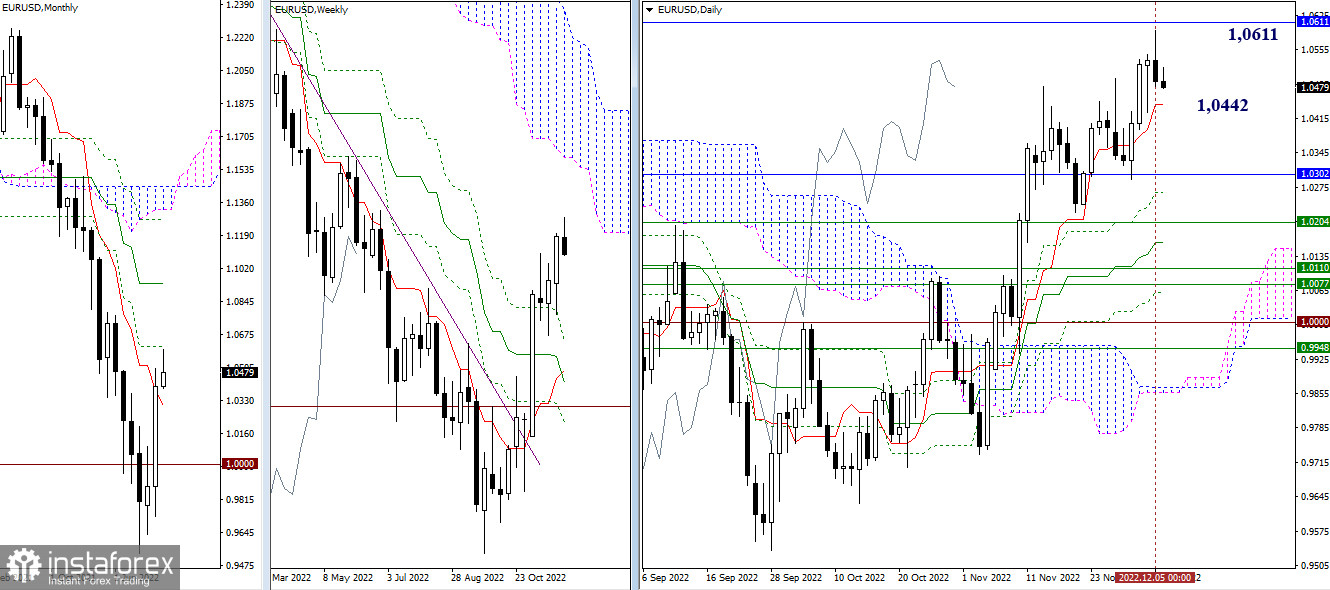

EUR/USD

Higher timeframes

Yesterday, the bulls entered the range of 1.0611. By the close of the day, the price pulled back from resistance. If bearish sentiment keeps growing a pullback may be confirmed on the daily and weekly charts. Then, a reversal may occur. The nearest support level is seen at 1,0442 (daily short-term trend). If the downtrend extends, the pair may encounter the monthly short-term trend at 1.0302.

H4 – H1

Following a pullback in lower time frames, a bearish correction is currently taking place. The bears left behind the central daily Pivot level of 1.0522, in line with resistance and serving as a bullish target. Other resistance classic Pivot points stand at 1.0563, 1.0637, and 1.0678. The key support level in lower time frames is seen at 1.0457 (weekly long-term trend). It also serves as the bearish target. A breakout and a reversal of the MA may cause a shift in trading forces.

***

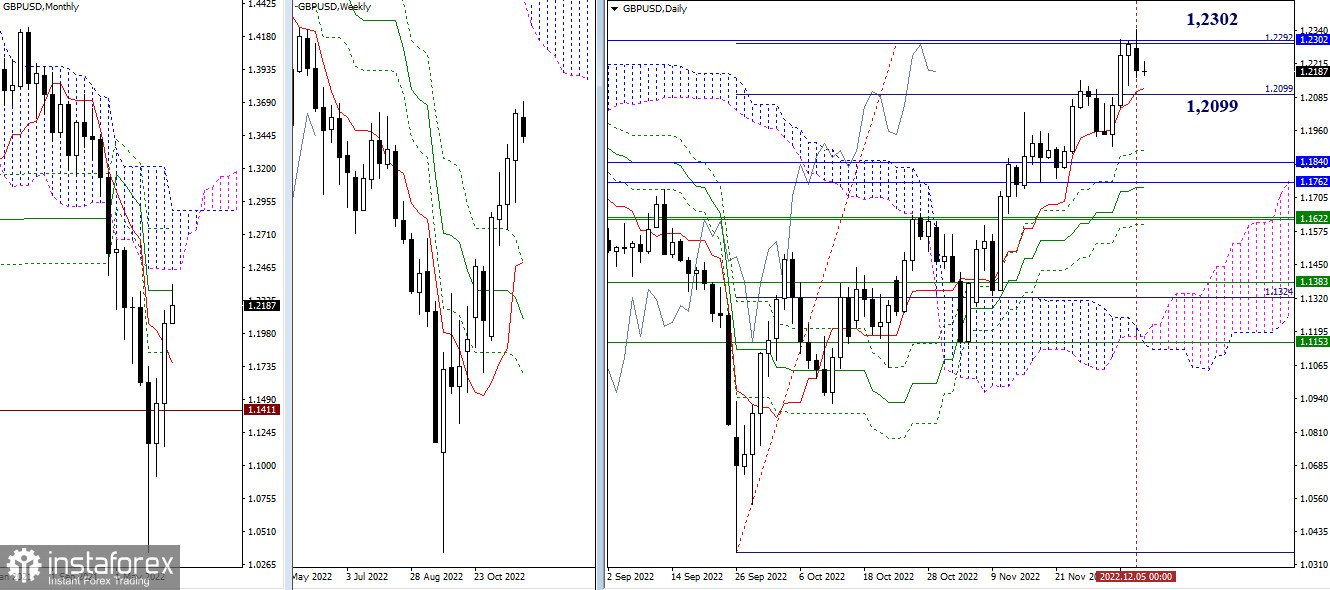

GBP/USD

Higher timeframes

In the daily time frame, a breakout through the Ichimoku cloud at 1.2292 took place. The target was seen at 1.2302 (medium-term trend). As a result of a test in the daily time frame, a pullback occurred. An increase in bearish sentiment may push the pair to support standing at 1.2121 and 1.2099 (daily short-term trend + first daily target) and then to 1.1840 and 1.1762 (daily and monthly Ichimoku crosses).

H4 – H1

In lower time frames, a bearish correction is ongoing. The pair is approaching the support level of 1.2146 (weekly long-term trend). This is where the distribution of trading forces takes place. Bullish sentiment may increase if the price goes above the MA. Meanwhile, bearish sentiment may rise in case of consolidation and a reversal below the MA with a shift in trading forces. Additional support today stands at 1.2118, 1.2048, and 1.1935.

***

Indicators used in technical analysis:

Higher timeframes: Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – Pivot Points (classic) + Moving Average 120 (weekly long-term trend)