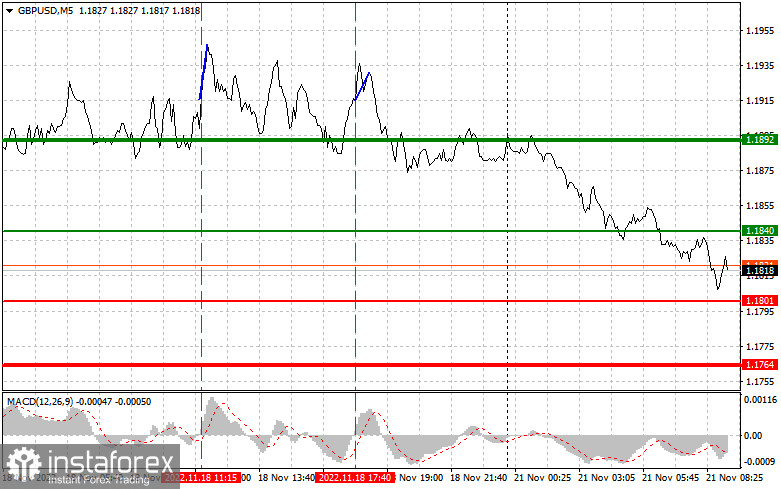

Signals to buy GBP/USD:

Scenario 1: today, traders may buy the pound sterling if it hits the level of 1.1840 (a green line in the chart) with the target at 1.1892 (a thicker green line in the chart). Traders should leave the market near 1.1892 to open sell orders, expecting a decline of 30-35 pips. The pound sterling is likely to rise as traders are likely to make use of low prices after the pair's considerable correction. Notably, before opening buy orders, make sure that the MACD indicator is above zero and is starting to climb from this level.

Scenario 2: traders may also go long if the price hits 1.1801. At that moment, the MACD indicator should be in the oversold area. This will limit the downward potential of the pair, thus causing an upward reversal of the market. The pair may climb to 1.1840 and 1.1892.

Signals to sell GBP/USD:

Scenario 1: today, traders may sell the pound sterling only if it goes above 1.1801 (a red line), which will cause a rapid decline. The main target is located at 1.1764, where traders should close sell orders and open the buy ones, expecting a rise of 20-25 pips. If the BoE's representatives provide dovish comments, pressure on the pound sterling will remain in force. Notably, before opening sell orders, make sure that the MACD indicator is below zero and is starting to drop from it.

Scenario 2: traders may also go short if the price touches 1.1840. At that moment, the indicator should be in the overbought area. This will cap the upward potential of the pair, thus causing a market reversal. The price may decrease to 1.1801 and 1.1764.

What we see on the trading chart:

A thin green line is a key level at which you can place long positions on EUR/USD.

A thick green line is the target price since the quote is unlikely to move above it.

A thin red line is a level at which you can place short positions on EUR/USD.

A thick red line is the target price since the quote is unlikely to move below it.

A MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions to enter the market. Before the release of important reports, it is better to stay out of the market to avoid sharp fluctuations in the price. If you decide to trade during the news release, place stop orders to minimize losses. Without stop orders, you can lose the entire deposit, especially if you do not use money management and trade large volumes.

Notably, for successful trading, it is necessary to have a clear trading plan. Rash trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.