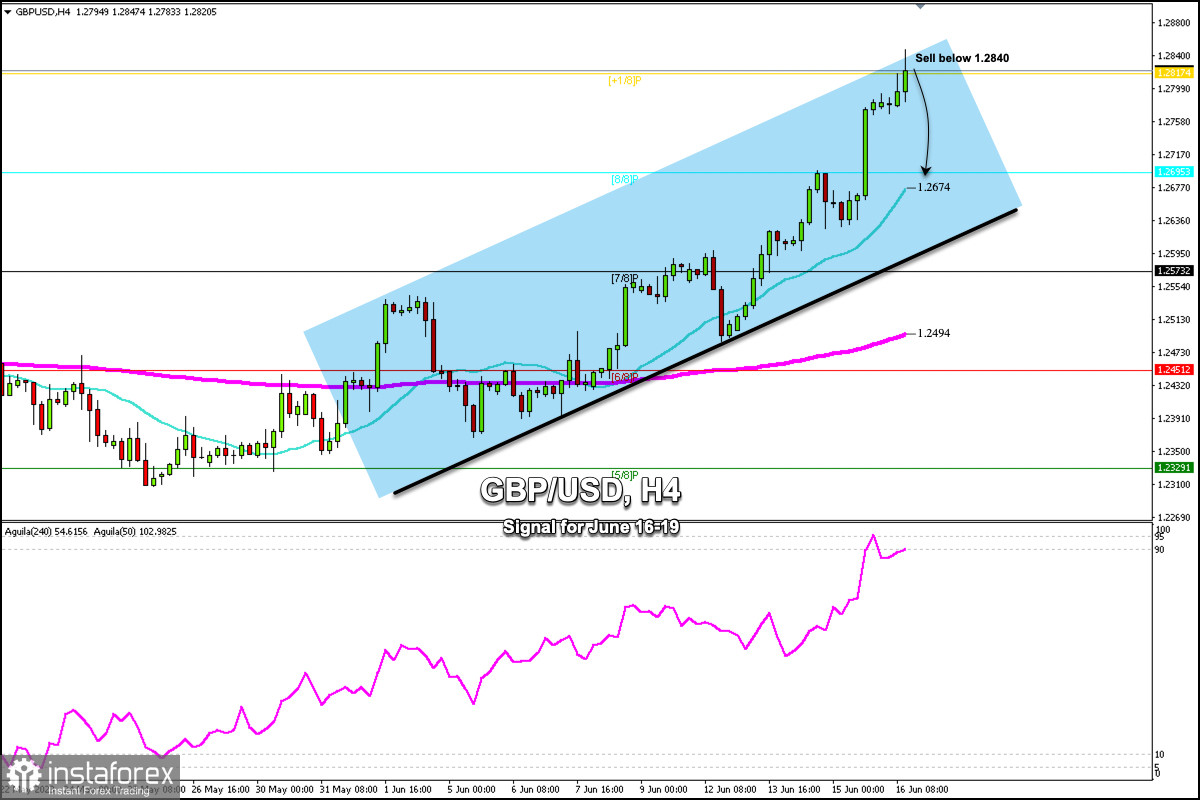

Early in the American session, the British pound is trading around 1.2826, above the 21 SMA, and above the +1/8 Murray. The 4-hour chart shows that the pound has found a strong overbought area around 1.2840. This level could strongly reject the pair.

GBP/USD reached levels since April 2022 at 1.2848. The pair remains overbought in the short term. GBP/USD is expected to make a technical correction as part of profit-taking, which could make it difficult for the pound to continue rising.

The strong weakness of the US dollar was one of the reasons for a strong boost to the British pound and other currency pairs that include the USD. At the next meeting, Fed officials are likely to reassess the possibility of a further rate hike in July.

Our trading plan for the next few hours is to sell the British pound below 1.2840, with targets at 1.2695 (8/8 Murray) and 1.2674 (21 SMA). The eagle indicator reached the extremely overbought zone which supports our bearish strategy