US stock index futures opened near yesterday's high and continued to rise as well as European stock indices, which remain stable during the regular session. Investors await the publication of the minutes of the Federal Reserve's latest meeting. They will be looking for hints that the pace of rate hikes may slow down as early as the committee meeting this December.

Yesterday, futures on the S&P 500 index rose by 0.3% after the index closed at its highest level since mid-September during the regular session. Futures on the Nasdaq 100 index changed slightly as well as the Dow Jones Industrial Average. The Stoxx Europe 600 index remains trading near a new three-month high amid gains in mining and energy stocks.

The US dollar index continues to decline, and the yield of ten-year US Treasury bonds remained virtually unchanged. All this points to a pause taken by traders before the publication of the Federal Reserve's November meeting minutes. If there are any hints of easing the aggressive rate hikes, we are likely to see another rally in the stock indices. Investors will analyze the Fed minutes to see how policymakers feel about future inflation. Some investors expect the lower-than-expected consumer price index reading for October that may force the Fed to soften the pace of rate hikes as early as next month.

Investors may easily react prematurely to any change in the Fed policy. If it becomes clear that no one else is going to deliberately destroy the economy, it would eliminate the chance of interest rates above 5.0%. Thus, the demand for risky assets may return. Many economists, including Federal Reserve policymakers, have long agreed that the recent slowdown in price growth is not a reason to make policy changes.

European investors were disappointed by data showing that private sector activity in Germany and France, the eurozone's two largest economies, declined in November. This means that the region may have slipped into a recession. Another survey showed that the UK economy also sunk into a recession, and the downturn is expected to worsen in 2023.

The Manufacturing PMI rose unexpectedly in November, signaling that companies are seeing early signs that the region's economic slowdown may be easing as record inflation recedes and expectations for future manufacturing improve.

Meanwhile, bitcoin rebounded from its yearly low and posted gains of 4.2%.

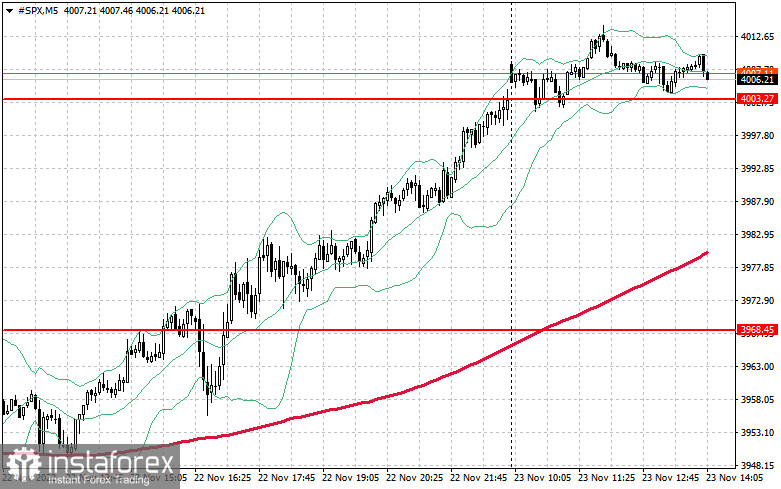

As for the S&P 500 index, yesterday's surge gives confidence for the future. Bulls need to protect the support of $4,000. As long as the index is trading above this level, the demand for risky assets is likely to persist. This may strengthen the trading instrument and return the level of $4,038 under control. If the price breaks through $4,064, the upward correction with a target at $4,091 may continue. The next target is located in the area of $4,116. If the price declines, bulls will have to protect the psychologically important support of $4,000. If this level is pierced, the price may be pushed down to $3,968, opening the way to a new support of $3,942.