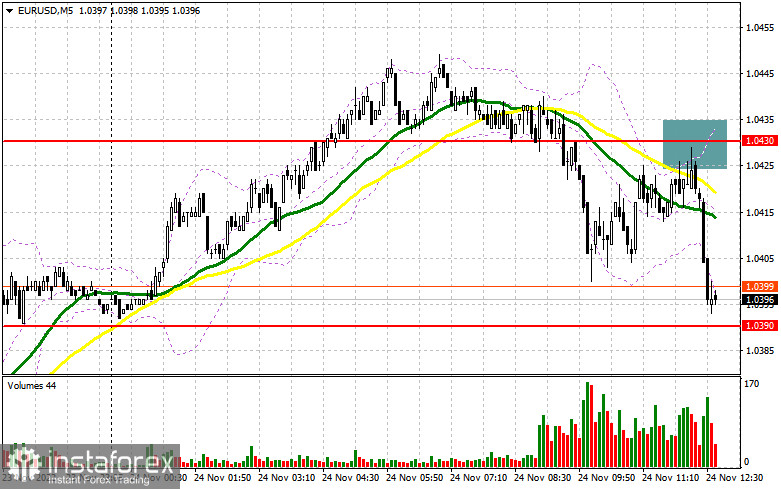

In the morning, we focused on the mark of 1.0430 and considered entering the market from there. Let's take a look at the M5 chart to get a picture of what happened. A breakout through 1.0430 and its retest to the upside following the release of mixed statistics in Germany generated a sell signal. At the moment of writing, the pair fell by over 30 pips. In the second half of the day, I decided to stick to the same trading plan and strategy.

When to go long on EUR/USD:

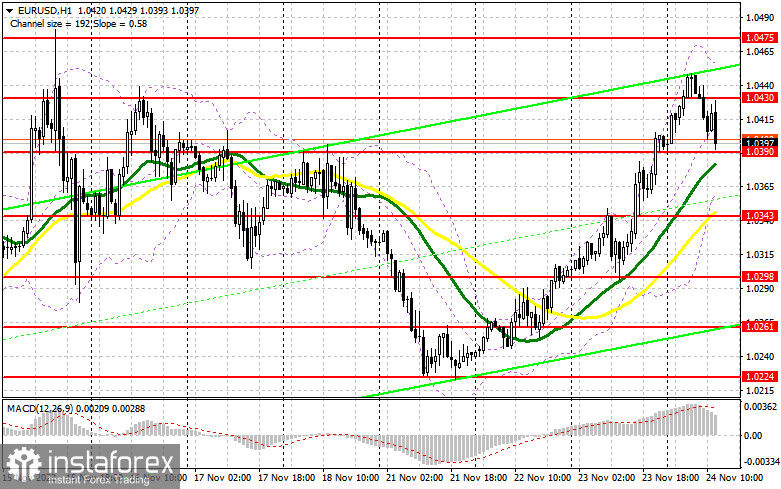

The pair is likely to trade coolly in the second half of the day due to a federal holiday in the United States. The country celebrates Thanksgiving Day today. Trading volumes will be much lower, which will affect volatility. If the downtrend continues, it will become possible to go long after a false breakout at 1.0390. This will make a buy signal. The EUR/USD pair may then recover to 1.0430. This mark was seen as support in the morning. Bullish activity is likely to rise if the price breaks and tests the barrier to the downside. In such a case, the target will stand at 1.0475. Should the price go above the range, the uptrend may extend to 1.0525 where it will become possible to lock in profits. If EUR/USD goes down during the North American session when there is no bullish activity at 1.0390, the pressure on the euro will increase, and the pair will plunge. Therefore, it would be wiser to buy the instrument after a false breakout through 1.0343 support, which is in line with the bullish moving averages. It will also be possible to open long positions on EUR/USD right after a bounce off 1.0298, or even lower, at 1.0261, allowing a bullish correction of 30-35 pips intraday.

When to go short on EUR/USD:

The bears took advantage of the macro data that came from the eurozone to push the euro below 1.0430, which triggered a row of stop orders, and the pair went further down. It remains to be seen whether the bulls try to regain control over the mark of 1.0430 in the second half of the day. Meanwhile, the bears should protect the level of 1.0430. After a false breakout through the mark, the euro may fall to the nearest support of 1.0390. Consolidation and a retest of this range to the upside will make an additional signal, triggering a row of bullish stop orders, and the euro will go down to 1.0343, where it would be wiser to consider locking in profits. The most distant target is seen in the area of 1.0298. Should the pair go there, it will undermine the strength of the uptrend. If EUR/USD rises during the North American session when there is no bearish activity at 1.0430, the sellers may start leaving the market again. In such a case, bullish activity will increase and the uptrend will resume with the price ascending to 1.0475. Therefore, it would be wiser to go short at 1.0475 after a false breakout only. It will also be possible to sell EUR/USD immediately after a bounce off the 1.0525 high, allowing a bearish correction of 30-35 pips.

Commitments of Traders:

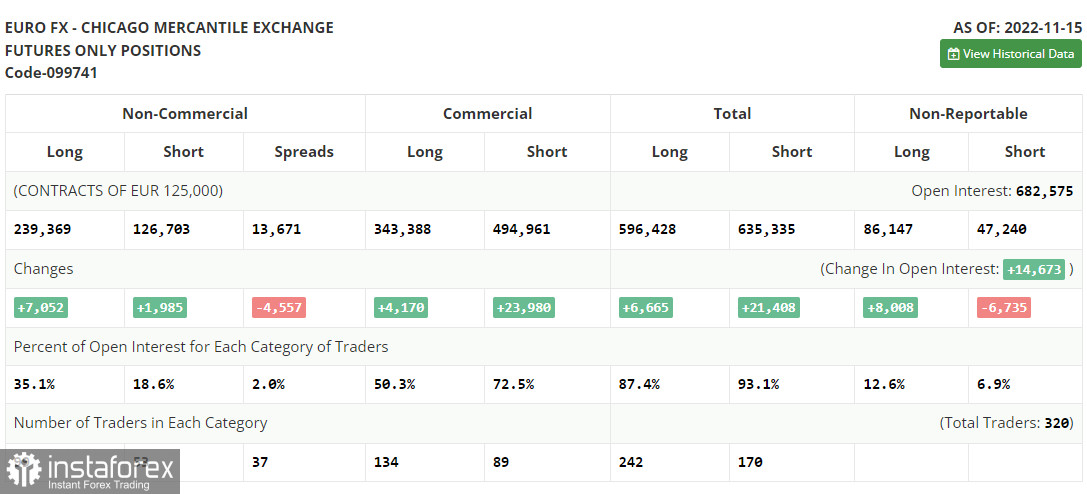

The COT report from November 15 logged an increase in both short and long positions. There has been growing speculation lately on the Fed's less-aggressive stance on monetary tightening which could be announced in December. However, such assumptions contradict the latest US retail sales data for October, which came better than expected, proving high inflationary pressure at the year-end. For this reason, the recent US inflation report should be treated cautiously as the CPI indicated easing inflationary pressure. Apparently, the Federal Reserve will stick to its hawkish agenda, going ahead with sharp rate hikes. When it comes to the euro, demand for risky assets has grown a bit. Nevertheless, following the latest EU statistics, especially GDP, the pair is unlikely to show another explosive jump by the year-end. According to the COT report, long non-commercial positions rose by 7,052 to 239,369 and short non-commercial positions increased by 1,985 to 126,703. The total non-commercial net positions remained positive at 112,666 last week versus 107,599 a week ago. In other words, investors keep taking advantage of the situation and buying the undervalued euro even above the parity level. Traders are accumulating long positions, hoping for a resolution to the crisis and betting on a stronger euro in the long term. The weekly closing price rose to 1.0390 versus 1.0104.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages, a continuing recovery in the euro.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance is seen at 1.0460, in line with the upper band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.