Although markets are sluggish ahead of the upcoming holiday and long weekend in the US, stock indices are rising, while Treasury yields and dollar are falling. This is mainly due to the slightly less hawkish comments from Fed speakers this week, which is in contrast with the statement of St. Louis Fed President James Bullard last week that stressed that interest rates should reach at least 5-5.25%. San Francisco Fed chief Mary Daly also pointed out the need to be mindful of delays in the transmission of policy changes, and Atlanta Fed President Raphael Bostic stated that an additional tightening of 75-100p would be justified.

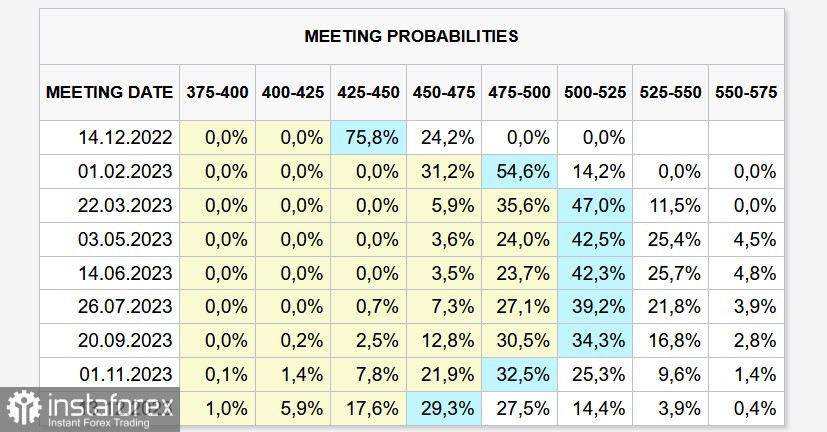

So far, the rate forecast is stable. There is a 75% chance of a 50p increase, another 50p in February, and a peak to 5.06% by June. This is the benchmark that is currently guiding the markets.

Today is packed with important statistics from the US. The first one will be the report on orders for durable goods, which will reflect the state of the industrial sector and consumer demand. Next is the consumer confidence indices from the University of Michigan, followed by the Fed minutes, where players will be looking for signals of a dovish reversal by the Fed. There are no signs that the dollar will resume rising.

USD/CAD

The slowing Canadian economy has not yet led to any noticeable deflationary pressure. The labor market is strong, with employment and wage growth being higher than that of the US. Retail sales also rose 1.5% m/m in October, which means that the Bank of Canada has more room to maneuver than the Fed and so far can implement a policy of containing inflation without looking at the rate of economic growth.

Bank of Canada Governor Tiff Macklem will be giving a speech today, where markets expect to see a similar position to that of the Fed. However, this is likely to rule out strong moves.

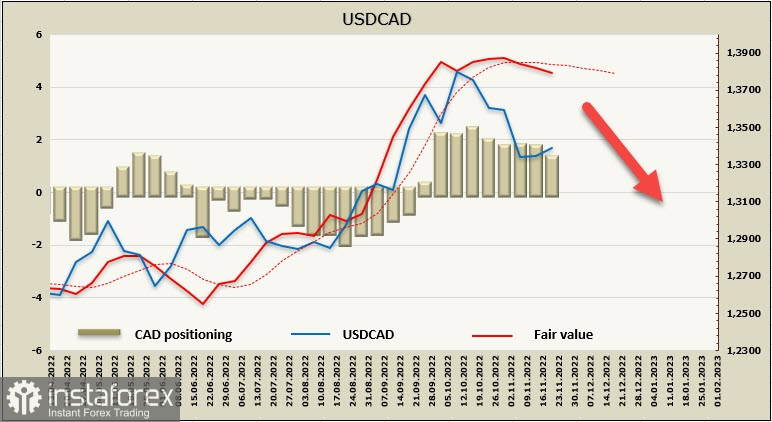

Regarding the loonie, the latest CFTC report showed that cumulative short positions declined by 402 million to -973 million, which means that there is a slow shift in sentiment. But overall the loonie remains bearish, with the settlement price pointing downwards and below the long-term average. It has a chance to strengthen.

The possible rise of USD/CAD will end in the resistance area of 1.3500/30, followed by an attempt to test the local low of 1.3224. Chances for a deeper decline have become higher, with the target being the technical support at 1.30.

USD/JPY

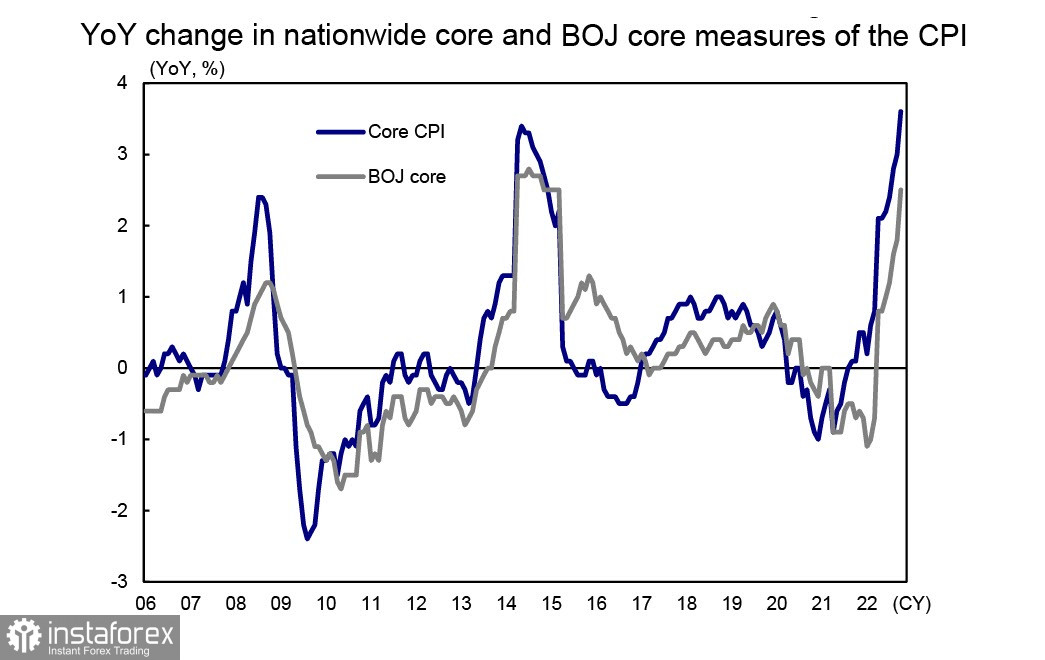

Core CPI rose 3.6% y/y in October, 0.6% higher than that of September's. The data has risen for the 14th consecutive month, and the rate of growth is already higher than in 2014, when the sales tax was introduced to break out of the deflationary squeeze.

By all indications, the time for deciding whether to end the stimulus programs is approaching. Last November 10, Prime Minister Fumio Kishida met with Bank of Japan Governor Haruhiko Kuroda, which resulted in new signals. Kuroda expressed the BoJ's position that a unilateral sharp depreciation of the yen is not welcome. This means that raising the yield ceiling for 10-year bonds from the current 0.25% is rejected, as is the ending of QQE.

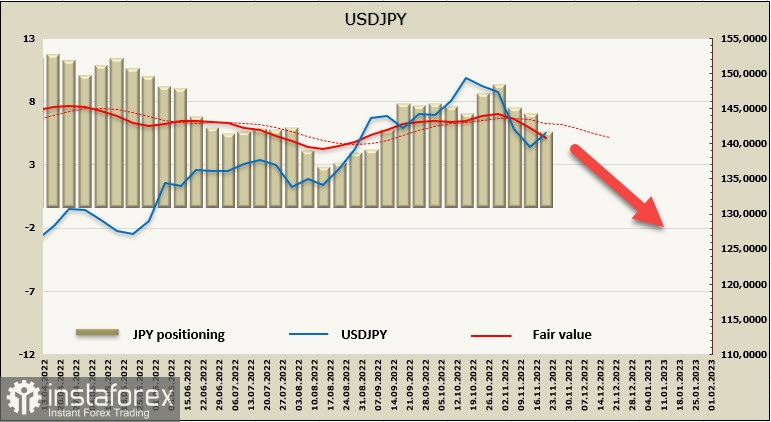

The rising inflation and ruling out of the BOJ of rate cuts for the time being sends a clear signal to investors who are selling the yen. As a result, the net short positions continued to decline, falling by 548 million to -5.909 billion during the reporting period. The settlement price is also reversed downward.

For now, there is less reason for USD/JPY to resume its record rise as trading is highly likely to be sideways. There is also little chance that it will move beyond the technical resistance at 143.12, unless there are clearer signals from the Bank of Japan.