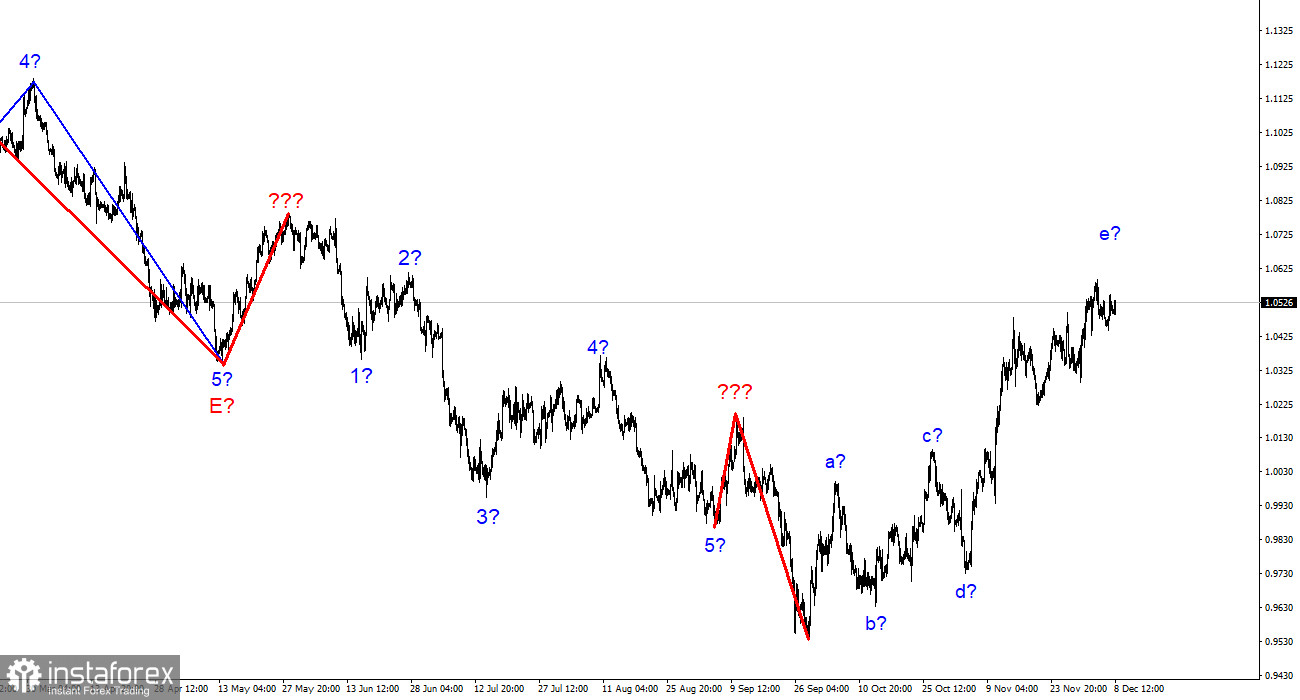

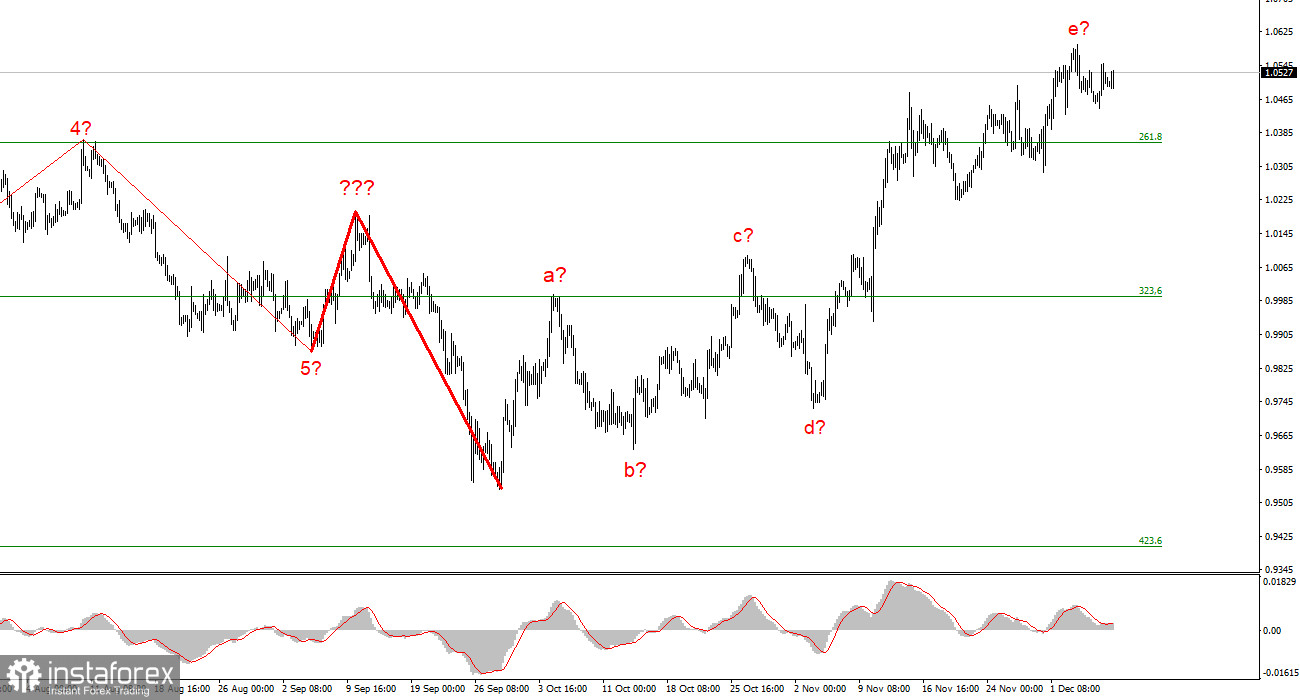

The wave marking on the euro/dollar instrument's 4-hour chart still appears to be quite accurate, but the entire upward section of the trend is becoming more convoluted. It has already assumed a clear corrective and somewhat prolonged form. We have obtained a complex correction structure of waves a-b-c-d-e, in which wave e has a much more complex form than the first four waves. Since wave e is much higher than the peak of wave C, if the wave markings are accurate, construction on this structure may be nearly finished. In this instance, it is anticipated that we will construct at least three waves downward, but if the most recent phase of the trend is corrective, the subsequent phase will probably be impulsive. Therefore, I am preparing for a new, significant decline in the instrument. The market will be ready to sell when a new attempt to break the 1.0359 mark, which corresponds to 261.8% Fibonacci, is successful. The last decline of the instrument, however, is not the first wave of a new descending section; rather, the rise in the instrument's quotes over the past few weeks suggests that the entire wave e may end up being longer. Consequently, the scenario involving the first two waves of a new downward trend segment is rejected. Because there is no increase in demand for US currency, the wave pattern starts to become muddled and complex.

The euro/dollar exchange rate is stable but not in the dollar's favor.

On Friday, the euro/dollar instrument decreased by 20 basis points. This week's news background could have been much better. There were only a handful of events, more or less interesting ones, that did not result in a significant market response. I can only draw attention to two things on Friday: the producer price index and the consumer sentiment index in the US. The market typically ignores both of these reports at these times. The consumer price index, or inflation, is much more significant than the producer price index. The producer price index and other indices that reflect price changes decrease when inflation falls. As a result, the drop in this indicator from 8.1% to 7.4% is neither surprising nor intriguing.

About the consumer sentiment indicator, the same thing is true. Long before it was close to 50, it started to decline. It was reliably located close to the 100-mile mark a few years ago. Therefore, despite all of their efforts, changes of 2-3 points for one month cannot be deemed significant, and the market even needs to pay more attention to this. As a result, the instrument's amplitude on Friday was once more lacking. With the release of the producer price index, there was a brief increase in activity, but things quickly returned to normal. By Friday's end or the end of the previous week, there was no increase in demand for the US dollar. Let me remind you that the current wave marking assumes that both the ascending wave e and the ascending trend section have been built to completion. However, if the demand for US dollars rises, a new wave and part of the trend will not have the chance to begin to develop physically. It ends up being close to a deadlock.

Conclusions in general

The upward trend section's construction has grown more intricate and is almost finished. As a result, I suggest making sales with targets close to the estimated 0.9994 level, or 323.6% Fibonacci. The likelihood of this scenario is increasing, and there is a chance that the upward portion of the trend will become even more extended and complicated.

The wave marking of the descending trend segment becomes more intricate and lengthens at the higher wave scale. The a-b-c-d-e structure is most likely represented by the five upward waves we observed. After the construction of this section is finished, work on a downward trend section may resume.