The robust US economy and aggressive rate hikes are strong trumps for the US dollar but they are not the only ones. The USD index rose due to strong demand for safe-haven assets at a time when markets were dominated by fear. The armed conflict in Ukraine, the energy crisis, the turmoil in the British financial markets, and COVID-19 outbreaks in China - this is not the whole list of events that forced investors to get rid of risky assets. The fall of stock indices was another driver of the EUR/USD peak. However, at the end of 2022, the situation started to change. In 2023, we may see more strange events.

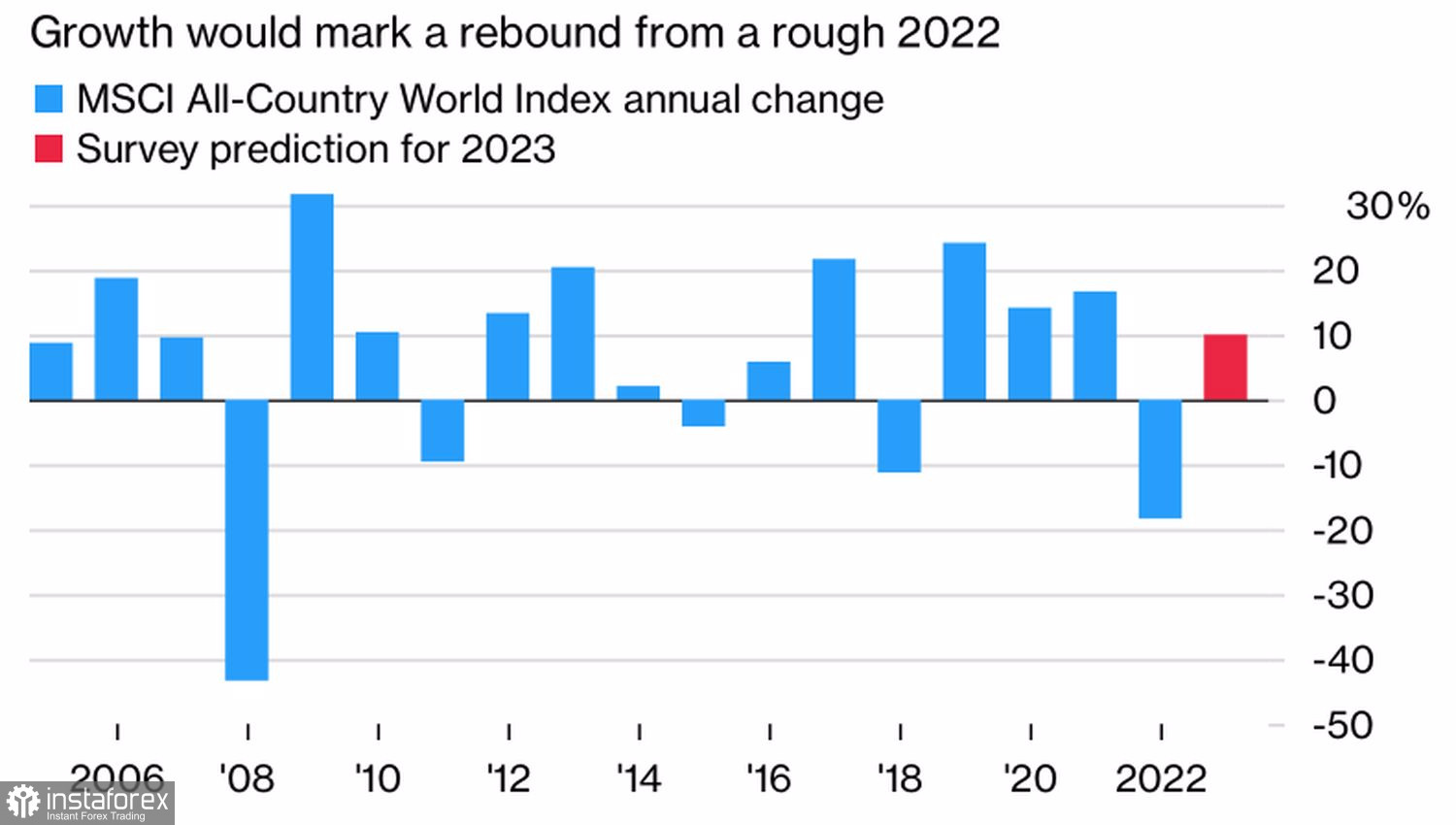

The Bloomberg survey of 134 global investors - which included such major asset managers as BlackRock, Goldman Sachs Asset Management and Amundi - shows that 71% expect the global equity market to grow next year. The median estimate was +10%.

Global stock market

Investors see the main risk factors as stubbornly high inflation (48%) and a deep recession (45%). Against this backdrop, stock indices will lose ground and close the year in the red. If US consumer prices do not continue to slow down, the Fed will be forced to raise rates higher than expected. A deep recession would increase demand for the US dollar as a safe haven asset.

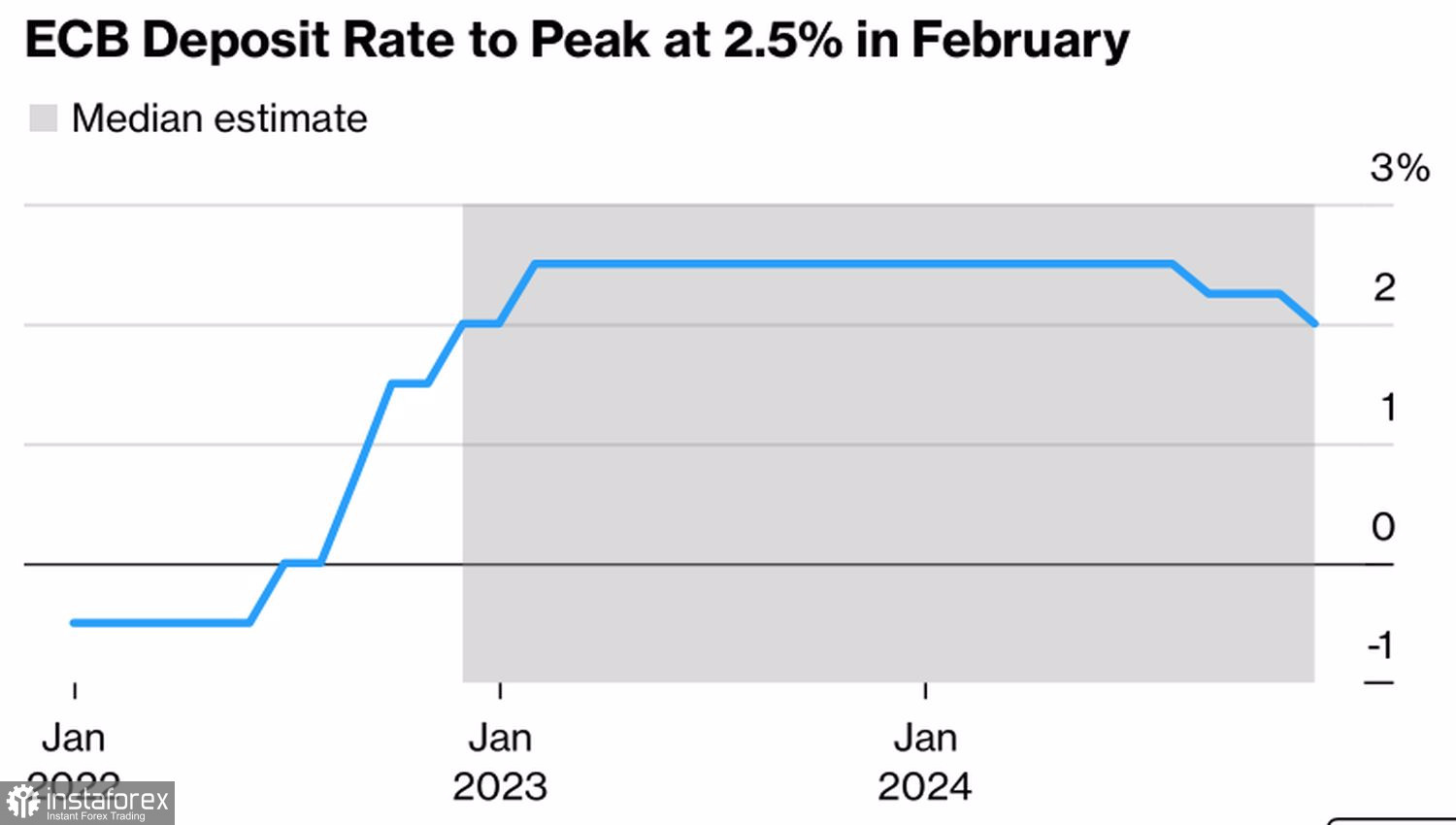

At the same time, the favorable outlook for equities is one of the positive factors for the EUR/USD pair in 2023. Among other factors are the rapid recovery of China's economy after easing restrictions and a less deep recession in the eurozone than expected. Bloomberg experts forecast that the EU GDP may shrink in winter and then slowly start to grow. At the end of next year, the deflation will be a modest 0.1%. Meanwhile, inflation will slow to 6.1% at the end of 2023 and the deposit rate will peak at 2.5%, slightly below market estimates of 3%.

ECB deposit rate

Thus, if the US economy faces a recession no earlier than Q2, by that time the eurozone will have already started to recover and China will grow significantly. This will create the necessary environment for an increase in global appetite for risk and will support the EUR/USD pair. Moreover, by March 2023, the Fed is likely to complete the cycle of monetary policy tightening, finally depriving the US dollar of an important driver.

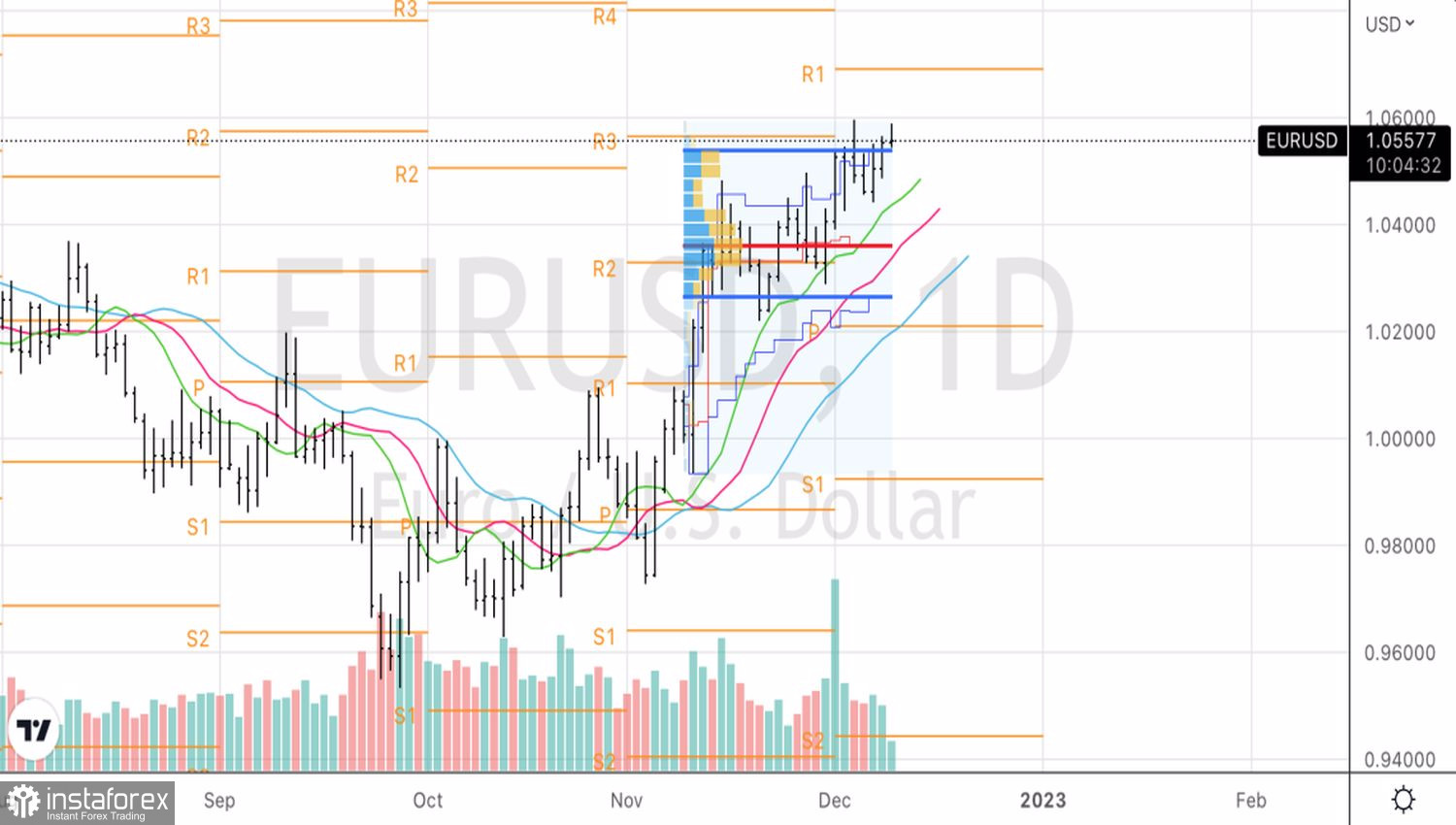

This scenario assumes that the US currency may resist the euro for one to three months but then the bulls are likely to dominate the market. This gives grounds to predict that by the end of February the euro will be quoted at $1.03, and then it will grow to $1.08 at the end of the next year.

Technically, the return of the EUR/USD pair to the range of 1.027-1.054 may strengthen the risks of an upward pullback and be the basis for short-term sales in the direction of 1.05 and 1.044.