The week's most intriguing day was Wednesday. We also learned about the Fed protocol in addition to receiving fairly sizable packages of statistical data from the UK, the USA, and the European Union. The majority of analysts believe that the minutes of the November meeting were much more significant than the minutes of earlier meetings because the Fed is now at the point where it must choose whether to keep raising rates at their maximum or to begin slowing them down. The FOMC members' recent speeches supported the idea that the rate would increase gradually. Additionally, Jerome Powell alerted the market that rate increases may eventually be greater than anticipated. The most crucial query to which the protocol was required to respond was, "To what level will the rate rise?"

The protocol did not respond to this query. Furthermore, it was unable to respond to it. The time lag, which is several months, between the rate hike and the economy's response is a crucial point. In other words, if the Fed increases the rate by 75 basis points today, the impact will be felt over the next two to three months, if not longer. As a result, the rate increase to 4% has yet to cause inflation to respond fully. If this is the case, inflation may begin to decline in March 2023, even without a subsequent increase in interest rates. But since it is unlikely to decrease from 7.7% to 2% in 4 months, as the Fed wants, it makes sense to continue raising it, but more slowly, since the economy should also be remembered: a strong rate increase will slow its growth.

This data was presented in the protocol that was made public last night. Most FOMC members agreed that the pace of monetary policy tightening needed to be slowed down, but it was unclear how much longer the rate would increase. Currently, the market anticipates it to grow to 5%, but a gradual decrease in inflation may prompt the FOMC to improve it more significantly. The "insignificant but obvious progress" on inflation, according to FOMC members, indicates that rates still need to be raised.

The Fed will thus accomplish two objectives by choosing to slow down the tightening of monetary policy. It will first keep up the difficult fight against inflation. Second, it won't put as much of a strain on the US economy. Generally speaking, a pause is taken for a few months to evaluate the effects of those four rate increases of 75 basis points that occurred in the year's second half on inflation. In the interim, the impact on inflation will be assessed, rates will increase to 5%, and it will be possible to predict how many additional increases will be necessary for March of the following year.

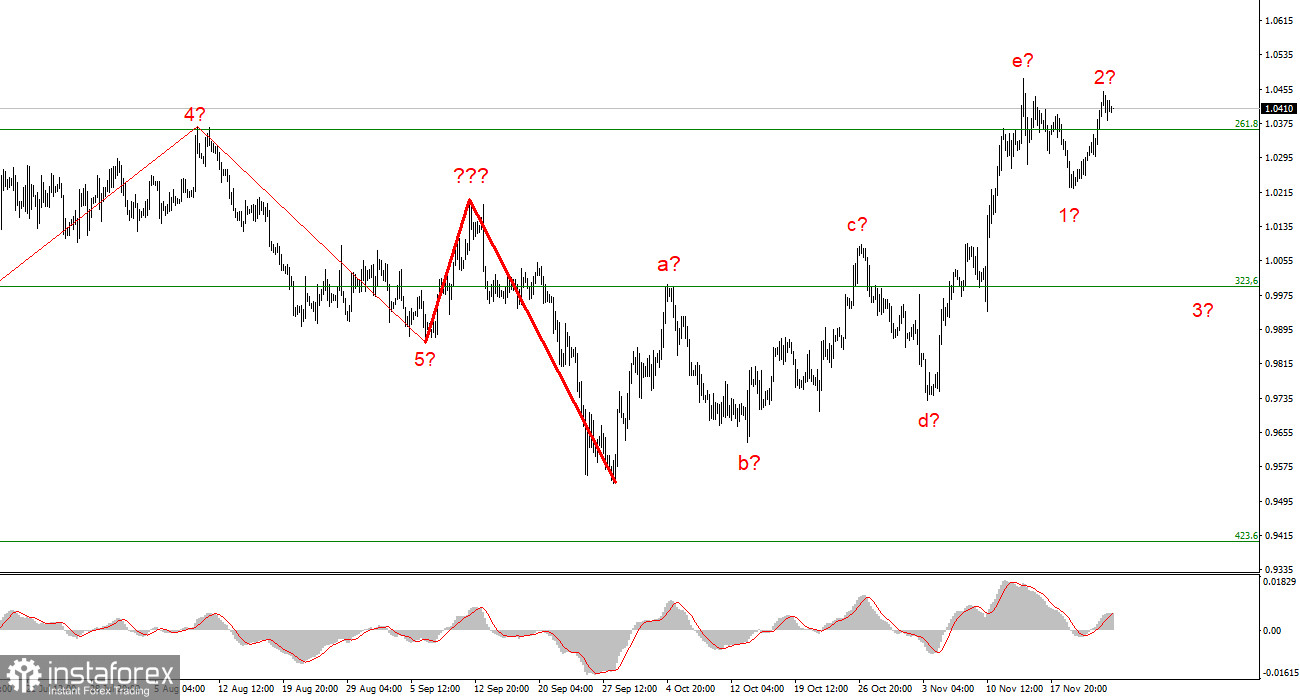

Based on the analysis, the upward trend section's construction is finished and has evolved into a five-wave structure. As a result, I suggest making sales with targets close to the estimated 0.9994 level, or 323.6% Fibonacci. Although there is a chance that the upward portion of the trend will become more complicated and take on an extended form, this possibility is currently at most 10%.

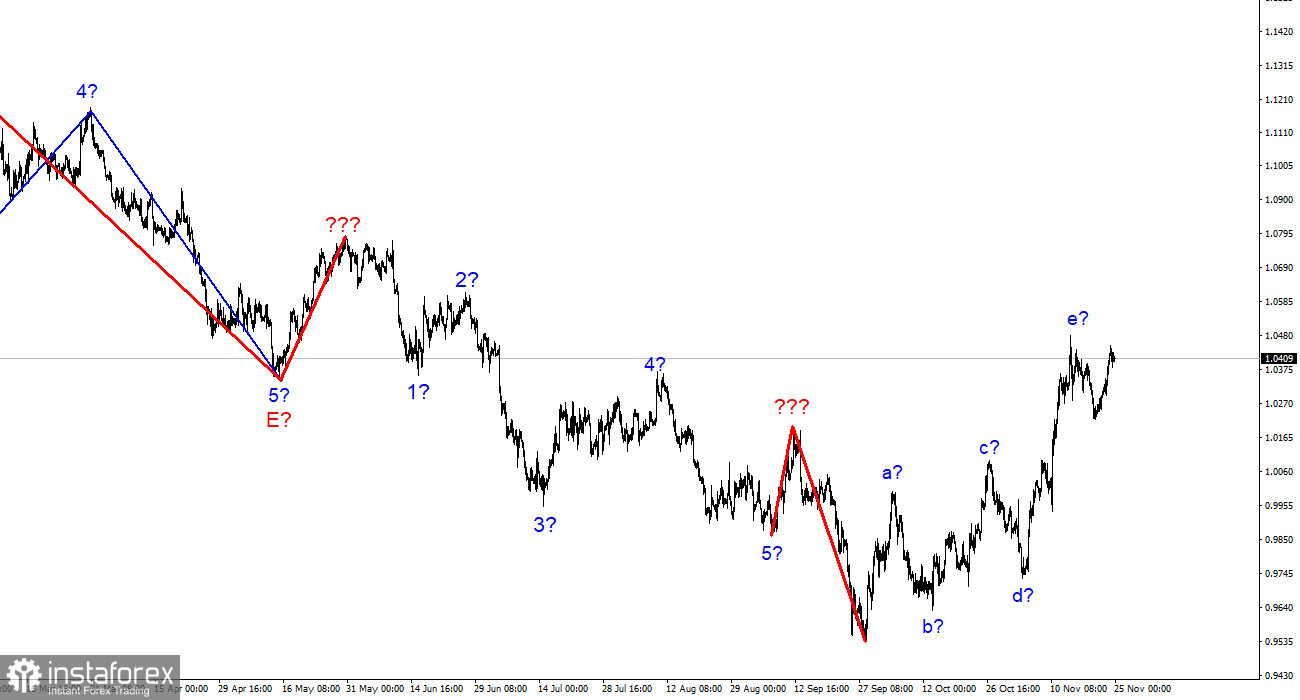

The construction of a new downward trend segment is predicated on the wave pattern of the pound/dollar instrument. I cannot suggest purchasing the instrument immediately because the wave marking already permits the development of a downward trend section. Sales are more accurate now that the targets are close to the 200.0% Fibonacci level.