Bitcoin has been trading almost flat after bouncing off the yearly lows, while Ether has dropped slightly. However, the situation remains stable. Before focusing on the technical picture, let's mention that the Turkish government has launched an investigation on the former CEO of failed cryptocurrency exchange FTX, Sam Bankman-Fried. According to local media reports, Ankara authorities have also seized assets belonging to the founder of the troubled coin trading platform.

Turkey's financial regulators have started to investigate the founder and former CEO of cryptocurrency exchange FTX, Sam Bankman-Fried, for alleged fraud. The move follows the initiation in mid-November of a probe into the collapse of the company, which also operated a Turkish platform. Many countries where FTX was operated have initiated similar investigations and the Turkish authorities have also decided to follow suit.

The investigation is led by the country's Financial Crimes Investigation Board (MASAK), a department under the Ministry of Treasury and Finance. As part of the data available about criminal schemes, the authorities have seized the assets of Sam Bankman-Fried and other affiliates. However, it is not clear why they had not done it until after FTX filed for bankruptcy.

Turkish Finance Minister Nureddin Nebati announced that the risks associated with digital assets have serious consequences, warning that the cryptocurrency market should be approached with "maximum caution".

Amid skyrocketing inflation of the national currency, the lira, many Turks have been investing in crypto assets over the past few years to preserve their savings. However, the failures of domestic trading platforms and scams, as well as the ongoing crypto winter, have hurt Turkish investors hard.

Notably, FTX, which was one of the world's top crypto exchanges, filed for Chapter 11 bankruptcy protection in the US on November 11. It happened after liquidity problems were revealed as the company's managers were using client funds at their own discretion. Bankman-Fried resigned, having debts of more than $8 billion.

Besides Turkey, the FTX Group of companies is now under investigation in a number of other jurisdictions, including the United States, the Bahamas, where it was headquartered, and Japan. According to a recent report, the Bahamas authorities may extradite Sam Bankman-Fried to the US for questioning.

As for the technical picture of Bitcoin, having rebounded from the key level of $15,560, the asset's further growth is limited to resistance of $16,630. In case BTC is under pressure again, the key target will be to defend $15,560. If sellers break through this level, the asset will be hard hurt. That will increase the pressure on Bitcoin, causing its decline to $14,650 and $14,370. A breakout of these levels will be the reason for BTC to fall to the area of $13,950 and $13,675. The situation may improve only after the digital asset rises above $16,630. A breakout of this area will push it back to a major resistance of $17,460 and give a chance to test the level of $18,108.

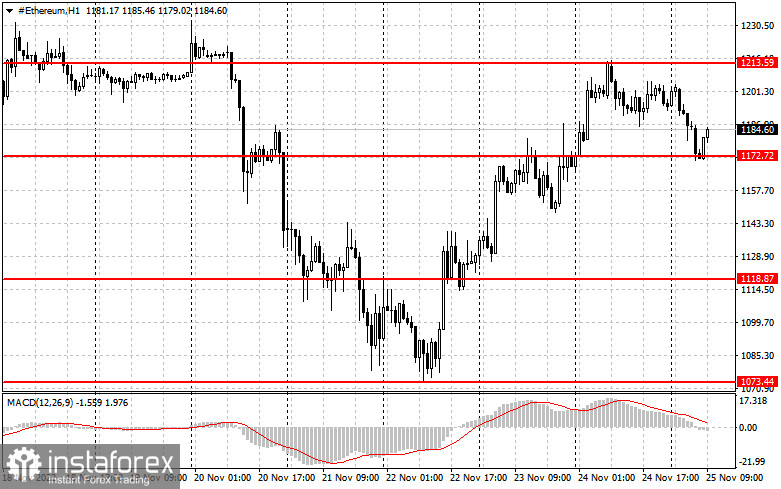

Ether has recovered from the recent FTX collapse. Currently, it is not clear whether buyers will be able to defend support at $1,170. It is obvious that they focus on breaking through the nearest resistance of $1,210 to stabilize the situation. That will be enough to cause dramatic changes in the market and stop a new bearish wave. A fixation above $1,210 will improve the situation and return the Ether balance with the prospect of a correction in anticipation of a renewal of the highs of $1,280. A more distant target will be the area of $1,340. If the trading instrument comes under pressure again and support at $1,173 is broken through, the level of $1,118 will be dominant. Its breakout will push the asset to the lows of $1,070 and $999. Lower levels $934 and $876 will harm cryptocurrency holders.