The main battleground over the past few weeks has been the $15.5k–$16.6k range. Last week, Bitcoin made an important recovery move, showing growth two days in a row and securing above $16.1k. This is a key support zone that has the potential to be a springboard for further growth in the asset.

Despite bullish efforts, the $16.1k level is constantly being tested by negative factors that increase selling pressure. As of November 29, we can state that the bulls' position is strong, and the $16.1k level remains intact.

Fundamental background

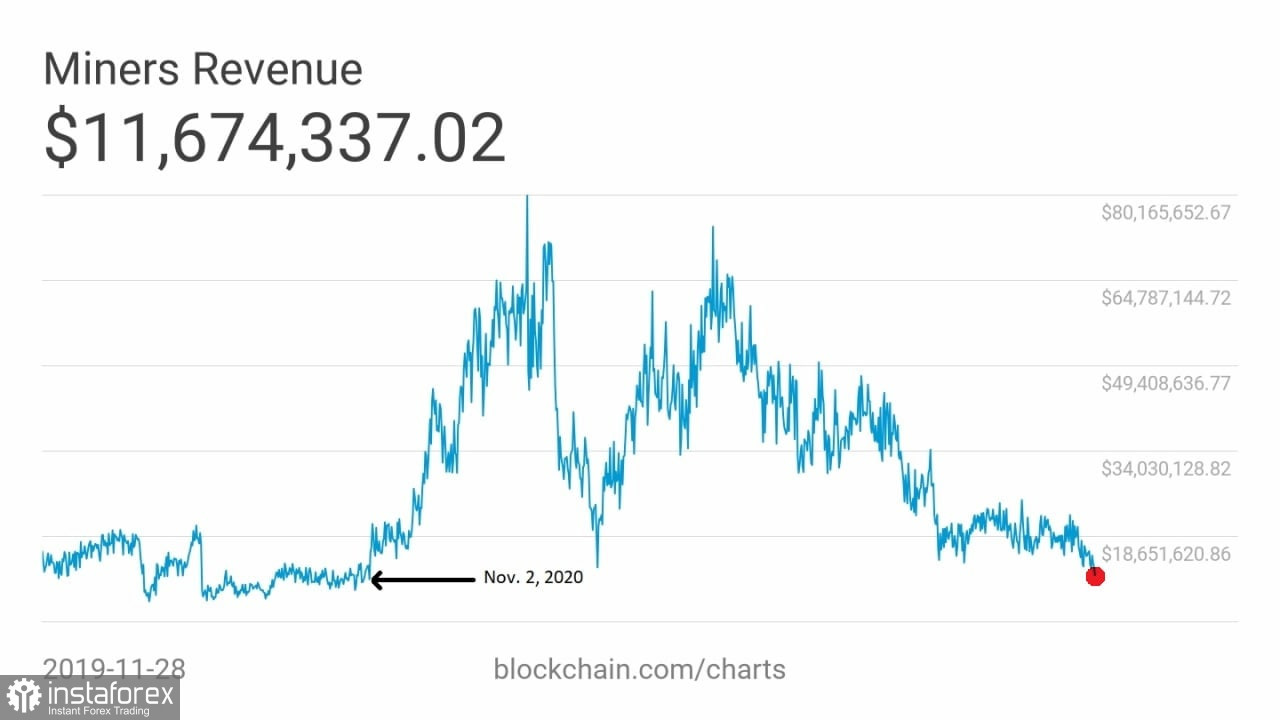

Holding the $16.1k level is questionable given the looming events which, combined with the negative factors already in place, could bring down the crypto market. The first and key on-chain factor for BTC's decline is the drop in miners' earnings to a two-year low.

In addition, the correlation between Bitcoin and stock indices is recovering, but in the current situation it plays against cryptocurrencies. In China, the largest protests in 30 years erupted over covid restrictions. They affected the Chinese stock market and triggered a risk-off strategy until the rallies subsided.

It also became known that crypto firm BlockFi filed a Chapter 11 bankruptcy. Not long after the announcement, Bitcoin quotes again tested the $15.6k level, but it is worth noting the decrease in the volume of reaction to the negative news.

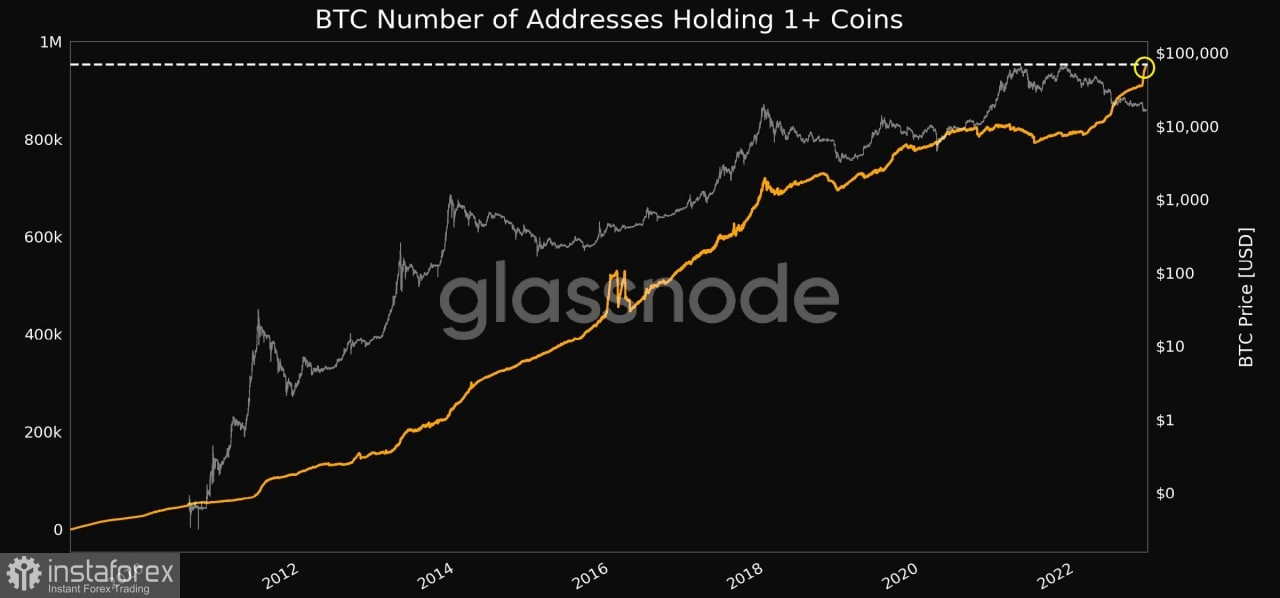

At the same time, a positive trend in the accumulation of BTC coins by long-term investors remains. According to Glassnode, the number of addresses with a balance between 1 and 10 BTC could soon set an all-time high above 800,000.

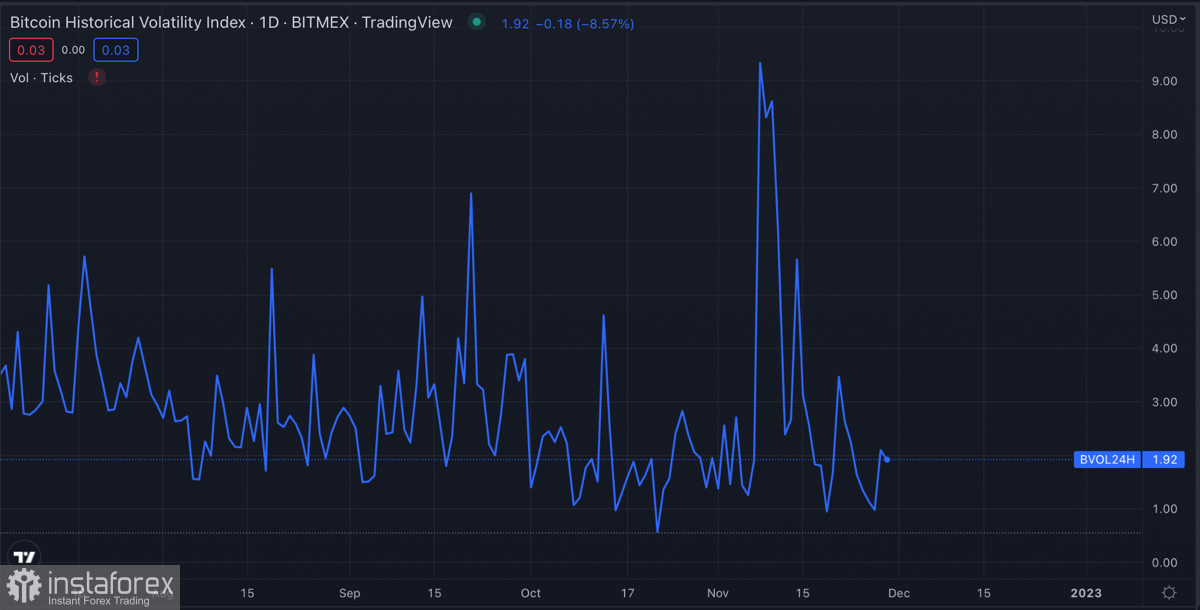

Also, higher volatility is expected tomorrow, as US economic growth data for the third quarter (forecast +2.7%) will be released. Moreover, Fed Chairman Jerome Powell will prepare the markets for December rate hike and will announce the agency's policy in 2023.

BTC/USD Analysis

Bitcoin remains locked into a narrow $15.6k–$16.6k fluctuation channel, where massive accumulation is taking place. Wallets with balances of less than 1 BTC have increased their holdings by 96,200 BTC, matching the historical peak of the local bottom bite.

Despite the ongoing absorption process, the main task of Bitcoin remains to hold the $16.1k level. The cryptocurrency is moving within an emerging triangle, and in order to have a chance for an upward breakout, it is important to maintain a foothold above $16.1k.

As of Monday's results, the price of BTC fell below $16.1k and tested the $15.5k support level. On the one hand, we see a sharply negative impact of the news on investor behavior, but on the other hand, the instant rebound points to the strength of the buyers.

BTC/USD technical metrics have resumed their upward movement, while BTC has consolidated above $16.4k. The RSI index suggests growing buying sentiment, and the stochastic has formed a bullish crossover, indicating the presence of a local upward trend.

The MACD indicator also continues its upward movement, which indicates that the asset is fundamentally ready to continue moving to local highs. Taking this into account, it is likely that we are facing an assault of the $16.6k–$16.8k range. With a confident consolidation above, the price will move to the $17.1k key resistance level.

Results

Bitcoin remains bullish and buying back after retesting the $15.6k level indicates the willingness of buyers to go higher. The on-chain activity and the low impact of stocks where greed reigns help the cryptocurrency to keep demand high.

That said, it is important to understand that Powell's speech tomorrow could negatively impact cryptocurrency quotes. A volatile period of important economic reports is coming, which will predict how long the current crisis will last. And the reaction to the economic reports will be impulsive, which allows us to assume that the BTC price will move in either direction.