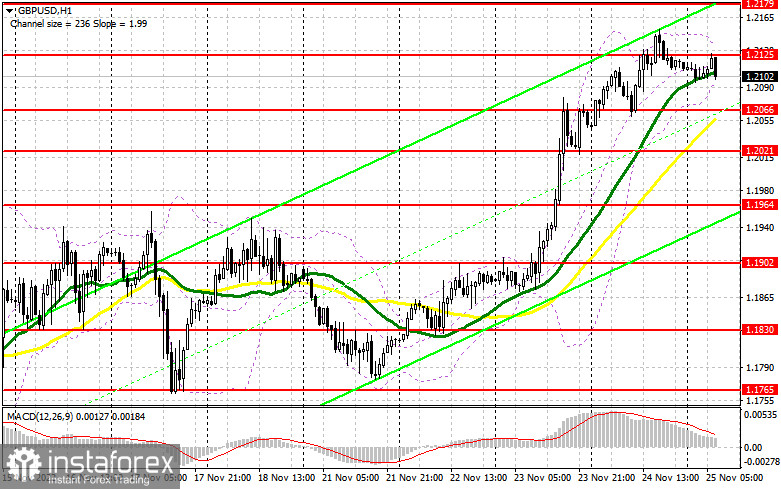

Although trading on Thursday was rather volatile, there were no good entry points. In the morning article, I turned your attention to 1.2078 and recommended making decisions with this level in focus. A buy signal did not take place as the price declined and bulls failed to push it higher in the afternoon. For this reason, it was quite risky to open positions at 1.2078. Bulls are bears were tussling for this level. So, I refrained from opening new positions. In the afternoon, even after the revision of the technical outlook, a similar situation took place. The pair moved in a completely different direction and there were no entry points.

When to open long positions on GBP/USD:

The economic calendar for the US and the UK is empty today. This is why trading volumes as well as volatility are likely to be low. In this case, it is better to be rather cautious when opening long positions. Even after a good buy signal, the price may change its direction. It would be appropriate to buy GBP/USD only after a false breakout of the support level of 1.2066. It could boost the price to the resistance level of 1.2135. A breakout of this level is the main task of the bulls for today. A breakout and a downward retest of 1.2135 will open the way to 1.2179. If the price rises above this level, it is likely to return to 1.2224. A more distant target will be the 1.2256 level where I recommend locking in profits. If the bulls fail to push the price to 1.2066, which may happen in the afternoon, the bears are sure to exert pressure on the pair at the end of the week. If so, I would advise you to open long positions on a decline and after a false breakout of 1.2021 takes place. You could buy GBP/USD immediately at a bounce from 1.1964, where the moving averages are passing in the positive territory, or 1.1902, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

Sellers are now unwilling to enter the market as bullish momentum is quite strong. The pair reaches new intraday highs almost every day. Bears might try to assert strength today as trading is rather lackadaisical today. Trading floors in the US are closed on the occasion of Thanksgiving Day. I would recommend speculators open short positions after a false breakout of 1.2135 takes place. This will lead to an increase in short positions with the prospect of correction to 1.2066. The bears need to take control of this level at the end of the week. If they fail, they will hardly be able to regain ground. A breakout and an upward retest of 1.2066 will generate a sell signal with the prospect of a drop to 1.2021. If so, it could significantly undermine the bullish trend. A more distant target will be the 1.1964 level where I recommend locking in profits. However, even a test of this level will hardly affect the bullish run of the pound sterling. If GBP/USD grows and bears show no energy at 1.2135, it will be quite hard to predict a further trajectory of the pair. The GBP/USD pair is likely to advance to 1.2179 and 1.2224. Only a false breakout of these levels will give a sell signal. If bears do not make attempts to take control of these levels, you could sell GBP/USD immediately at a bounce from 1.2256, keeping in mind a downward intraday correction of 30-35 pips.

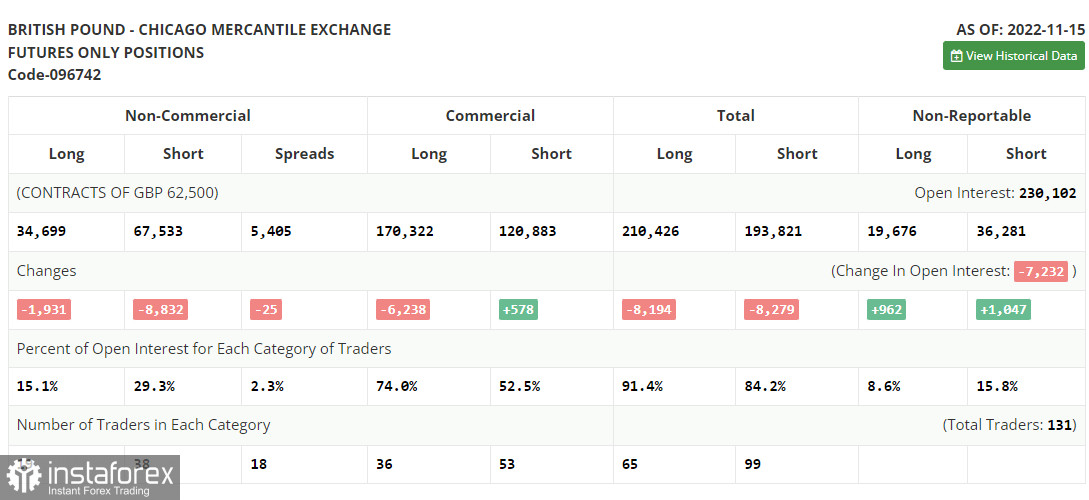

COT report

Commitments of Traders for November 15th logged a decline in both long and short positions. An unexpected surge in inflation in the UK is sure to impact the BoE's monetary policy stance. Given the persistently high inflation, the regulator has no choice but to stick to monetary tightening. If so, it will spur demand for the pound sterling. It will be able to climb higher versus the greenback. However, given the headwinds the UK economy is now facing, it will not be enough to attract investors to the market who firmly believe that the pound sterling has entered a long-term recovery cycle. Besides, the Fed remains strongly committed to aggressive tightening to cap galloping inflation. Hence, GBP/USD may be unable to start a rally in the medium term. According to the latest COT report, the number of long non-commercial positions dropped by 1,931 to 34,699 and the number of short non-commercial positions sank by 8,832 to 67,533, which led to a further increase in the negative non-commercial net position to -32,834 from -39,735 a week earlier. The weekly closing price of GBP/USD grew to 1.1885 against 1.1549.

Indicators' signals:

Trading is carried out above the 30 and 50 daily moving averages, indicating a further increase in the pound sterling.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD moves up, the indicator's upper border at 1.2140 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.