Yesterday's strong data on factory orders and business activity in the US was able to stop the development of risk appetite. October Factory Orders were up 1% in October, November ISM Services PMI rose from 54.4 to 56.5. The dollar index was up 0.78%, the S&P 500 -1.79%, and oil -3.66% (WTI).

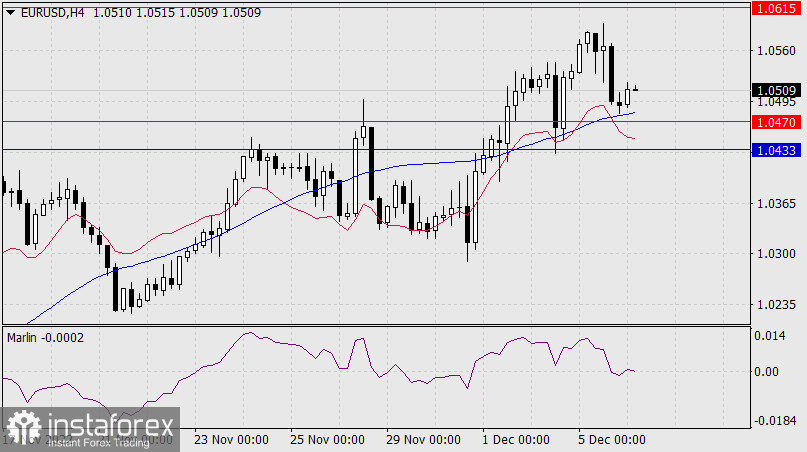

The euro fell a bit short of hitting the target range of 1.0615/42. Consequently, the situation becomes more complicated - will it reach the range once a complex structure of the divergence with the Marlin oscillator is completed, or has the price reversal already taken place yesterday?

Let's look at the weekly chart. Here the price is above the MACD indicator line (1.0433).

If the current week closes below the MACD line, then it is considered false when it rises above this line, but if it actually closes above the line, then EUR will rise further. The Federal Reserve will hold a meeting next week. The committee has been indicating more signals that the central bank might tighten policy much longer than what the market initially expected. As a consequence, the technical signals may be broken, and the euro may reverse after the price settles above any level.

On the four-hour chart, the price reversed from the support of the MACD line. The price can "run away" from this line and reach the 1.0615/42 range. The Marlin oscillator shows the intention to move up from the zero line. But if the price does intend to reverse into a medium-term decline, it needs to overcome two supports: 1.0470 and 1.0433.