What issues should this week's currency traders discuss? Business activity indices for the UK, the USA, and the European Union's services sectors were made public at the start of the week. While they continued to fall short of the crucial 50.0 points in the UK and the EU, the US index unexpectedly increased above 55.0 points. The dollar should have strengthened this week. The third quarter GDP for the European Union was almost the only report of the week that wasn't about America, and it was only released on Wednesday. It supported the demand for the euro but has already grown sufficiently in recent weeks and months. In the third quarter, GDP growth was 0.3% q/q; in the United States, the increase was 2.9% for the same quarter. The US dollar had more reasons to increase, even based on this aspect.

But as I have repeatedly observed, there is simply no desire to see an increase in demand for American currency. Of course, the market supports this because it does not want to purchase dollars. However, based on this point, the question arises: under what circumstances can the market increase demand for the US currency again? Or should we disregard the dollar's growth in the upcoming months and years? There would be no questions since it is correct - the alternation of ascending and descending structures - if the instruments had at least built the correction sections of the trend, as the wave marking now requires. But right now, all we see are sections of corrective upward trends.

The first meeting of the three regulators will take place in less than a week, but what does the market anticipate, given that each central bank's decision has already been made? The Bank of England, the ECB, and the Fed will increase interest rates by 50 basis points or more. In addition, there is a good chance that European and British regulators will slow down the tightening of monetary policy. Based on everything mentioned above, the market is anticipating the ECB and Bank of England meetings rather than the Fed meeting. Nothing will happen if these banks' rates increase by 75 points because the market is already anticipating this. The currency demand may finally decline if these banks' rates increase by 50 points, allowing both instruments to construct the necessary downward trend sections.

Since all of the most significant recent reports (like nonfarm payrolls) did not have the intended impact on the market mood, I can only see this scenario at this time.

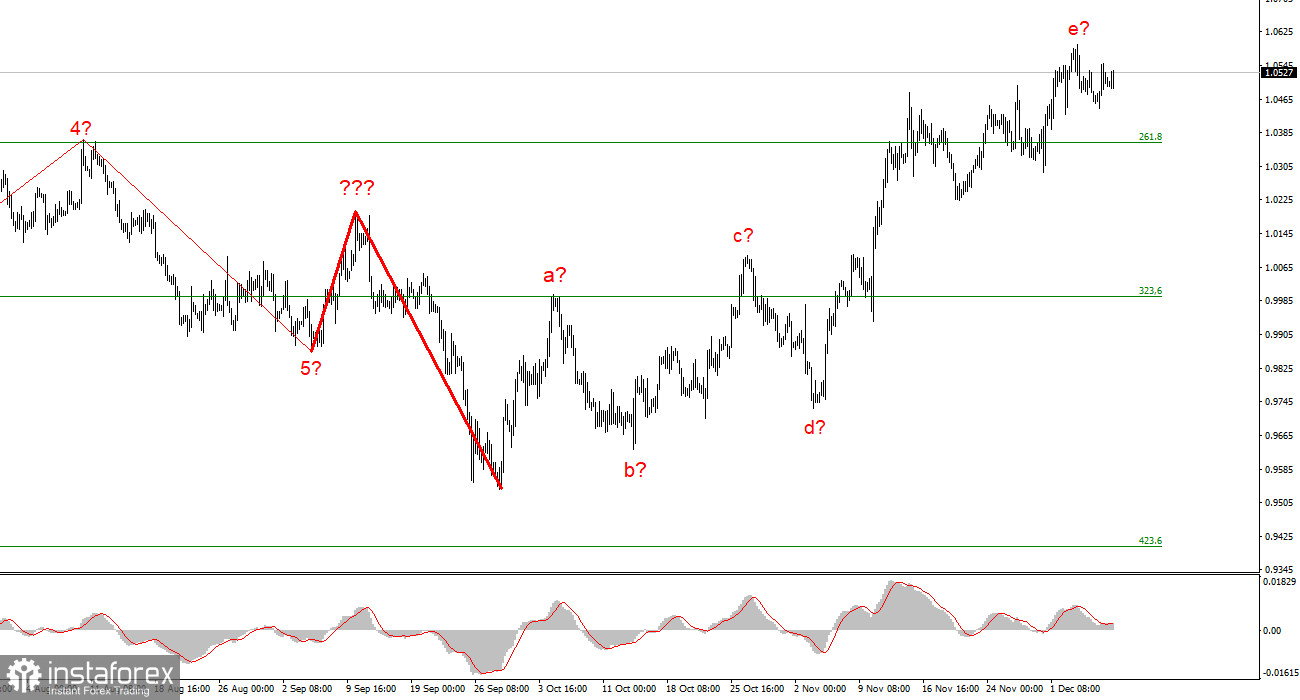

The upward trend section's construction is complete and has increased complexity to five waves. As a result, I suggest making sales with targets close to the estimated 0.9994 level, or 323.6% Fibonacci. The likelihood of this scenario is increasing, and there is a chance that the upward portion of the trend will become more complicated and take on an extended form.

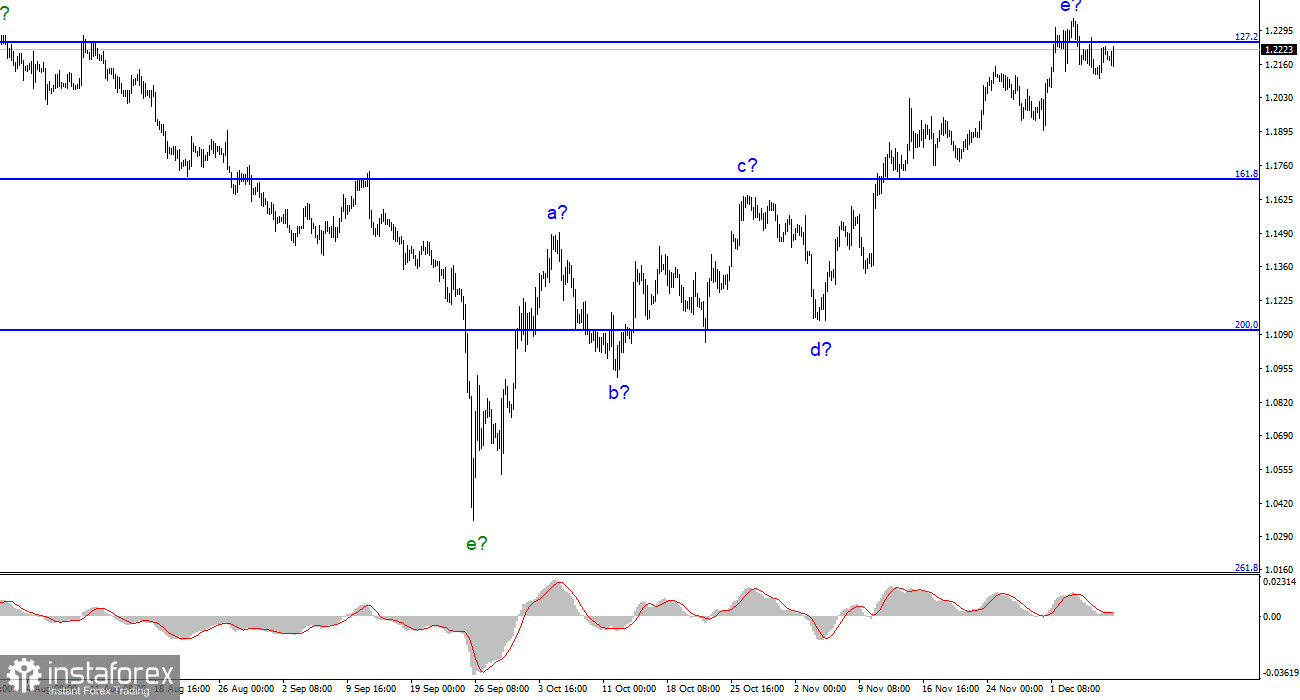

The construction of a new downward trend segment is predicated on the wave pattern of the pound/dollar instrument. I cannot suggest purchasing the instrument immediately because the wave marking already permits the development of a downward trend section. Sales are now more correct with targets around the 1,1707 mark, which equates to 161.8% Fibonacci. The wave e, however, can evolve into an even longer form.