Stock markets opened the week lower as investors worry that China may have to further tighten its Covid restrictions. That could undermine global economic growth prospects, and has led to protest across key cities.

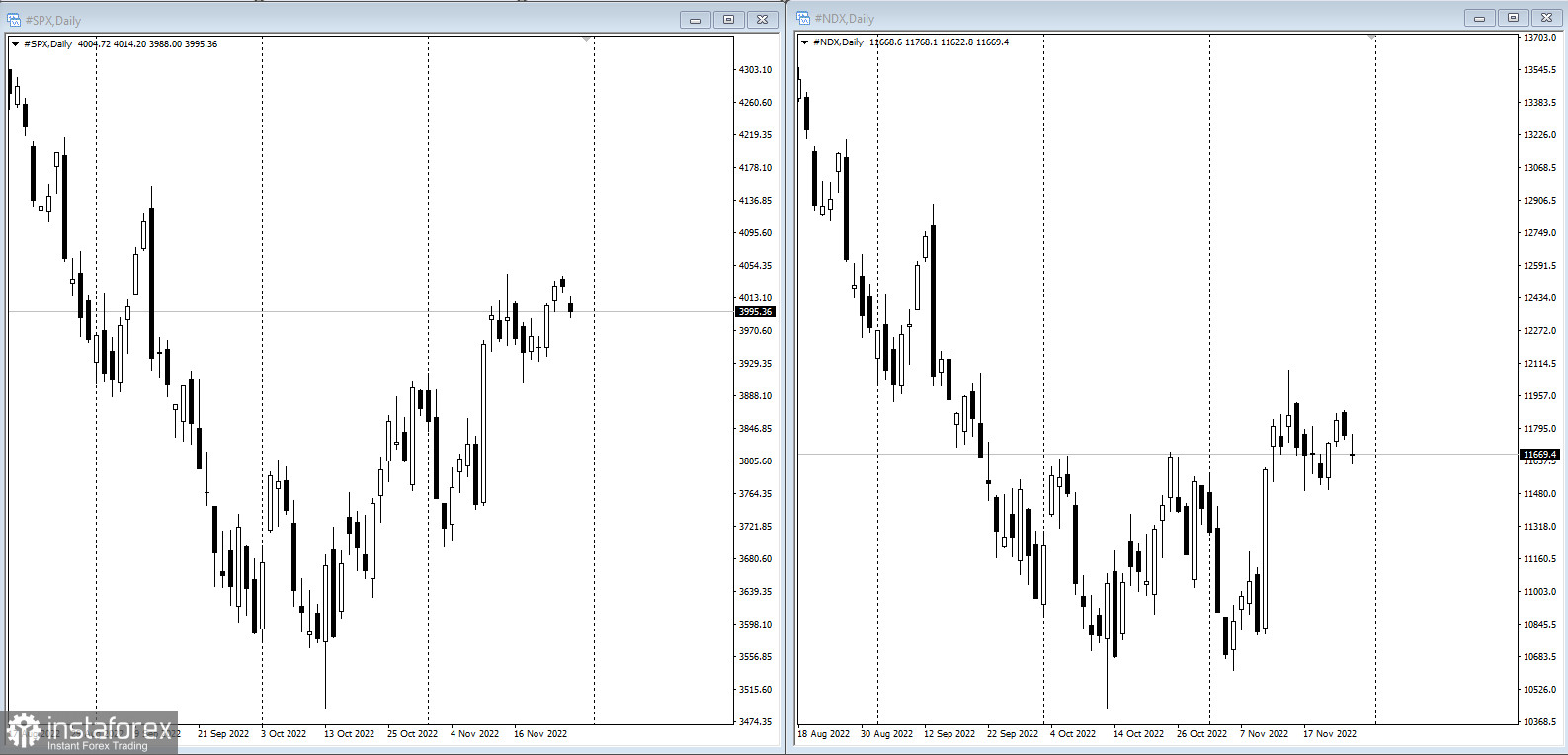

Data indicates that the S&P 500 cut its monthly rally, with Apple seeing losses after Bloomberg News reported that unrest at its key manufacturing center in Zhengzhou is likely to lead to a production shortfall of nearly 6 million iPhone Pro units this year. Meanwhile, Amazon made gains in retail sales, and analysts say the Cyber Monday results will paint a fuller picture of demand this holiday season.

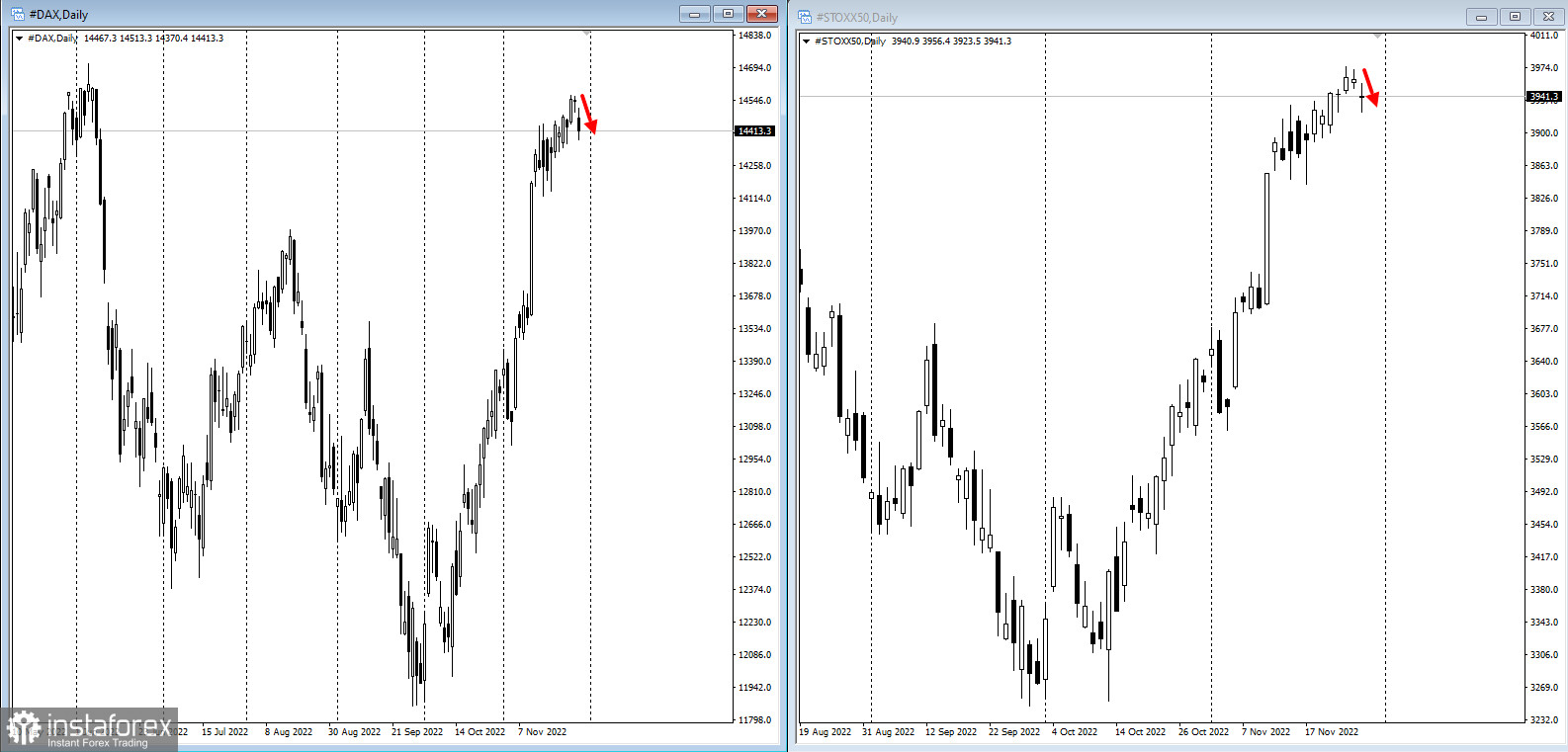

European stock indices also fell, following the US.

The unrest in China is complicating the country's path to economic opening. This, along with the potential moderate rate hikes by the Fed in upcoming sessions, has spurred interest towards riskier assets. Analysts at Goldman Sachs have warned that the chances of a disorderly exit from Beijing's Covid Zero policy are also rising.

Just as the S&P 500 was trying to break above its mid-November highs, sentiment turned negative, threatening the recent market momentum. The timing is most inconvenient here as the index is approaching an important technical zone in the form of both the 2022 downtrend and the 200-day moving average. If the bullish mood ends, short-term trades could trigger profit-taking.

In Europe, ECB President Christine Lagarde said that she would be surprised if inflation in the region peaked. This would mean that interest rate hikes are not over.

On the other hand, Fed Chairman Jerome Powell is expected to reinforce expectations that the central bank will slow the pace of rate hikes next month. However, the fight against inflation will last until 2023.

Key news for this week:

* US consumer confidence, Tuesday

* EIA crude oil report, Wednesday

* China PMI, Wednesday

* Fed Chairman Jerome Powell's speech, Wednesday

* Fed Beige Book, Wednesday

* US GDP, Wednesday

* US PMI, Thursday

* US construction spending, consumer income, initial jobless claims, ISM Manufacturing, Thursday

* Bank of Japan Governor Haruhiko Kuroda's speech, Thursday

* US unemployment and nonfarm payrolls report, Friday

*ECB chief Christine Lagarde's speech, Friday