Unlike the sluggish state of the market last week, which was caused by limited activity amid a shorter trading time in the US, this week is bound to be characterized by strong movements due to key economic data. The most important of these are the consumer inflation figures in Germany and the Eurozone as a whole. But even if the index shows a slight correction, it will not have a huge impact on the performance of euro.

In the US, data on core PCE will be released, which should also show a slight correction. This will have a positive effect on the Fed's decision on rates after their meeting on December 13 and 14. The revised US GDP figures are also worth keeping an eye on as it might show an increase in quarterly terms. Another one is the manufacturing data, which is likely to show some stagnation in developed European economies but a slight decline in the US. Of course, the US employment data for November is also important, especially since a slight correction is expected there. Even so, the figure is still likely to be high.

The scheduled speeches of ECB and Fed officials may also help markets understand what to expect at the end of their December meetings. For example, Jerome Powell's speech will give an idea whether the US is able to keep away from recession. This will also determine if rates will increase by another 0.75%, or just by 0.50%.

If the economic data does not indicate a plunge into recession, subdued inflationary pressures, strong labor market, subdued business activity and possible aggressive rate hike, equity markets could rally, which will lower Treasury yields and dollar.

Forecasts for today:

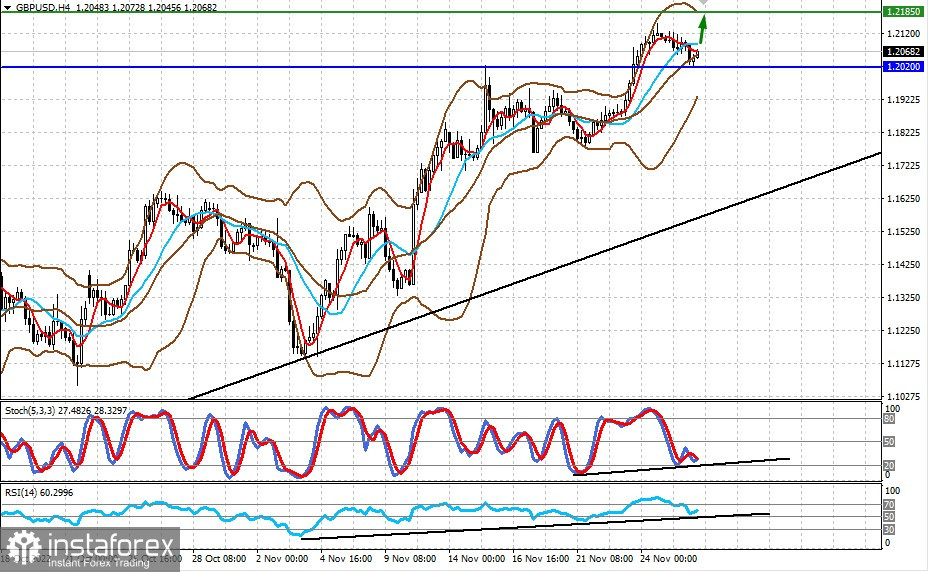

GBP/USD

The pair found support at 1.2020. A consolidation above it, along with positive market sentiment, could push the quote to 1.2185.

USD/JPY

Although the pair is currently trading above 138.00, a fall below it could trigger a decline towards 136.60.