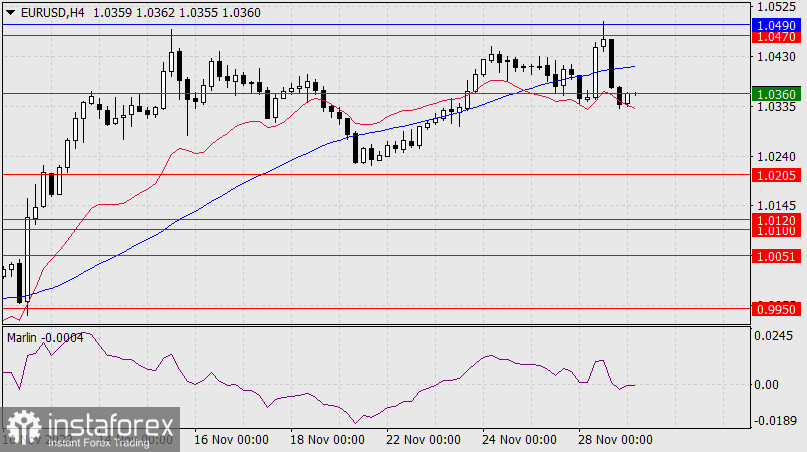

Yesterday, the euro traded in the range of 164 points and closed the day with a decline of 56 points. The upper shadow of the price reached the MACD indicator line on the weekly chart. Then the price returned to the global range, it is marked with green lines.

The usual divergence has formed on the daily chart and now the price is aiming for 1.0205. At the same time, the divergence does not disrupt the formation of a double top.

Oil was down 0.53% yesterday (WTI) and the S&P 500 stock index also down 1.54%. The euro is also losing support from related markets. Yesterday evening, Federal Reserve officials James Bullard and John Williams spoke and said that the US central bank intends to keep policy tight longer than the markets currently anticipate.

On the four-hour chart, the price reached the 1.0470/90 range that I previously mentioned, then it settled under the MACD line and under the upper limit of the 0.9710-1.0360 range. The signal line of the Marlin oscillator has entered the negative territory. We expect the price to reach the nearest target support of 1.0205.