Overview of trading and trading tips for EUR/USD

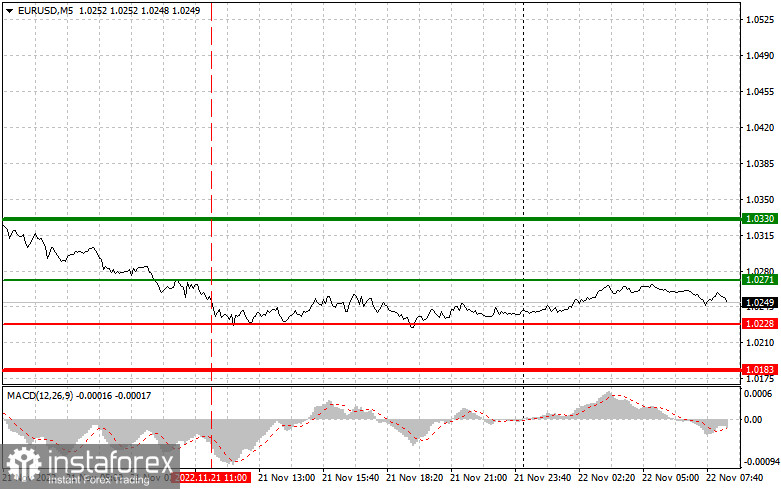

The level of 1.0249 was tested at the moment when the MACD indicator had made a considerable downward move from the zero level which capped the downward potential of the currency pair. Due to this morning decline without a correction, I decided not to sell the euro. The pair did not generate other signals because the volatility ebbed away.

The report on Germany's PPI came as a pleasant surprise because factory inflation eased, defying the consensus. Nevertheless, the euro did not find support from this. The PMI by the Federal Reserve Bank of Chicago also did not make any impact on the market. Today, the market will trade quietly because of the empty economic calendar. The reports worthy of attention are the eurozone's current account balance and the consumer confidence index which are due during the European session. Traders are likely to neglect remarks from Bundesbank President Joachim Nagel and policymaker Johannes Beerman.

In the second half of the day, the US will not unveil any important data. The retail sales index by Redbook and manufacturing PMI by the Federal Reserve Bank of Richmond are the data of secondary importance. Market participants will be alerted to comments by FOMC members Loretta Mester and James Bullard. Recently, their colleagues dropped hints that the central bank might revise its extremely aggressive monetary policy and ease the pace of further rate hikes. Indeed, the hawkish policy is pushing the economy into a recession. If the policymakers again come up with such statements, the euro could assert its strength against the US dollar.

Buy signal

Scenario 1. Today we could buy the euro after it reaches 1.0271 plotted by the green line on the chart with the target at 1.0330. I would recommend leaving the market at 1.03306 and then selling the euro in the opposite direction, bearing in mind a 30-35-pips downward move from the market entry point. We could bet on the euro's growth on condition Fed policymakers again send a message that the Fed might soften its rhetoric. Importantly, before opening long positions, make sure that MACD is above the zero mark and is going to begin its climb from it.

Scenario 2. Besides, we could buy the euro after it reaches 1.0228, but at that moment MACD should have entered the oversold zone which will limit the downward potential of EUR/USD and reverse the market in the opposite direction upwards. We could expect the instrument's growth to 1.0271 and 1.0330.

Sell signal

Scenario 1. We could sell the euro after it falls to 1.0228 plotted by the red line on the chart. 1.0183 could serve as the target where I recommend leaving the market and buying the euro in the opposite direction, bearing in mind a 20-25-pips upward move. Selling pressure on EUR/USD will escalate in case of bad news from China and strong statistics from the US. Importantly, before selling EUR/USD, make sure that MACD is below the zero line and is beginning its decline from it.

Scenario 2. We also could sell the euro today in case the price reaches 1.0271, but at that moment MACD should have entered the overbought zone which will subdue the upward potential of the pair and will reverse the market downwards. The currency pair might decline to 1.0228 and 1.0183.

What's on the chart

The thin green line is the key level at which you can place long positions in the GBP/USD pair.

The thick green line is the target price, since the price is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the GBP/USD pair.

The thick red line is the target price, since the price is unlikely to move below this level.

MACD line. When entering the market, it is important to adjust trading decisions to the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being trading during sharp fluctuations in market quotes. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation will inevitably lead to losses for an intraday trader.