Meanwhile, yesterday's comments made by the Fed officials encouraged the market. Investors analyzed them looking for hints about the pace of interest rate hikes, adding to all this the risk of introducing more anti-covid restrictions in China. The S&P 500 and Nasdaq 100 futures contracts added about 0.2%. The Dow Jones Industrial Average index showed no movement and traded near its opening levels today. The Stoxx Europe 600 index rose by 0.4%, with oil companies Shell Plc and BP Plc as the main growth drivers.

The US dollar slightly weakened against all major currencies. At the same time, Treasury yields fell. Crude prices stabilized after yesterday's large sell-off as investors returned the price to the previous levels after fears about supply prospects and weaker demand in China subsided.

Fed officials stuck to their hawkish stance on inflation. Nevertheless, San Francisco Fed President Mary Daly and Cleveland Fed President Loretta Mester were less hawkish. "I think we can slow down from the 75 at the next meeting. I don't have a problem with that, I do think that's very appropriate," Mester said, adding that the policy was entering a new cadence where further rate hikes could put more pressure on the economy.

Earlier, Mary Daly said: "As we work to bring policy to a sufficiently restrictive stance - the level required to bring inflation down and restore price stability - we will need to be mindful," Daly told the Orange County Business Council on Monday in Irvine, California. "Adjusting too little will leave inflation too high. Adjusting too much could lead to an unnecessarily painful downturn," she added.

Asian stock indices fell as the daily number of Covid cases in China reached nearly the highest level.

Covid restrictions now affect one-fifth of China's economy, driving Chinese stocks lower during premarket trading on the NYSE.

Meanwhile, gold rose due to the weakening dollar. Cryptocurrency prices continue to decline as investors prepare for new turmoil following the collapse of Sam Bankman-Fried's FTX, which could cause new bankruptcies in the digital asset market.

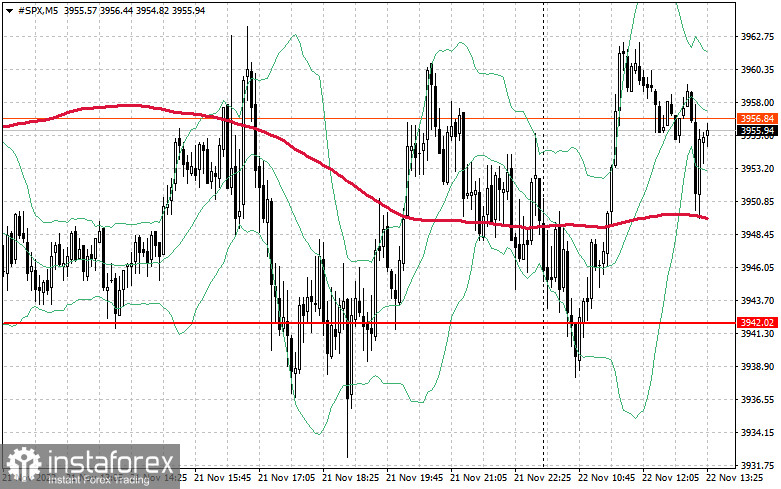

As for the S&P 500 index, after yesterday's rather calm day, the index is trading within the sideways channel. Bulls need to protect the support of $3,942. As long as the index is trading above this level, the demand for risky assets is likely to persist. This may strengthen the trading instrument and return the levels of $3,968 and $4,003 under control. If the price manages to pierce $4,038, the upward correction may drive the pair to the resistance level of $4,064. The next target is located in the area of $4,091. If the index declines, bulls will have to protect $3,942. If this level is broken through, the trading instrument may be pushed down to $3,905, opening the way to a new support level of $3,861.