Specifics of economic calendar on November 25

The last trading week ended with an empty economic calendar and low trading volumes. The reason is the public holiday in the US, Thanksgiving Day. Thus, Thursday was a day-off and Friday was a shorter trading day.

Overview of technical charts on November 25

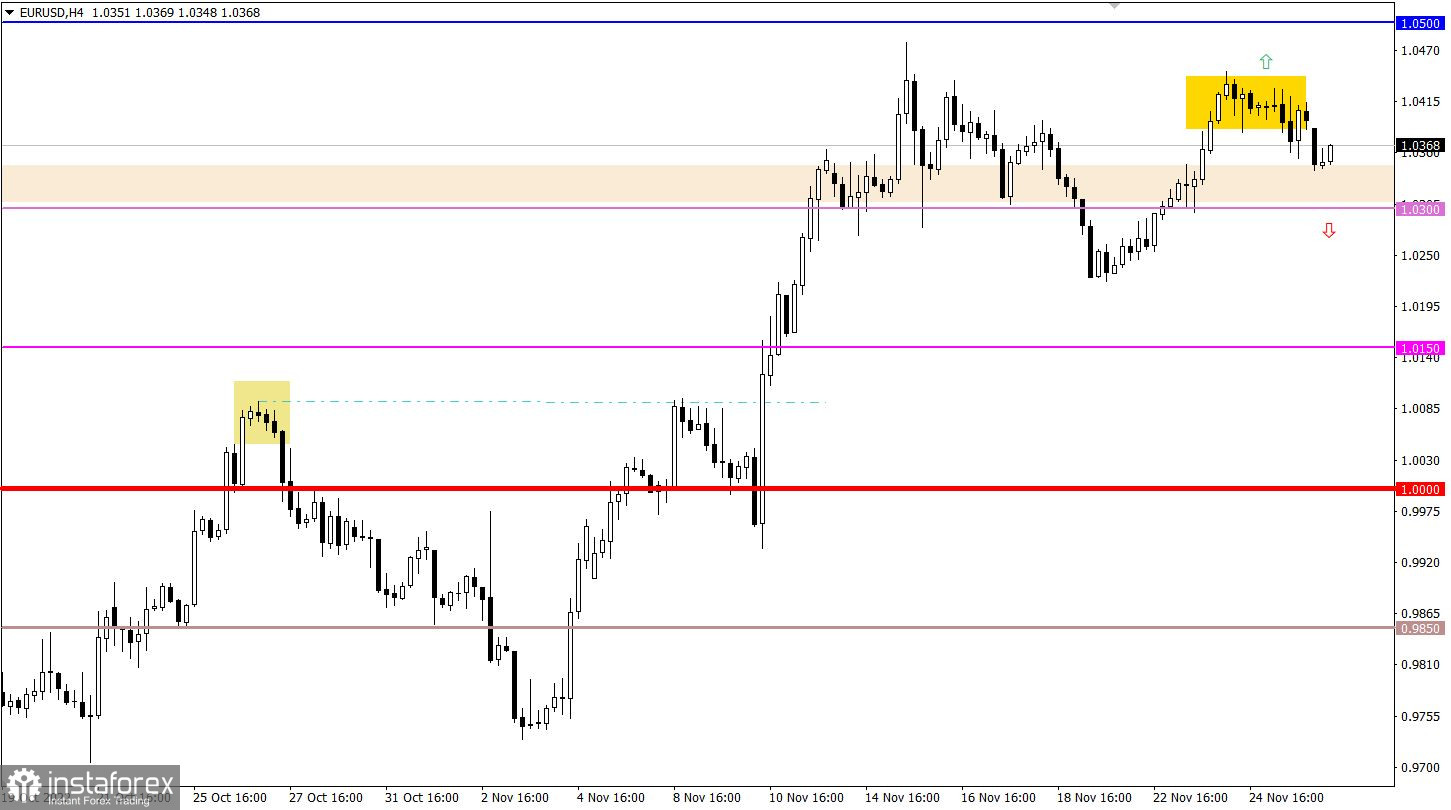

Having reached the peak of the upward cycle, EUR/USD entered the range-bound market. The price escaped the trading range, pushed downwards by speculative activity. As a result, the currency pair went below 1.0350.

GBP/USD climbed to the interim resistance at 1.2150. Then, traders decided to accumulate short positions bit by bit. Eventually, the instrument began a retracement stage and the price rebounded to the upper border and psychological level of 1.2000 (1.2000/1.2050).

Economic calendar on November 28

All market players are resuming trading on Monday. Nevertheless, the week is opening with an empty economic calendar. Therefore, all investors and speculators can do is monitor the information environment and grasp breaking news from mass media.

Trading plan for EUR/USD on November 28

In this situation, if the price settles firmly below 1.0350, this may assure traders to increase short positions towards 1.03000, the level passed earlier. Further sellers' activity will depend on how the price will behave at around 1.0300.

Trading plan for GBP/USD on November 28

Under such market conditions, the psychological level of 1.2000 could serve as a pivot point for the sellers which in turn, will assure traders to cut short positions. If the actual price move meets expectations, the instrument might get stuck with the following price bounce which will update the local high of the upward cycle.

As for the downward scenario, the price should settle below 1.1950 to make this forecast come true. In this case, traders could revise sentiment on GBP towards bearish.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed on history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.