Trading volumes were quite low early this week because of the upcoming holiday in the US and increased expectations that the Fed will continue aggressively raising rates, at least until the end of this year. Even so, optimism prevailed in markets because the latest inflation data in the US noticeably decreased. The worsening situation in China, where the coronavirus infection continues to run rampant, has also prompted authorities to suspend school and business activities in Covid-infected areas. This points to a likely decline in the country's economic growth, which in turn is bound to have an impact on exports and imports to the US and other economically advanced countries.

Market volumes will continue to decline, which will lead to a strong increase in volatility. However, it is unlikely to lead to any noticeable changes in the forex market because the sideways trend will continue, with some local rises or falls in the pairs where the dollar is present.

A similar scenario could be seen in the stock markets, connected firstly with the above-mentioned factors, and secondly with extremely high uncertainty about the Fed's decision on rates and the bank's plans and forecasts for next year. Most likely, the decline will continue even amid positive news or data on the US economy. The focus will remain on the October Fed minutes, which might be the reason for noticeable movements.

Forecasts for today:

USD/JPY

The pair is trading below the strong resistance level of 142.25. A break above it might push the quote to 143.30.

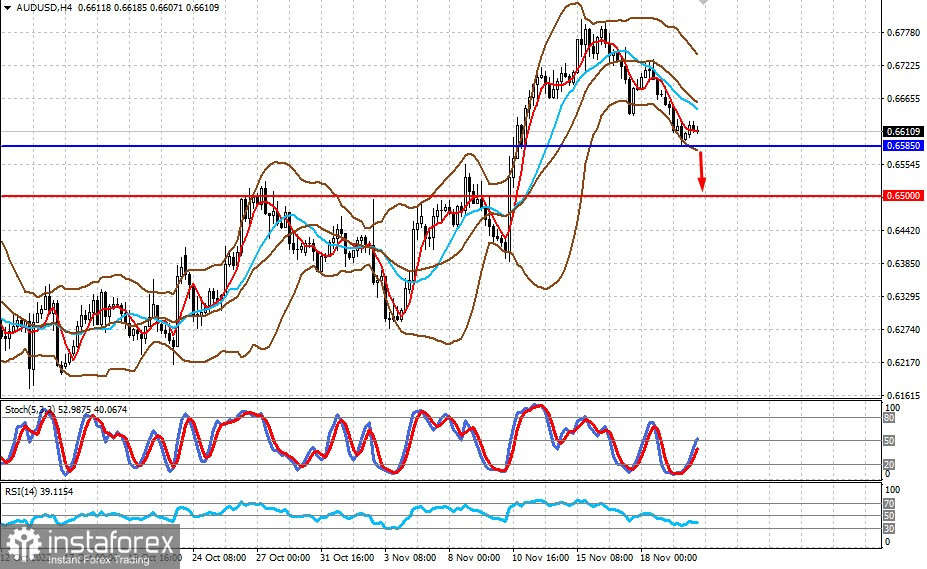

AUD/USD

The pair might resume the decline amid negative news from China and gloomy sentiment in the markets. A decline below 0.6585 might push the quote down to 0.6500.