The dollar index is showing signs of recovery. Perhaps it will show even stronger signs in the coming sessions. However, traders will refrain from making bold attempts to push the dollar higher before the release of the Federal Reserve minutes. The fact that we are facing a short week may also play a role here. The United States will be celebrating its Thanksgiving holiday on Thursday, which will lead to lower activity in markets and limited reaction to market data and other news.

Wednesday will be an important trading day. A series of macroeconomic data will be released on this day, as well as the minutes. There might be a flurry of activity before holidays and weekends. It is possible that there will be a delayed reaction to all of this as early as next week. In the meantime, markets are evaluating or rather quietly studying the fresh opinions of the Fed members on the central bank's further steps.

The main question is whether the central bank will eventually shorten the time period during which it is not expected to pause in policy tightening. No matter what the Fed members say, investors are hoping for less aggressive measures and an early transition to dovish rhetoric. They will be looking for signals for such a scenario in all publications, statements and other news reports.

News from the Fed

The speech of the head of the San Francisco Fed, Mary Daly, was quite long. The members of the central bank don't seem to have a definite line on what they plan to do next. Now is the time when they are thinking and discussing their next steps.

Citing new research from her regional bank, Daly said that "the level of financial tightening in the economy is much higher than what the (federal) funds says." Financial markets are acting as if it is about 6%.

Markets have priced in QE parameters that far exceed those outlined by the Fed. In this regard, Daly noted that "it will be important to remain conscious of this gap between the federal funds rate and the tightening in the financial markets. Ignoring it raises the chances of tightening too much."

Anyway, the Fed still has a lot of work to do to steer monetary policy in the right direction to curb inflation. Those were probably the key words.

Daly, speaking to reporters, made no secret of the fact that she has yet to decide which rate hike she will support at the December FOMC meeting. We need to look at new economic data before making a decision.

The central bank representative also warned against using the market funds rate of 6% as a benchmark for determining the actual policy.

"I use the proxy rate as a point of reference, not as an indication that we should stop early," Daly summarized.

In economic forecasts released in September, the central bank's policy makers outlined an average target rate of 4% for the next year. Most officials have since assumed that, given the dynamics of inflation and the continuing strength of the labor market, they may want to go higher. Daly did not rule out the possibility of an increase to 5.25%.

At the same time, everyone understands and knows that raising rates too sharply will cause great damage to the economy, so the possibility of reducing the size of individual rate hikes is being discussed in parallel. In addition, recent data showing signs that inflation may slow down has given officials some room for such a maneuver.

Daly said in her formal remarks that the next stage for the Fed will be "in many ways more difficult". She added that officials will need to be "mindful" of their choices and its consequences. Too much adjustment can lead to an unnecessarily painful recession. At the same time, "adjusting too little will leave inflation too high".

The dollar reflects

BNP Paribas has provided a number of new interesting research for dollar bulls. According to analysts' calculations, the bottom of the stock market in the current bear market has not yet been reached.

After analyzing 100 years of crashes, BNP Paribas finds market bottoms typically require a capitulation event – which is associated with a coordinated spike in volatility, skew, and convexity.

"We have not yet seen this, suggesting that the bottom is not yet in," says Calvin Tse, Head of US Macro research, at BNP Paribas. "Recessionary bear markets historically have often ended with a capitulation. We are calling for a capitulation in equities next year."

Therefore, if the bottom of the stock market has not yet been reached, then neither is the dollar's peak.

The dollar is countercyclical and rises in bad market conditions as investors seek cash as protection against asset depreciation. If the BNP Paribas economists' assessment has merit, then those who advocate for a stronger dollar could win.

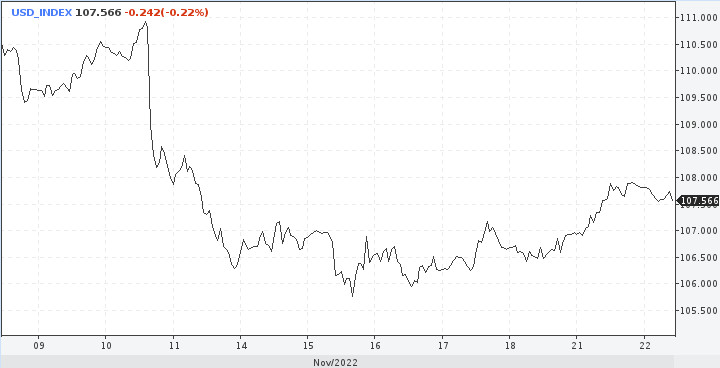

Meanwhile, the dollar index rose for the third consecutive session and is trading near the key barrier at 108.00. Although, the bulls' grip eased somewhat.

The uptrend meets obstacles in the way. However, if it breaks through the 109.18 resistance and then the 109.70 level, it could encourage the exchange rate to rise in the short term.

Today's dollar losses could be due to the fact that investors are cautiously awaiting the latest Fed meeting's minutes, which could affect the U.S. rate forecast. Traders also analyzed various comments from Fed officials and found them largely soft. Central Bank officials are still sticking to their version of lower inflation, but doubts are certainly present.

Meanwhile, the dollar index jumped 1% on Monday due to the worsening Covid situation in China. This factor is known to have a short-term effect.