Markets are looking out for today's US employment data as it could signal whether the Fed will finally end its cycle of aggressive interest rate hikes.

Wednesday's ADP jobs report already came in well below expectations, while Jerome Powell's recent speech was less hawkish than expected. If upcoming news indicate a surge in lay-offs, sharp fall in employment and dip in new job gains, then this means that inflation is likely to ease soon, so the bank can confidently start to reduce the rate increases. This is also what Powell said when he indicated that Fed rates may increase by 0.50%, not 0.75%, in December.

In short, below-forecast labor market figures could encourage the Fed to shift to a softer stance, which will be positive for markets. It could lead to a new rally in equities, especially in the US. As for Treasury yields, they will go down along with dollar.

Forecasts for today:

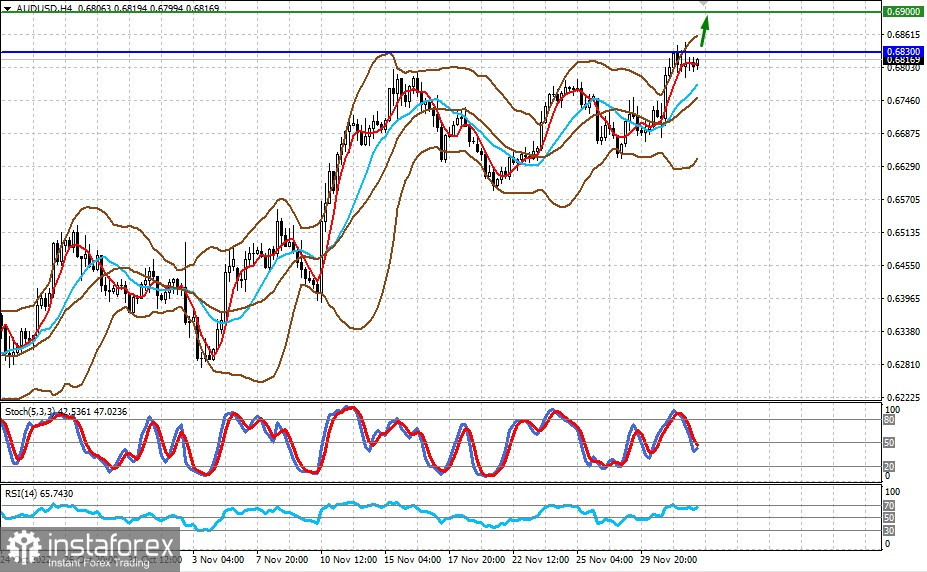

AUD/USD

The pair is trading below 0.6830. If positive sentiment increases, the quote could break out of the resistance level and head towards 0.6900.

USD/CAD

A renewed rally in crude oil prices could put pressure on the pair. A drop below 1.3400 will bring it down to 1.3300.