The foreign exchange market may currently be undergoing significant structural changes. Recall that the market has been busy creating a downward trend section for the past two years. This section ended up being very lengthy and complex. Since in this section, we have yet to see any classical structures (5 waves down - 3 up) or at least structures resembling them, some waves still need to be identified. The geopolitical situation in Ukraine and rising Fed rates were the main drivers of the increase in demand for US currency in 2022. Regarding geopolitics, nothing changes, but things start to go the other way when it comes to Fed interest rates.

If the market responds favorably to the FOMC's rate hike, then the ECB and the Bank of England will likely raise interest rates more quickly in the coming months than the FOMC. As a result, the gap, which widened in favor of the dollar, will now close and no longer favor the dollar. This reasoning leads to the conclusion that the new environment will favor the euro and the pound in the next three to six months. Of course, geopolitics will also play a significant role, but making predictions in this area is much more challenging.

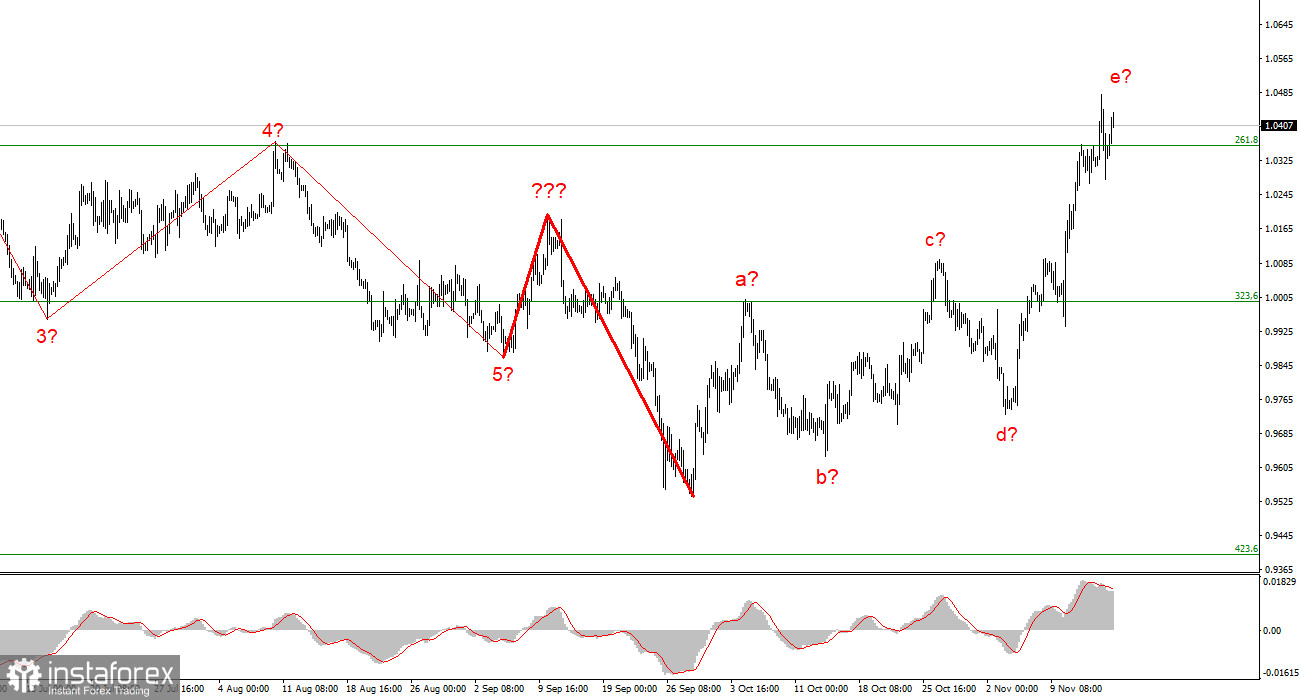

The only way to prevent a protracted decline in the US dollar is for the ECB and the Bank of England to eventually raise their rates less than the Fed. The ECB rate, for instance, will be 4%, while the Fed rate will be 5%. The US dollar would then be able to avoid a sharp decline. The Bank of England operates similarly. The dollar will only fall in value if the rates eventually equalize, but it won't have a significant advantage either. Since the Fed rate is no longer rising faster than the ECB or the Bank of England rate, the market is pulling both instruments away from the lows reached a few months ago. However, we need more than this element to detect a long-term upward trend section. Additionally, the upward trend that is currently in place is not an impulse. It is five waves long and corrective at the same time. Even now, the EU and UK's currencies do not significantly outperform the dollar, preventing them from smiling as they look to the future.

Based on everything stated above, I do not anticipate both instruments to experience significant growth over the next six months. The likelihood is that descending structures will be constructed after the current corrective ascending structures are finished. The news background is unlikely to be appropriate for impulsive downward trends, so the instruments can alternate the trend's correction sections one after the other. All of this implies that the euro and the pound can live comfortably for a long time in an area that is 700–800 base points wide.

Based on the analysis, the upward trend section's construction has been complicated into five waves. However, because the wave markup does not suggest a further increase, I cannot advise purchasing euros. If there is a successful attempt to break through the 1.0359 level with targets near the estimated 0.9994 level, which corresponds to the 323.6% Fibonacci, I advise selling.