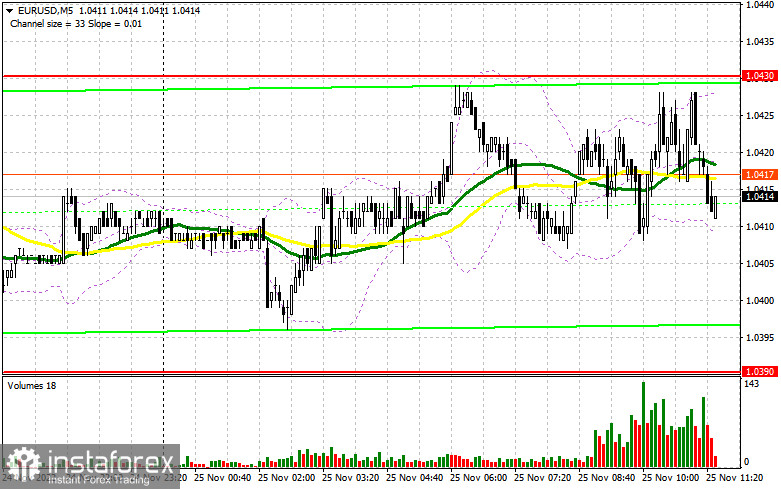

In my morning forecast, I paid attention to the level of 1.0430 and recommended focusing on it while making trading decisions. Let's take a look at the 5-minute chart. Due to low trading volumes, the price failed to reach the expected level. Accordingly, there were no signals to enter the market in early trade. As for the North American session, the situation from a technical point of view as well as the trading strategy remained unchanged.

Long positions on EUR/USD:

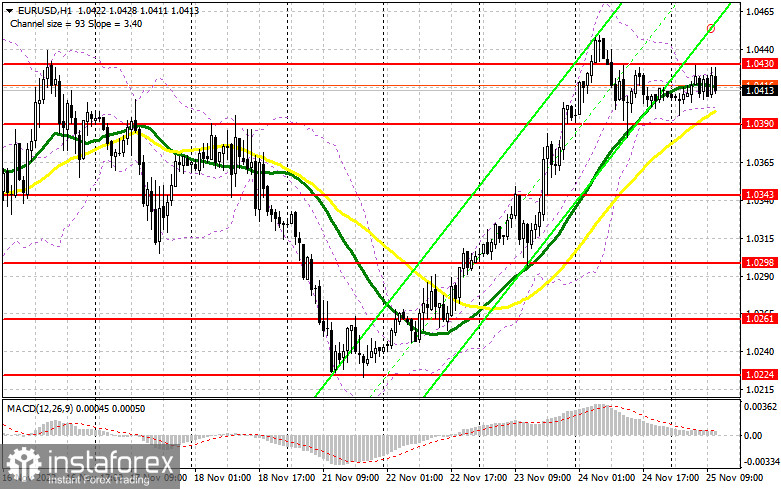

The second half of the day also promises to be quite calm as the US continues to celebrate Thanksgiving Day. Trading activity will be even more subdued than in the European session, which will also affect volatility. If the pair goes down, it will be possible to open long positions amid a false breakout around the nearest support level of 1.0390. In this case, one can count on a recovery to the area of 1.0430, the level acting as support in early trade. If the price breaks through and tests this mark from the top down, the way to 1.0475 will open. After the price rises above this area, it may well extend gains, heading for 1.0525, where I recommend locking in profits. If the EUR/USD pair slides during the North American session and buyers fail to retain control of 1.0390, the euro will come under stronger pressure. In this situation, long positions can be considered only in the event of a false breakout at the next support level of 1.0343, the area of moving averages. Going long on a rebound will be relevant at 1.0298, or even around the low of 1.0261, with a view to catching an intraday correction of 30-35 pips.

Short positions on EUR/USD:

The macroeconomic calendar for the second half of the day is bereft of any important releases, so market participants should rely on technical analysis. The best way to make a profit is to open short positions amid a false breakout of 1.0430. Thus, the European currency will dip to the nearest support level of 1.0390. If the price fixes below this mark and tests it from the bottom up, the euro will most likely extend losses, falling to 1.0343, where I recommend locking in profits. The more distant target will be 1.0298. If the EUR/USD pair goes up during the North American session and bears fail to protect 1.0430, speculative sellers will start leaving the market. Thus, bullish sentiment will increase, and the way to 1.0475 will open. Going short will be relevant only in the event of a false breakout. Short positions on a rebound can be considered at the high of 1.0525. In this case, one can count on a downward correction of 30-35 pips.

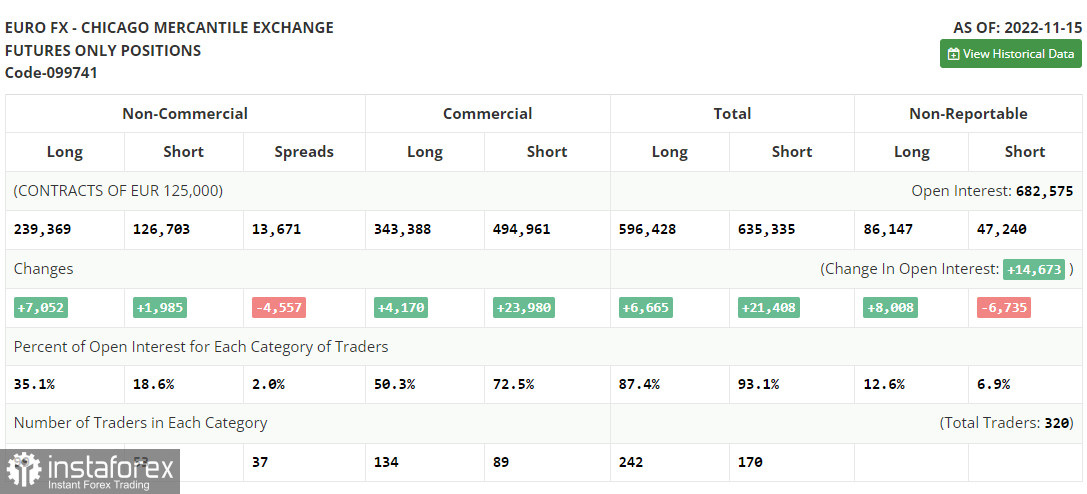

COT report:

The COT (Commitment of Traders) report for November 15 recorded an increase in both short and long positions. Lately, there has been more talk about the US Federal Reserve's less aggressive policy that could be announced as early as December 2022. However, these assumptions contradict recent data on US retail sales in October this year. The indicator exceeded analysts' forecasts, clearly indicating mounting inflationary pressures at the end of the year. That is why one should be rather cautious about the recent report on US consumer prices, which showed a slowdown in their growth. Apparently, the Fed will continue its aggressive tightening. As for the European currency, demand for risky assets did increase slightly. However, considering the latest statistics on GDP in the euro area, I doubt the EUR/USD pair will see another major rally by the end of the year. According to the COT report, long non-commercial positions added 7,052 to 239,369, while short non-commercial ones rose by 1,985 to 126,703. The total non-commercial net position remained positive and amounted to 112,666 in the week against 107 599. This indicates that investors continue buying a weak euro even above parity, as well as accumulate long positions, counting on the end of the crisis and a long-term recovery in the pair. The weekly closing price increased, standing at 1.0390 against 1.0104.

Indicator signals:

Moving Averages

Trading is carried out around the 30 and 50-day moving averages, which indicates market uncertainty.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case of a rally, the upper band of the indicator around 1.0430 will act as resistance.

Indicator description:

Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Marked yellow on the chart.

Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Marked green on the chart.

MACD (Moving Average Convergence/Divergence). Fast EMA 12. Slow EMA 26. SMA 9.

Bollinger Bands. Period 20

Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

Long non-commercial positions are the total long position of non-commercial traders.

Non-commercial short positions are the total short position of non-commercial traders.

Total non-commercial net position is the difference between the short and long positions of non-commercial traders.