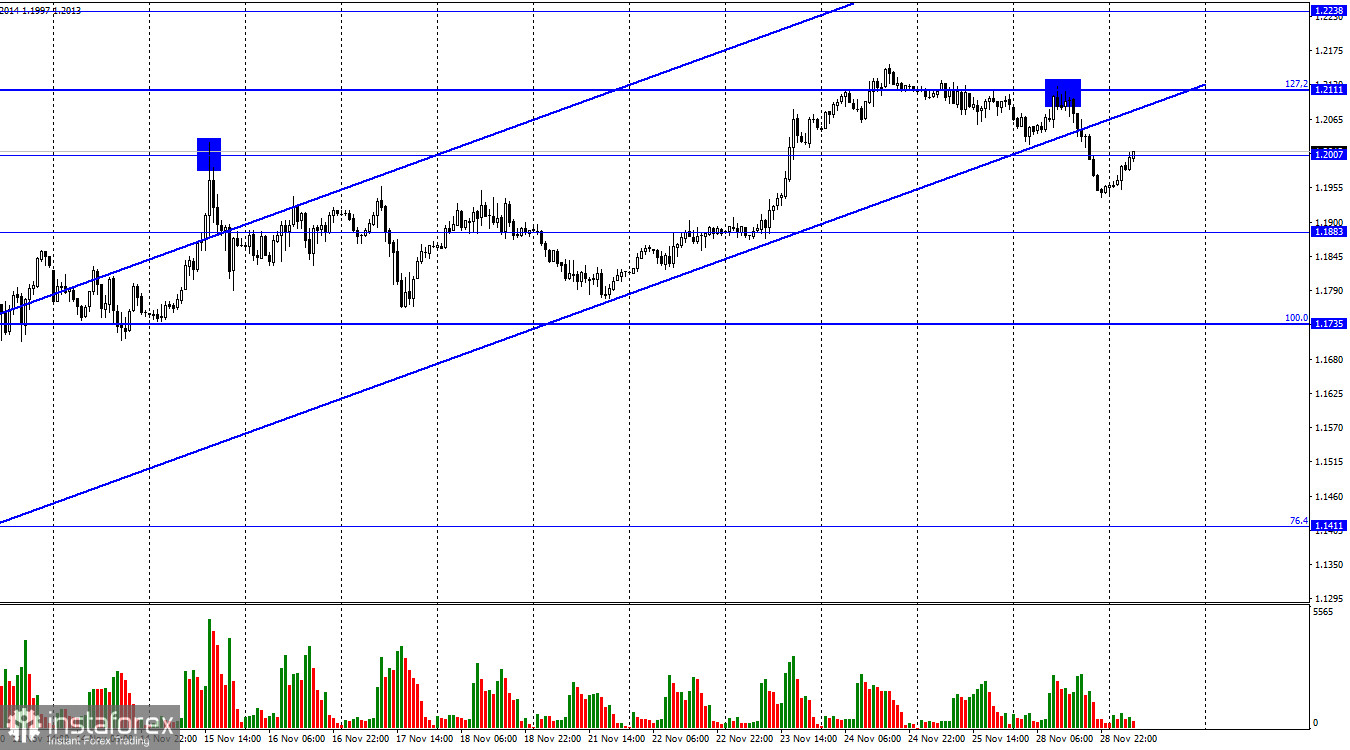

Hi, dear traders! On the 1-hour chart, GBP/USD broke through 1.2111, the 127.2% Fibonacci level on Monday. Then, it began its fall and closed below the uptrend line. If the price settles above 1.2007, we could reckon a further decline towards 1.1883. In my opinion, the key to a further downtrend is the price consolidation below the uptrend channel which has attracted the bulls to GBP/USD for long. Now the market sentiment is turning bearish. For this reason, I expect weakness in GBP which has revealed more significant growth than the euro in recent months.

Interestingly, if we analyze the price dynamics for the last 2-3 months, I don't see solid fundamentals for such robust growth in EUR and GBP. As I said earlier, the only factor to undermine the US dollar's strength is the probable scenario that the US Fed might moderate the pace of rate hikes, starting from December. Curiously, traders already priced in this scenario a few months before the event actually takes place. Therefore, when the central bank actually announces a softer rate hike, traders will not be able to respond properly because it has been already priced in.

The fears about the ECB's intention to slow down the pace of interest rate hikes are also valid in relation to the Bank of England. Today Governor Andrew Bailey will make a speech, which can shed light on the question of whether the British regulator is also going to start slowing down its interest rate increases. If Bailey drops a hint about this likelihood, then traders will have another excuse to sell the pound sterling. Jerome Powell is also due to make his comments later this week. The Fed's rhetoric now boils down to the fact that the regulator is likely to ease the pace of rate hikes in the near future, but at the same time its ultimate level may be slightly higher than planned. In my opinion, this is also a bullish factor for the dollar.

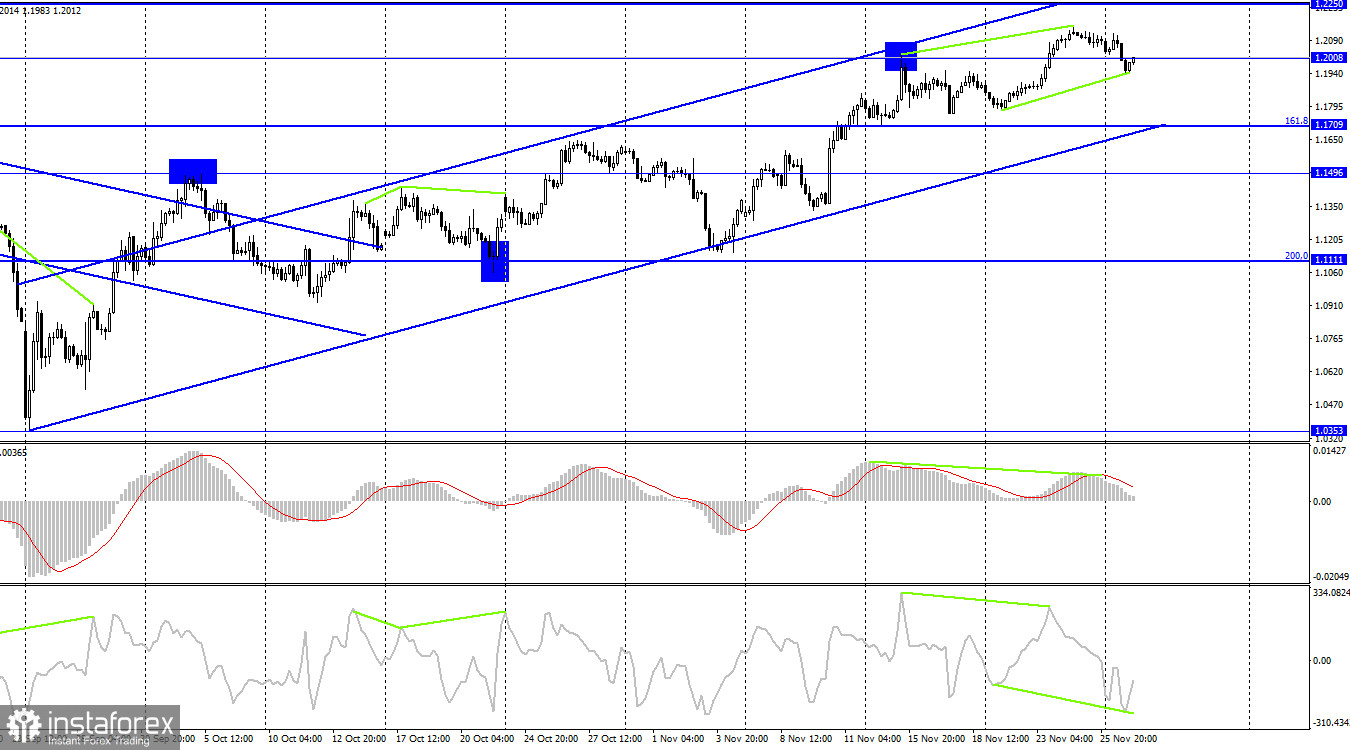

On the 4-hour chart, GBP.USD reversed in favor of the US currency and closed below 1.2008. The instrument might extend its fall towards 1.1709 which coincides with the 161.u% Fibonacci level. If the price settles below the upward trend channel, it will increase the likelihood of a decline towards 1.1111. So, the market sentiment will turn bearish. The CCI indicator is about to form a bullish divergence, thus the currency pair might resume its climb.

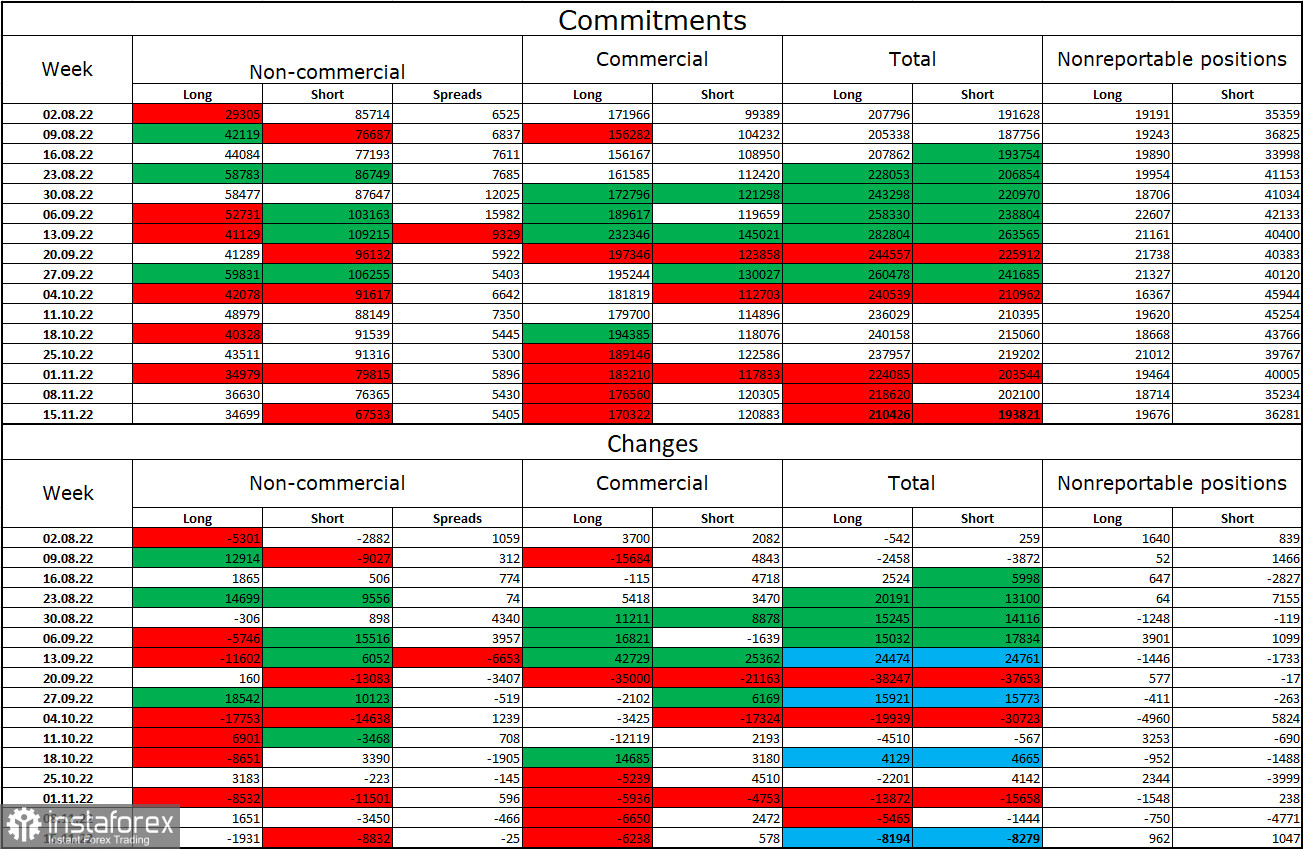

Commitments of Traders report (COT):

The sentiment of non-commercial traders turned less bearish last week from a week ago. The number of long contracts kept by speculators fell by 1,931 whereas the number of short contracts remains way more than the number of long contracts. All in all, large market players are still poised to sell the sterling, but their sentiment has been turning bullish in a few recent months. This process is painstaking. The pound sterling could assert its strength. This outlook is backed by technical analysis, in particular trend channels. The fundamental background is mixed because the latest economic data does not support the sterling. Nevertheless, GBP/USD has been developing a rally which is hard to explain.

Economic calendar for US and UK

UK: Bank of England Governor Andrew Bailey speaks (14-00 UTC)

The economic calendar is empty for the US on Tuesday. The only newsworthy event is a speech by the Bank of England Governor. The information background could be of average importance to trading sentiment today.

Outlook for GBP/USD and trading tips

I would recommend selling GBP/USD in case the price settles below the trend channel on the 1-hour chart with the targets at 1.1883 and 1.1735. I would not advise you to buy the pound sterling because the currency pair closed below the trend channel on the 1-hour chart.