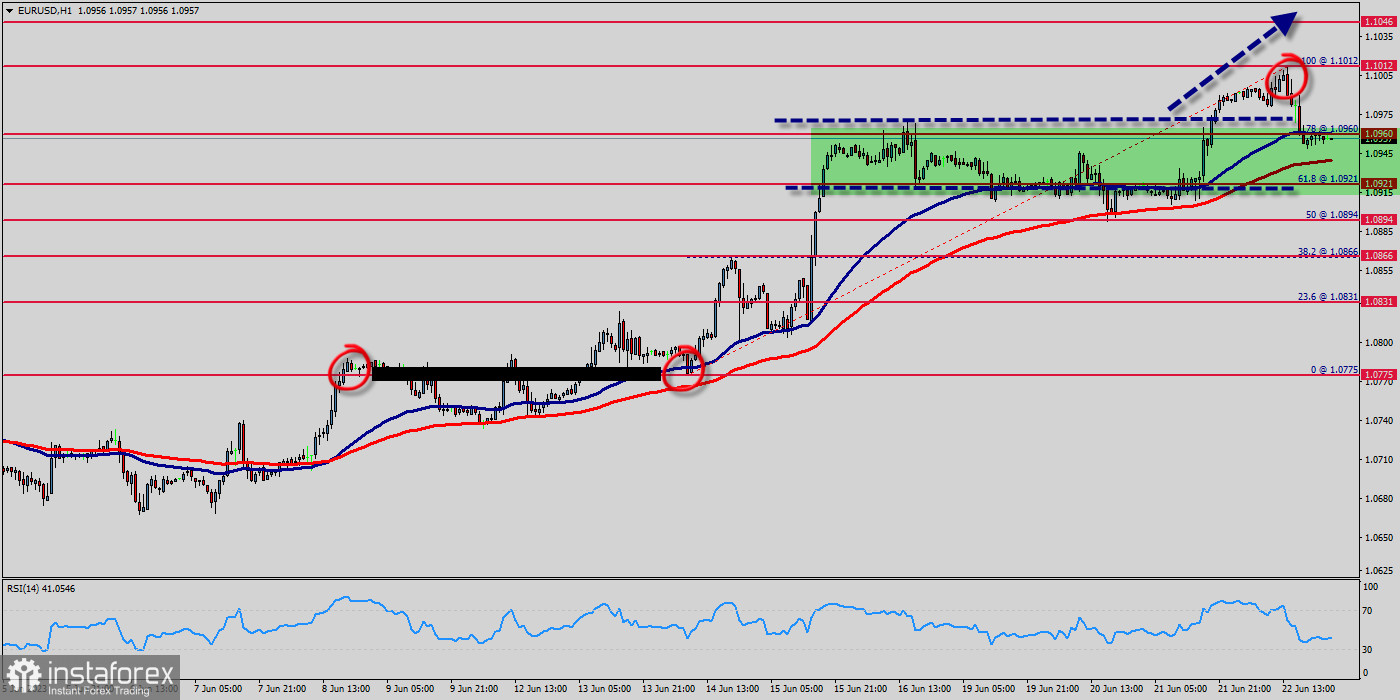

Since June at 1.1012 highs, the EUR/USD pair spent three months trading to the 1.0960 targets. Yet overall, the EUR/USD pair 's price path traded on the uneven side—the break of vital 1.0960 's delayed target completion much sooner than anticipated. The commonality to the target was 237 pips from 1.0775 lows to 1.1012, and the same pip amount targets were reported for all trades from May to June.

EUR/USD came under pressure and dropped on Thursday, consolidating around 1.0950. The pair lost bullish momentum and pulled back after reaching monthly highs near 1.1010. A recovery of the US Dollar on the back of higher Treasury yields drove the pair to the downside. Focus turn to June preliminary PMIs.

From the EUR/USD pair, next travels to hubris and arrogance. Once a target is identified, it's mathematically impossible not to trade with the target. The specialty is targets, known from tend years and gazillions of past trades posted.

No such concept as loss exists once a target is identified. Time may or may not remain on the right side. January to March trades all traded ideally, but the EUR/USD pair decided to wait an additional three months. Never, ever doubt the target, as we can't defeat mathematics.

On the one-hour chart, the Euro remains above key levels and is also supported by a short-term uptrend line. Technical indicators offer mixed signals. Ahead of the Asian session, the pair needs to hold above 1.0940 (50-Simple Moving Average) and to regain 1.0960 for the Euro to recover momentum. A slide under 1.0940 would point to an extension to the downside, targeting the 1.0910/20 support band. A break lower would clear the way for a test under 1.0900.

The EUR/USD pair averages radically changed over the past six months. On the bottom side are 1.0894 and 1.0775. On the topside, we have 1.0960, 1.1012, and 1.1046. Following targets below are 1.1012 and 1.0960. Above 1.0960 targets are: 1.1012, 1.1046, and 1.1103.