Overview of trading and tips on GBP/USD

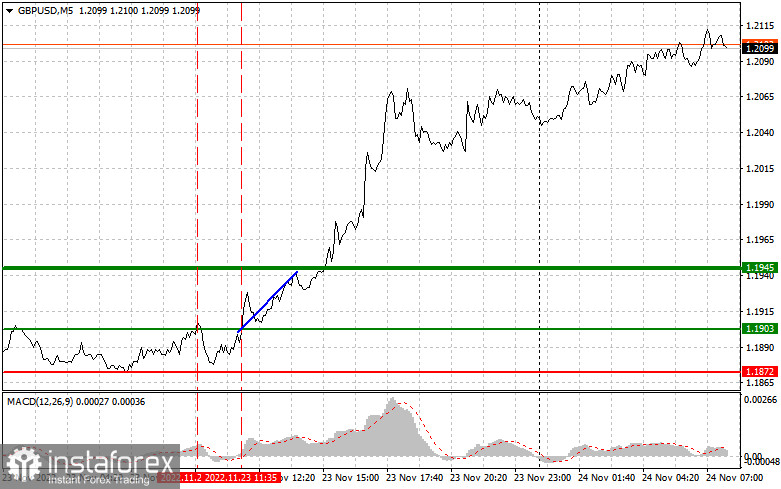

The test of 1.1903 happened at the moment when MACD stayed far away from the zero mark which capped the upward potential of the pair, especially amid expectations of weak PMIs. For this reason, I didn't buy GBP. In the second half of the day, the level of 1.1903 was tested again where MACD was beginning its upward move. This confirmed the right market entry point for long positions on GBP/USD. As a result, the price jumped to 1.1945.

Weak reports on the UK manufacturing PMI, services PMI, and composite PMI did not make a serious impact on GBP buyers who continued accumulating long positions on GBP after the publication of similar downbeat PMIs from the US. As for the FOMC minutes released yesterday, the policymakers of the rate-setting committee informed that the likelihood of a recession in the US increased almost to 50% next year due to the risks of dwindling consumer spending, global economic headwinds, and further rate hikes. This is a bad omen for the US dollar which is expected to weaken more against the pound sterling.

Today market participants are alert to comments by Deputy Governor for Markets and Banking at the Bank of England Sir David Ramsden and Monetary Policy Committee member Huw Pill. Their remarks will hardly change market sentiment. The report on industrial trends orders by the Confederation of the British Industry.

In case GBP/USD updates the daily high and trades sluggishly above 1.2117, it would be better not to hurry up with long positions because in the second half of the day, the market will be thin and nobody will increase long positions on the occasion of Thanksgiving Day in the US.

Buy signal

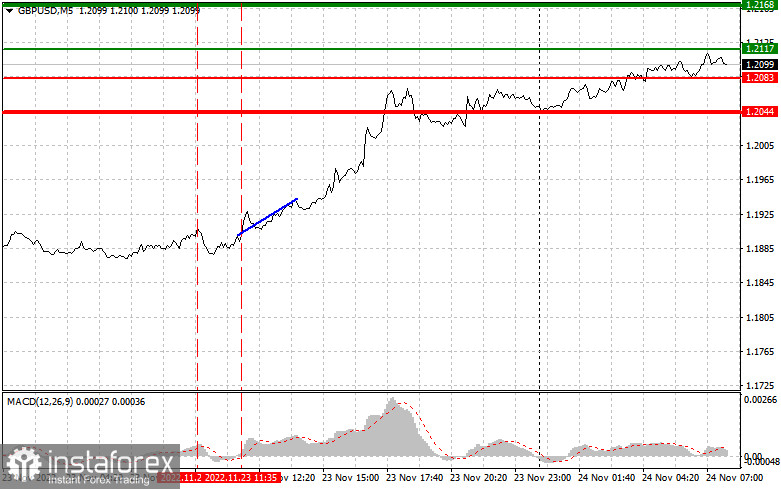

Scenario 1. We could go long on GBP/USD after the price reaches 1.2117 plotted by the green line on the chart with an upward target at 1.2168 plotted by the thick green line. I would recommend leaving the market at 1.2168 and opening short positions in the opposite direction, bearing in mind a 30-35-pips downward move from that level. We could bet on strong GBP growth only after strong statistics from the UK. Importantly, before buying the pair, make sure MACD is above the zero mark and is going to grow from it.

Scenario 2. Besides, we could buy GBP/USD today in case the price reaches 1.2083, but at that moment MACD should have already entered the oversold zone which will limit the downside potential of the pair and will reverse the trajectory upwards. We could expect a climb to 1.2117 and 1.2168.

Sell signal

Scenario 1. We could sell GBP/USD today after the price updates the level of 1.2083 plotted by the red line on the chart. This will trigger a rapid fall of the instrument. The key sellers' level will be 1.2044 where I recommend leaving sell positions and immediately opening buy positions in the opposite direction, bearing in mind a 20-25-pips upward move from that level. The instrument will come under selling pressure in case the buyers are inactive at highs. Importantly, before selling GBP/USD, make sure MACD is below the zero mark and is going to slip from it.

Scenario 2. Another option to sell GBP/USD is to go short after the price reaches 1.2117. At that moment, MACD should stay in the overbought zone which will limit the upside potential of the pair and reverse the trajectory downward. We could expect the price to decline to 1.2083 and 1.2044.

What's on the chart

The thin green line is the key level at which you can place long positions in the GBP/USD pair.

The thick green line is the target price, since the price is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the GBP/USD pair.

The thick red line is the target price, since the price is unlikely to move below this level.

MACD line. When entering the market, it is important to adjust trading decisions to the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid trading during sharp fluctuations in market quotes. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation will inevitably lead to losses for an intraday trader.