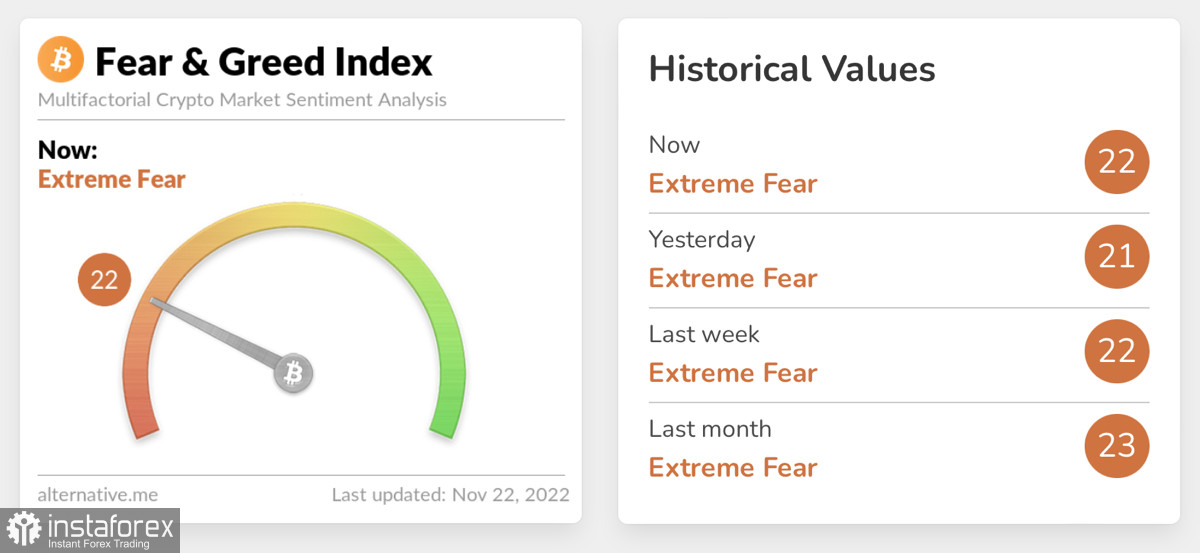

The increase in trading activity after the downturn over the weekend played a cruel joke on Bitcoin and cryptocurrency prices. Investor sentiment remains decadent, which directly affects the movement of cryptocurrency prices.

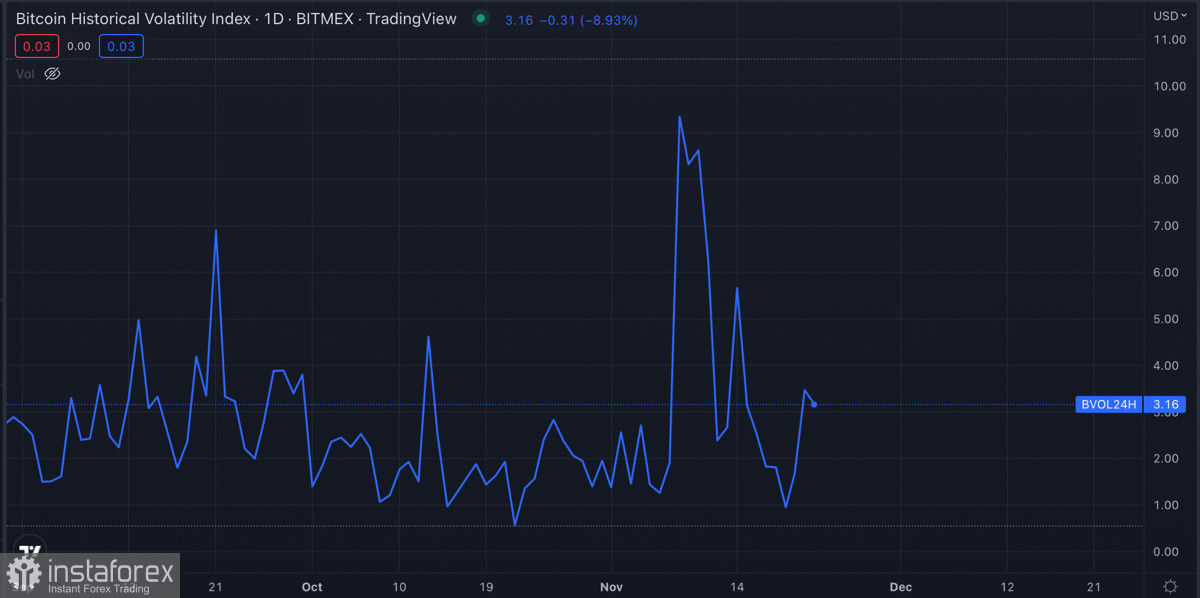

At the end of November 21, Bitcoin price slightly updated the local bottom below $15.7k. This process was accompanied by a surge in trading volumes, which, for the most part, were aimed at selling BTC coins. And despite the visual update of the local bottom, psychologically, the market is ready to see the cryptocurrency lower.

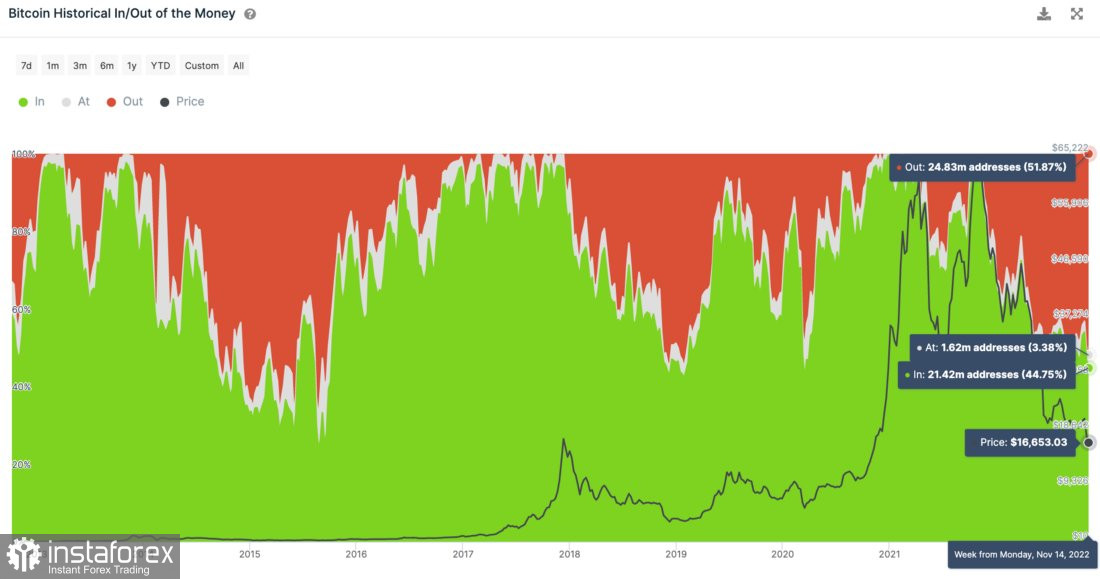

Total fear in the market

As of November 22, about 51.7% of addresses in the BTC network are at a loss. Recall that at the peak of past crises, this figure dropped to 55% in 2019 and up to 62% in 2015. Despite a clear downward trend, there is every reason to believe that the loss ratio will increase.

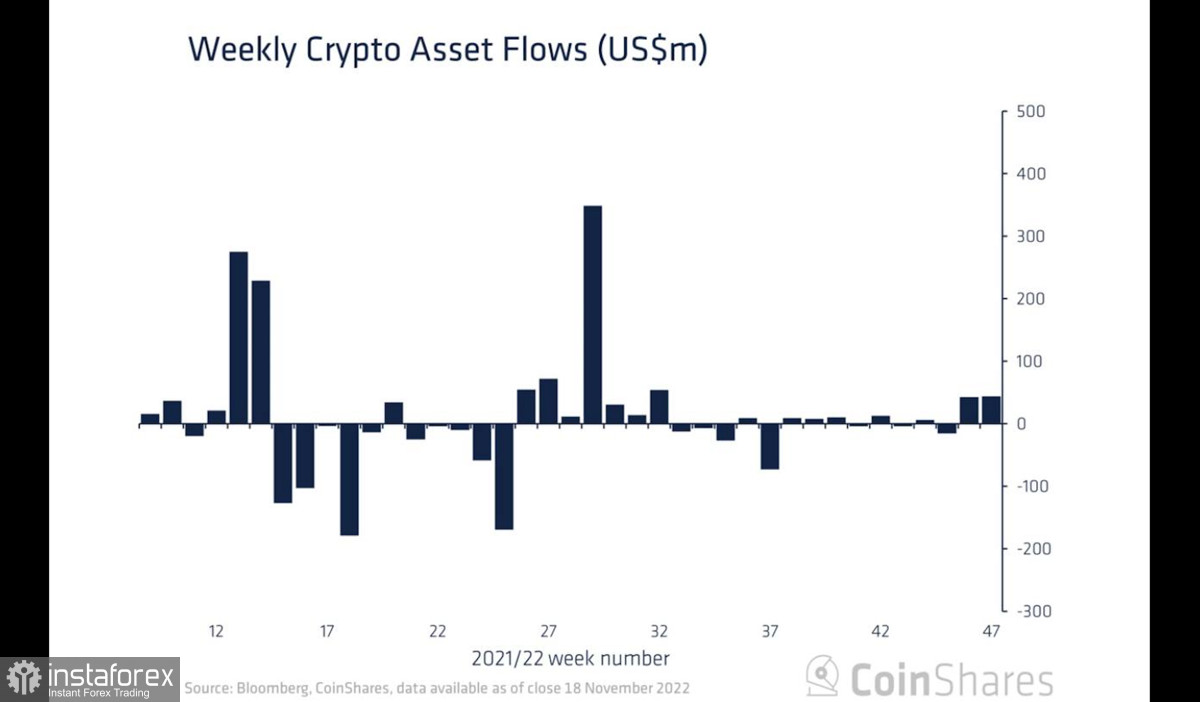

Last week, CoinShares recorded an inflow of $44 million into crypto funds. The catch is that more than 75% of the investments went into "short" crypto funds or products. This points to the complete dominance of bearish sentiment in the market.

Meanwhile, the Grayscale Bitcoin Trust story got a follow-up. Coinbase Custody published GBT reserves and reassured investors by confirming the company's solvency. CC representatives also noted that all Grayscale assets are safe from misuse.

At the same time, the situation of the Genesis crypto broker risks becoming another "black swan" of the current crisis. Binance turned down the opportunity to acquire Genesis, making matters worse. Genesis management said it is continuing to negotiate a $500 million investment in the company.

However, management does not rule out the possibility of filing for bankruptcy. The market is in a state of permanent fear and despair, and therefore any negative statements are perceived especially painfully. The Genesis announcement came last night ahead of the local Bitcoin bottom update.

BTC/USD Analysis

The bears managed to take full control of the situation and push the BTC/USD quotes below the $15.8k support level. As of writing, Bitcoin continues to trade near the $15.7k level, below a key support zone. If the situation does not radically change in the next 24 hours, then we expect a further fall.

A strong support area at $14.3k–$14.8k will be the main target for the bears. However, in the current situation, the fall could be deeper and uncontrolled. Bitcoin's calm below $16k indicates a total fear and reluctance to buy back the bottom.

Miner pressure, the macroeconomic crisis, institutional distrust and the threat of bankruptcy of Genesis, Gemini and a number of other companies are forcing investors to expect BTC to be much lower. In the current situation, technical analysis fades into the background, and psychology becomes the main driving force of the market.

The market believes that the combination of the above factors can provoke a deeper fall in Bitcoin. Possible targets include the $14.2k, $14k and $13.1k levels, where buyers could start a massive buyout.

Results

In any case, it is important to understand that this is the final plunge of BTC, which should end with a similar V-shaped pullback. It is the formation of a similar pattern of mass buyer activation that will indicate the final achievement of the bottom.