Today's trading day began with the dollar on the offensive. The dollar index (DXY) futures also opened today's trading day with a small gap up after a lackluster gain in the previous three trading days. As of writing, DXY futures were trading at 107.74, 79 points above today's opening price and 88 points above last Friday's closing price.

The dollar index ended last week with a small token gain of 17 points. Investors are still under the impression of disappointing consumer inflation data, which showed its slowdown. For instance, the Consumer Price Index (CPI) fell in October from 8.2% to 7.7% year-on-year, stronger than the estimate of an 8.0% decline. Core CPI adjusted to 6.3% versus a forecast of 6.5% year-on-year and 6.6% last month.

The Fed's efforts to rein in U.S. inflation are definitely paying off. This raises the possibility that the pace of monetary tightening may soon slow down.

Prior to the release of these inflation indicators, it was widely expected that interest rates would be raised again by 0.75% (to 4.75%) at the December meeting (December 13 and 14).

However, some Fed officials have already made cautious statements to the effect that a slowdown in monetary policy tightening is possible in the near term, although inflation remains too high, according to them, and much work remains to be done to bring it back to the 2.0% target level.

Thus, the likelihood of a 75 basis point Fed rate hike in December has declined. On the contrary, market participants are now pricing in an 80% chance of a 50 bps Fed interest rate hike in December, according to the CME Group.

If the released U.S. inflation numbers disappoint investors, it will trigger a new wave of dollar selling and bring the DXY down to 109.00.

As of writing, DXY futures were trading near 110.46, staying negative and moving to the bottom of last month's new downward channel (on the DXY chart).

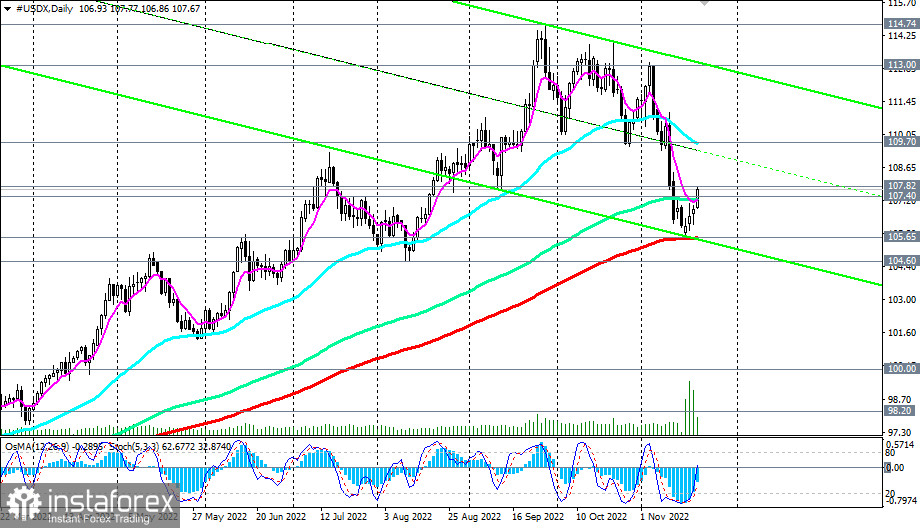

A break of these levels may trigger a deeper drop in DXY, down to the key support levels of 107.40, 105.65. And that's exactly what happened: the price broke through the lower border of the descending channel on the DXY chart at 109.00 and reached a local low of 105.15 in the next three days.

However, near this local low, the dollar sellers' strength ran out, and by now, as we noted above, the DXY dollar index is up to 107.74.

If you look at the daily chart of the USD index (shown as CFD #USDX in the MT4 trading platform), you can clearly see that the price failed to break through the key support level 105.65 (200 EMA). And in the next four days, the price rebounded from that level and rose, making an attempt to break above the long-term level 107.40 (144 EMA in the daily chart of CFD #USDX) at the moment.

In our previous review of DXY, we wrote that above the key support level of 105.65, the dollar index remains in the zone of a long-term bull market. With the appearance of signals to buy, long positions in DXY will again become preferable. Now the first such signal will be the return of the price to the zone above the resistance level of 107.40, and the confirming one will be the growth to the zone above the levels of 109.00, 110.00.

As you can see, the price, so far, is moving as we suggested earlier.

But, as always, we must also consider an alternative scenario.

Today's economic calendar is not rich in the publication of important macro statistics for the U.S., and this entire trading week in the US will be shorter than usual: on Thursday, November 24, banks and stock exchanges in this country will be closed on the occasion of Thanksgiving Day. This day marks the start of the holiday season. It includes Christmas and continues until the New Year. November 25 is a shortened working day in the United States as part of the continuation of Thanksgiving Day celebrations.

In early December, major financial market players will gradually begin to sum up the results of the outgoing year, which turned out to be generally successful for the dollar and, on the contrary, disappointing for buyers of the American stock market, although they will probably still be able to please the traditional New Year's Eve rally. But it is not a fact that it will take place this year. Nevertheless, one should not discount the intention of the Fed leaders to continue tightening monetary conditions for the time being, and this is not good for American private business.