There is nothing to talk about since there was no news background in the first two days of the week. But today we will receive the first data that could have a chance of affecting the market. The business activity data are relatively important reports. Usually we can expect traders to react to them when results are either significantly higher or lower, which the market does not expect at all. But that happens very rarely. Thus, I do not expect any unexpected values or strong reactions from today's business activity reports.

The Federal Reserve's minutes are just a normal economic report on the U.S. regions. It does not contain any information that might not be known to the market. It does not contain any important information at all. That leaves only a few reports like the durable goods orders, traders could react to it, but I don't think it will be significant.

The same applies to the speeches of the Federal Open Market Committee and the European Central Bank members. In recent months, the most popular topic on the foreign exchange market has been the interest rates of a particular central bank. So much has been said and written about it... The market clearly understands that the Fed will slow down the pace of tightening of the monetary policy, while the ECB is not planning such a step yet. The demand for the euro and the pound could increase in recent weeks due to this factor, which made it possible to complete the e waves. Now the new speeches of the FOMC members, who will repeat the rhetoric of their colleagues, no longer have an impact on the market.

For instance, Raphael Bostic, president of the Atlanta Fed said that he personally would be willing to support weaker interest rate hikes at the next meetings. He also said that in order to effectively fight inflation, the rate needs to be raised by a maximum of 100 basis points more. "I believe this level of the policy rate will be sufficient to rein in inflation over a reasonable time horizon", Bostic said. He, like Mary Daly, thinks the rate could end up rising a little higher than expected now, but based on current inflation data and GDP forecasts, no one is going to raise the rate above 5%. But at some point, he said, the Fed would need to pause and "let the economic dynamics play out," given that it may take what he estimated as anywhere from 12 to 24 months for the impact of Fed rate increases to be "fully realized."

In my opinion, all this has long been known to the market, and each new speech by a member of the FOMC does not differ in content from the previous one. Even James Bullard, who is the brightest hawk and who could have said that the rate should be raised above 5%, keeps silent and does not argue with his colleagues. Based on all of the above, all I can say is this: there is no new data and it is not expected this week. The wave markup should and will remain in the first place during the analysis.

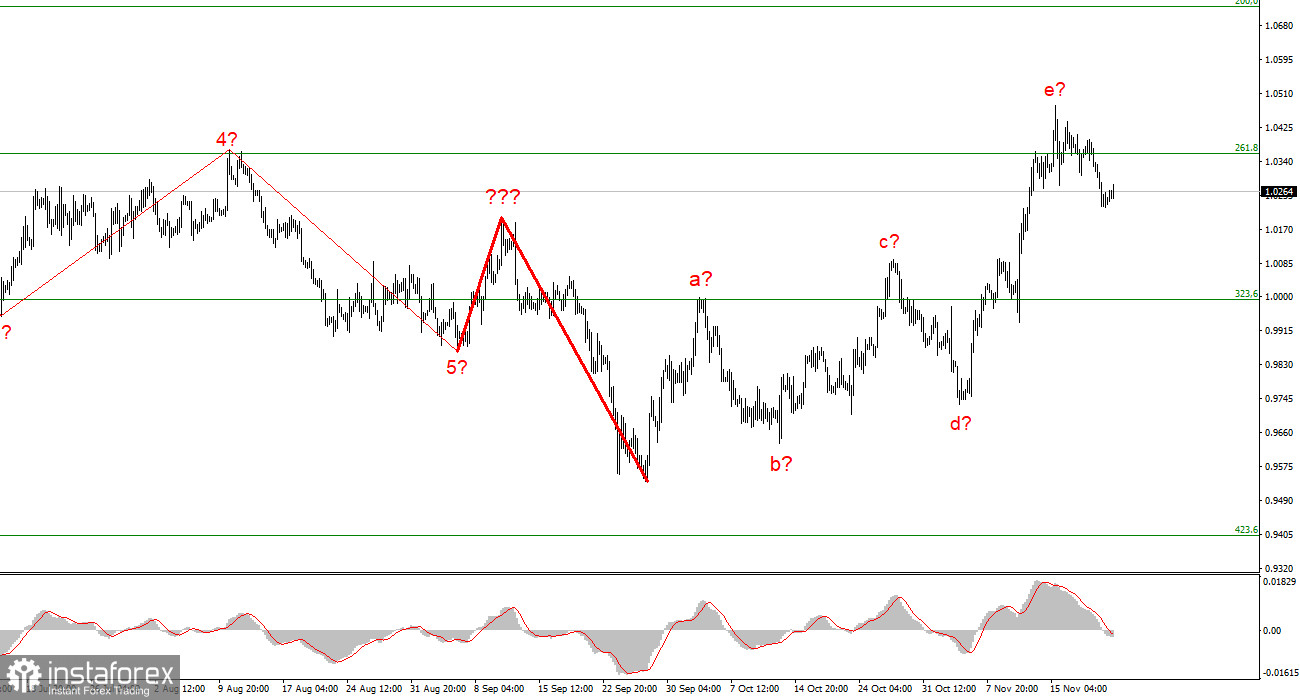

Based on the analysis, I conclude that the construction of the uptrend section has become more complicated to five waves and is completed. Thus, I advise you to sell with targets located near the estimated mark of 0.9994, which corresponds to 323.6% Fibonacci. There is a probability of a complication with the upward section and taking a more extended form, but so far it is not more than 10%.

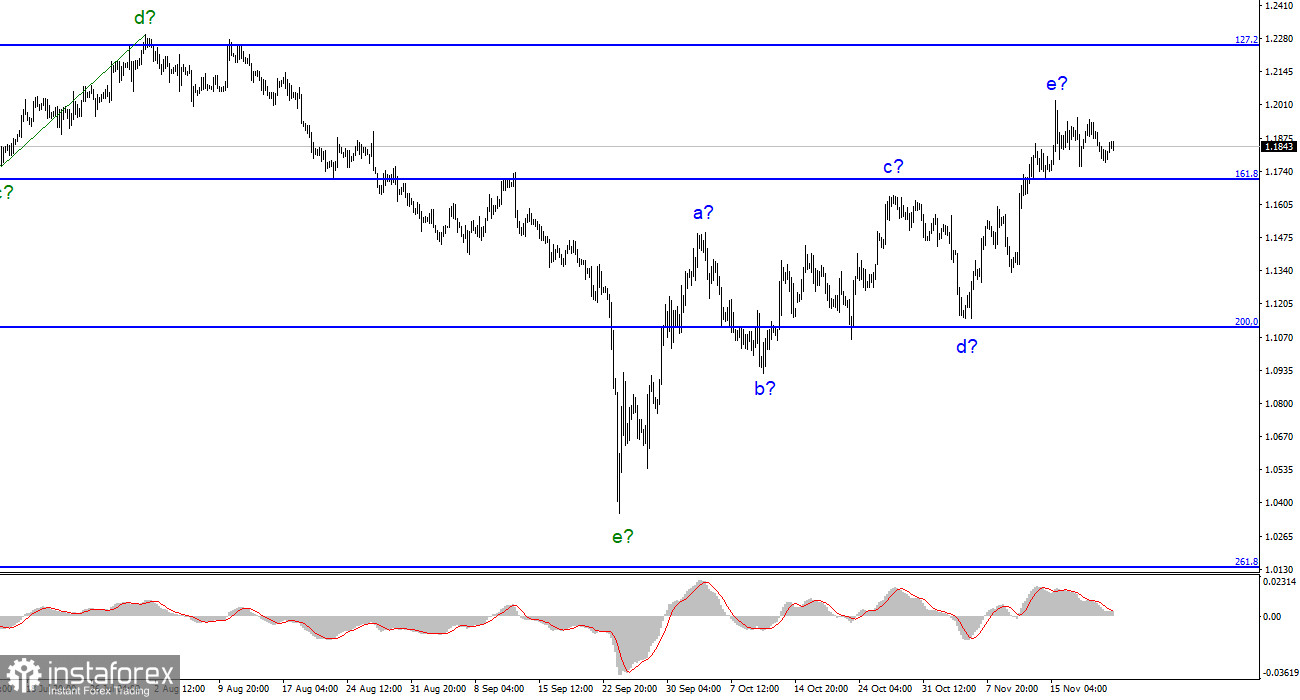

The wave pattern of GBP/USD assumes the construction of a new downtrend section. I do not advise buying the pound right now because the wave pattern allows the construction of the downtrend section. It would be better to sell with the targets located near the 200.0% Fibonacci level.