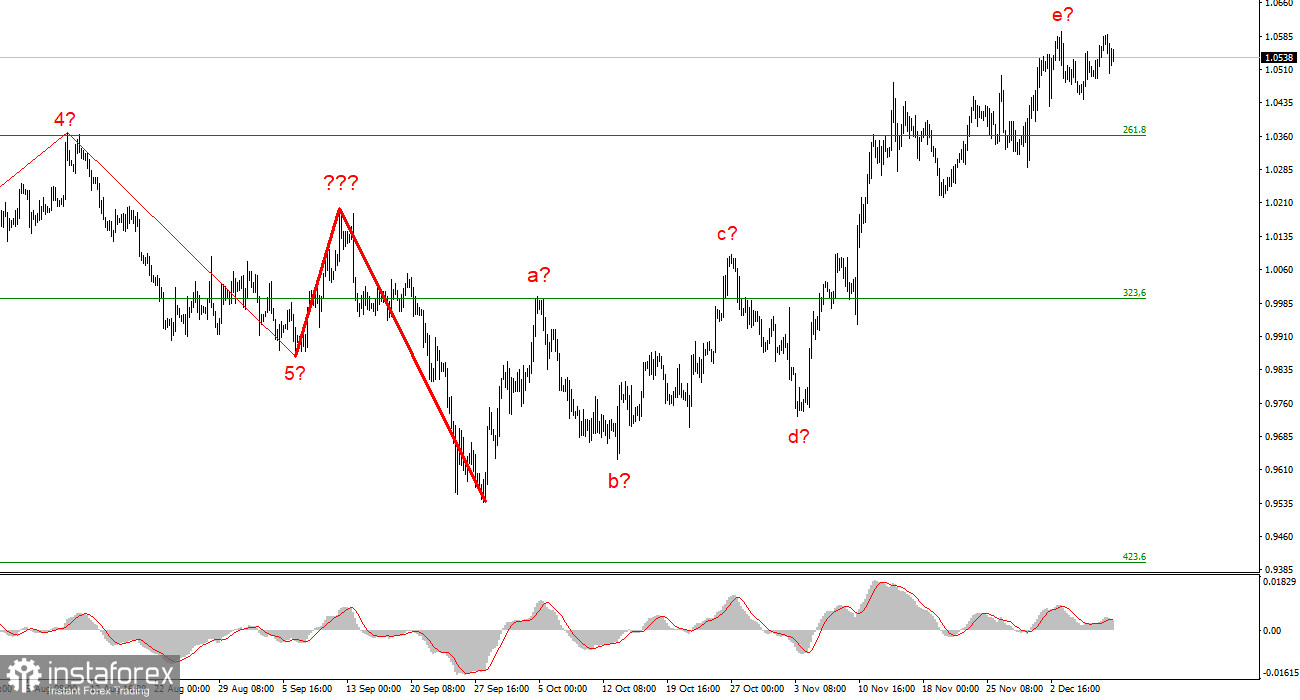

The Bank of England, the ECB, and the Fed will all meet this coming week. There will also be reports on the US inflation rate, the UK's GDP and inflation, and the EU's inflation rate. As a result, you won't have to be bored. I decided to concentrate on the choices central banks can make this week in this article. Recent discussions about how much a specific regulator can raise in December have been ongoing. No one had any concerns about the Fed acting alone. For several weeks, the FOMC members unanimously stated that the rate at which monetary policy was tightening needed to be slowed. As a result, I anticipate a rate increase of 50 basis points, which aligns with official projections and the consensus among market participants. Given how long the market has known about this FOMC decision, it is highly likely that it has been reversed. Even though the wave marking indicates that the upward portion of the trend needs to be completed, I have repeatedly pointed out in recent reviews that demand for US currency is staying the same. This leads me to the conclusion that the market has been able to downplay the rate at which the Fed has been raising interest rates in recent weeks.

ECB. There have been rumors that the rate will increase by 75 basis points in December. This was supported by the fact that the ECB began raising rates much later than the Fed and that inflation in the European Union is still rising in contrast to American inflation. But now, most economists agree that the rate can only increase by 50 basis points. In this situation, the euro might receive a different level of market support than it has received in recent weeks.

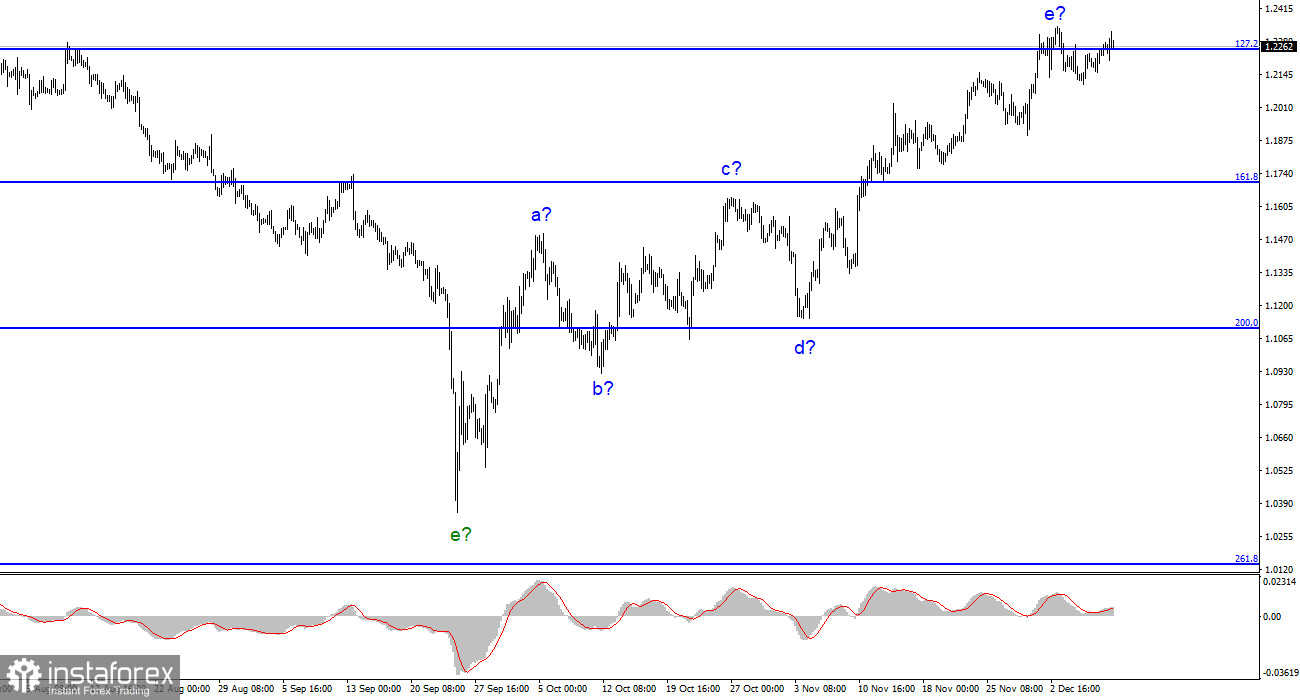

The Bank of England. A 50 basis point increase is the official prediction. Like the ECB, I had long assumed the final increase would be 75 basis points in 2023 due to the UK's persistently rising inflation rate. But as we can see, most analysts predict that the Bank of England will emulate the Fed. If this is the case, the market might stop supporting the pound sterling. Also, sometimes the forecasts still don't materialize. There's still a chance that 75 percentage points will tighten the EU and Britain's monetary policies. The currency of one of these two banks may experience an increase in market demand if 75 basis points are added to the rate. Although this week's events will depend more on the news background than the waves, the wave marking indicates the need to construct corrective waves.

The upward trend section's construction is complete and has increased complexity to five waves. As a result, I suggest making sales with targets close to the estimated 0.9994 level, or 323.6% Fibonacci. The possibility of the upward trend segment becoming more complicated and taking on a longer form still exists, and the likelihood of this happening is still very high.

The construction of a new downward trend segment is predicated on the wave pattern of the Pound/Dollar instrument. I can no longer recommend purchasing the instrument because the wave marking already permits the development of a downward trend section. With targets around the 1,1707 mark, or 161.8% Fibonacci, sales are now more accurate. The wave e, however, can evolve into an even longer form.