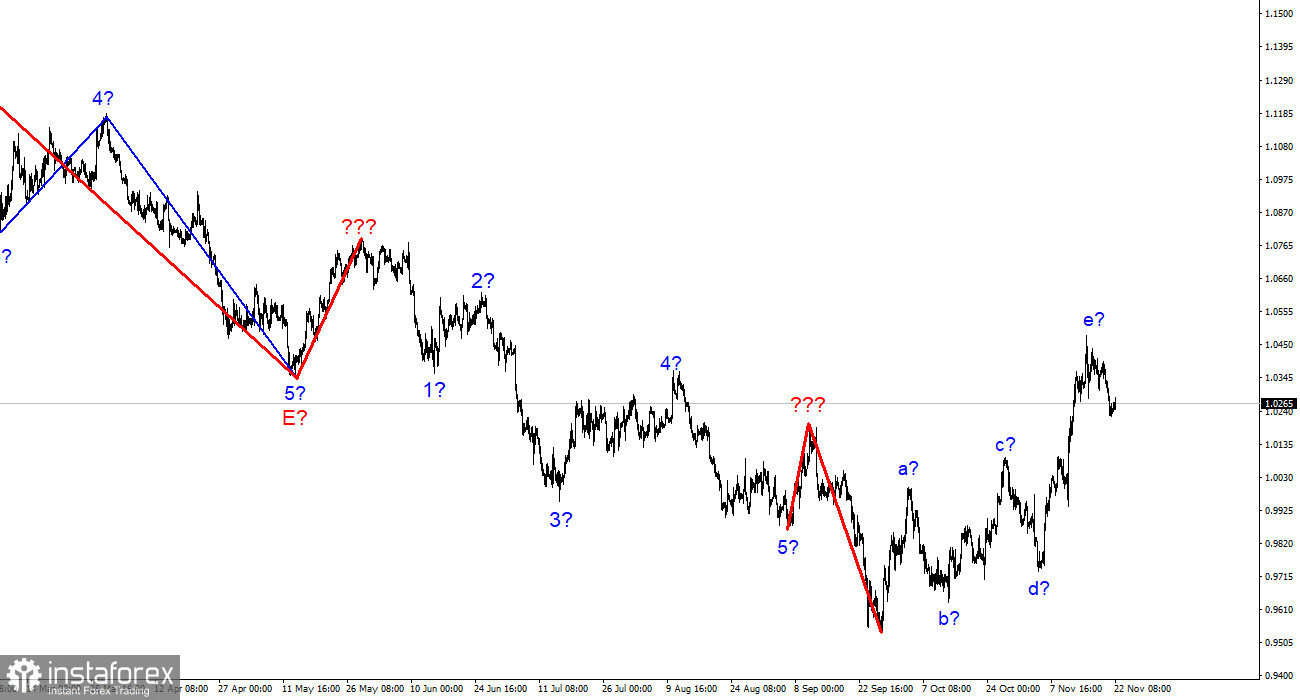

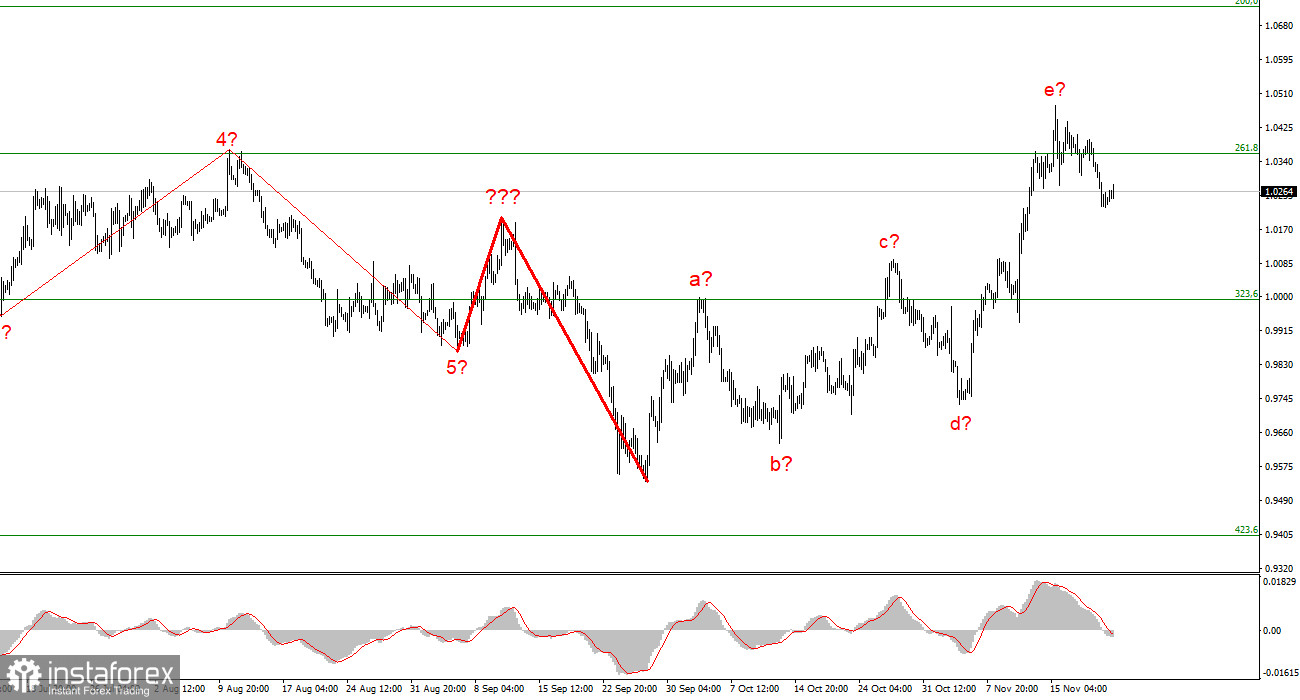

The wave layout on the 4-hour timeframe still looks convincing. The upward trend section has tipped into a clear-cut upward correction. Initially, I thought that the price would build three upward waves. However, now it is evident that there are 5 waves. Therefore, we have got a complicated wave structure a-b-c-d-e. If this assumption is true, this wave structure is coming to an end or has been already over because the peak of wave e is higher than wave c. In this case, we expect at least three downward waves. If the last trend section was a correctional one, the next one is likely to be impulsive. So, I'm braced for a new sharp fall of the trading instrument. If the price breaks 1.0359 successfully, which corresponds to the 261.8% Fibonacci level, it means that the market is ready for sell-offs. The currency pair rebounded from its lows yesterday but it didn't disrupt the current wave layout. The final climb of the price could be considered an inner correctional wave within a new downward trend section. A successful breakout of the current peak of wave e will indicate a more elongated shape, which in turn, will complicate the whole upward section.

Market discouraged by US PMIs

EUR/USD rose 10 pips on Wednesday but it jumped 10 pips on the day earlier. Wednesday was a really interesting trading day this week. In fact, it was the only interesting day. Yesterday, market participants got to know a slew of reports of secondary importance. The highlight of the day was certainly the Fed's minutes. Demand for the US currency was waning for the whole day. I explain this through the news environment.

To begin with, the market gave a lukewarm response to the statistics from Europe and the UK. It frequently happens nowadays.

Obviously, the market is more interested in the US statistics than in the economic data from the EU and the UK. All in all, the European and British PMIs were neglected by market participants. Nevertheless, the PMI readings were roughly as expected. However, they were not the reason for the growing demand for the single European currency yesterday morning.

The EU manufacturing PMI climbed to 47.3. The EU services PMI remained at 48.6. The EU composite PMI grew to 47.8. So, the two of them went up in November but stayed below the threshold level of 50.00 at the same time. Perhaps the market wants to believe that business activity is gaining momentum in the Eurozone. It is not true. The European economy is slipping into a recession. So, it makes sense to predict a further downturn in business activity. Christine Lagarde also pointed out in one of her recent speeches that the European economic output is set to lose steam. To sum up, I cannot draw up any positive conclusions from the PMI reports. I reckon the market took no notice of this data. I want to remind you that similar US PMIs were also weak in the second half of the day. Hence, demand for the US dollar, not the euro, increased.

Conclusion

Based on the wave and fundamental analysis, I'd like to make the conclusion that the upward trend section evolved into a five-wave structure. Thus, I would recommend you sell EUR/USD with targets at around 0.9994 which matches the 323.6% Fibonacci level. There is a slim chance of 10% that the upward trend section is likely to get complicated and more lengthy.

On the senior wave scale, the wave layout of the downward section is getting more complicated and elongated. We see five upward waves which look like an a-b-c-d-e structure. The downward section could resume once this upward five-wave structure is complete.