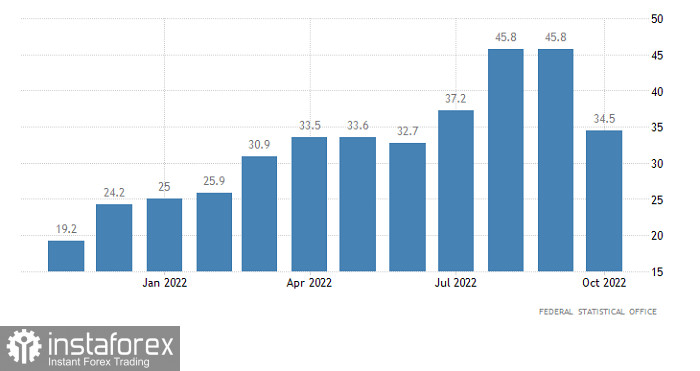

Surprisingly, the producer price data from Germany, which usually does not have a strong impact on markets, made euro fall down and lose a total of almost a hundred points. It was after it was revealed that consumer prices slowed from 45.8% to 34.5%, instead of only 42.0%. Such a massive decrease indicates that inflation in Europe may stop growing and start to decline soon. Consequently, the European Central Bank will have no reason to continue its aggressive rate hike.

Of course, it is difficult to make conclusions just on the basis of Germany's data, but it was enough for a noticeable correction. For example, pound bounced up after declining and came back to the values at which it was before the release of the PPI data. This means that it is too early to speak about the end of the correction.

Producer Price Index (Germany):

Today's macroeconomic calendar is completely empty. Most likely, the sideways trend will continue, especially since markets halted last night and started to stabilize around the reached values.

For EUR/USD, quotes corrected from the resistance level of 1.0500, falling about 250 pips and came close to 1.0150.

In GBP/USD, the situation is slightly different as quotes corrected from the psychological level of 1.2000, but slowed down around 1.1750. This formed a wide amplitude. For the correction to be prolonged, traders need to keep the pair below 1.1750, otherwise, it will remain within the range of 1.175/1.1950.