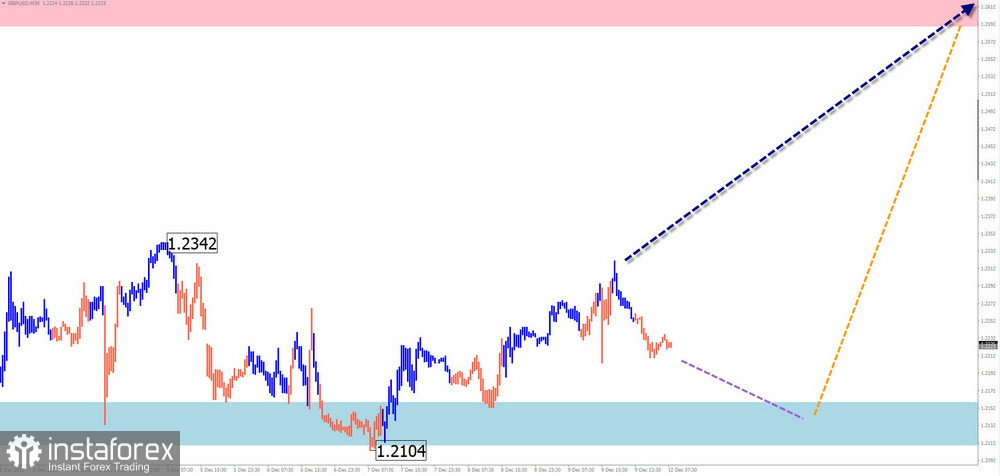

GBP/USD

Brief analysis

In comparison to the US dollar, the British pound is still rising. The quotes were in the vicinity of a strong potential reversal zone when the wave of September 26 rose. The price has been in a correction since it started moving sideways at the beginning of December. This section's organization isn't comprehensive.

Forecast for the coming week:

The sideways movement of the British pound is anticipated to continue in the first half of the upcoming week. It can decrease, but only up to the calculated support's lower limit. The end of the week is most likely to see an increase in activity, a reversal, and a continuation of the upward course.

Potential zones for reversals

Resistance:

- 1.2590/1.2640

Support:

- 1.2160/1.1730

Recommendations

Sales: are generally unprofitable and have limited potential.

Purchases: They can be advised for trading transactions after the appearance of confirmed reversal signals in the support area.

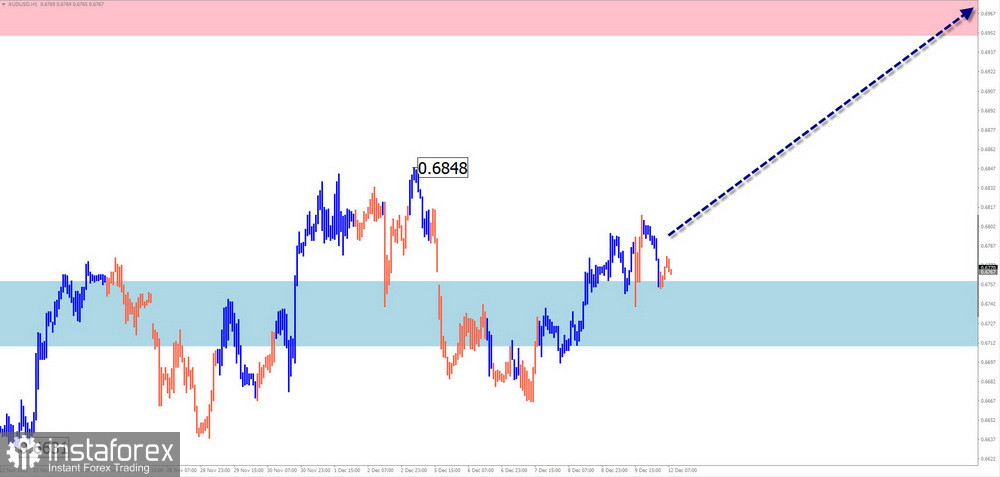

AUD/USD

Brief analysis

The wave height of the ascending portion of the October 13 Australian dollar chart was higher than that of the previous downward trend section. This is a sign that the previous trend is about to undergo a complete counterwave, at the very least. Quotes have gotten to the bottom of a significant potential reversal zone.

Forecast for the coming week:

A general flat mood of price fluctuations with movement along the support boundaries is anticipated at the start of this week. Once a reversal has formed, and the price is again rising toward the resistance level, you can wait.

Potential zones for reversals

Resistance:

- 0.6950/0.7000

Support:

- 0.6760/0.6710

Recommendations

There won't be any restrictions on sales in the upcoming days.

Purchases: this will be possible as soon as your vehicles' corresponding reversing signals appear in the support area.

USD/CHF

Brief analysis

The Swiss franc chart's descending plane has reached the end of its formation, which began in early May. Every week, the price is very close to the top of a strong potential reversal zone. On the chart, there are no reversal signals.

Forecast for the coming week:

The pair's rate is predicted to drop to the upper and lower bounds of the calculated support in the coming week, marking the full completion of the downward movement vector. Short-term growth at the start of the week must be considered, at least not above the levels of the resistance zone.

Potential zones for reversals

Resistance:

- 0.9450/0.9500

Support:

- 0.9250/0.9200

Recommendations

It is premature to make purchases before the current wave is finished.

Sales will be possible during individual trading sessions with a smaller lot.

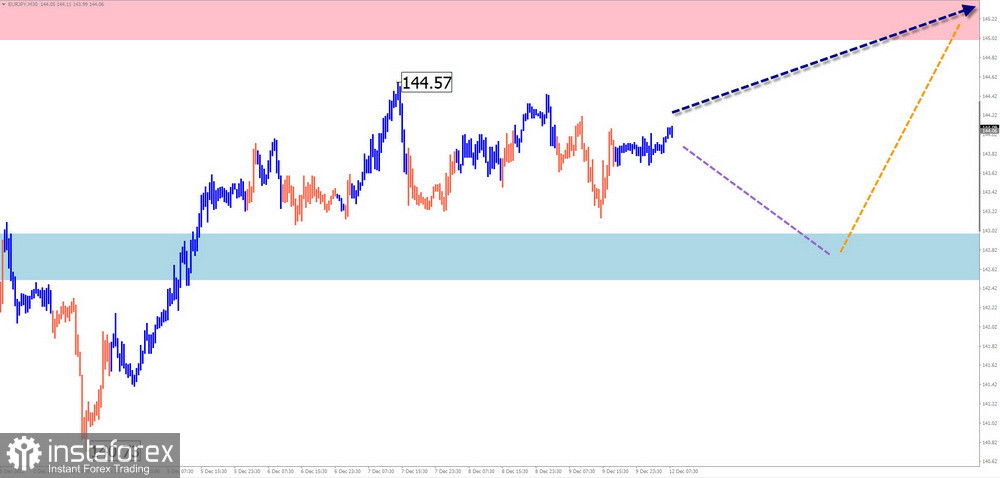

EUR/JPY

Brief analysis

The descending plane from October 17 is the incomplete wave structure on the chart for today's euro/yen pair. For the previous month, the wave structure has been undergoing a counter correction in the shape of a shifting plane.

Forecast for the coming week:

It is anticipated that the price increase will be completed in the vicinity of the calculated resistance during the upcoming week. A "sideways" along the support borders is most likely in the early going. Closer to the weekend, the most activity should be anticipated.

Potential zones for reversals

Resistance:

- 145.00/145.50

Support:

- 143.00/142.50

Recommendations

Sales should be advised in the near future.

Purchases are possible in fractional lots following the appearance of your used signals in the vehicle's support area. The resistance restricts the possibility of an upward entry.

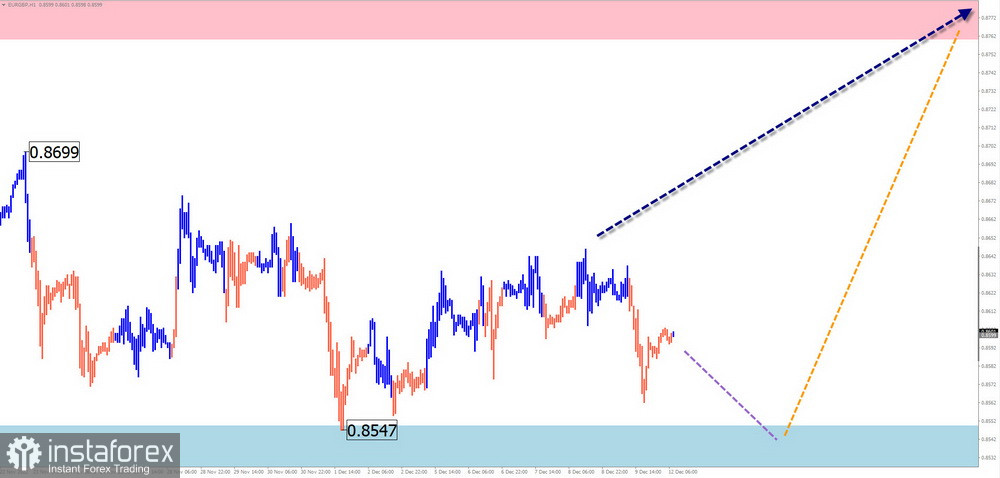

EUR/GBP

Brief analysis

The descending wave algorithm starting on September 26 determines the trend direction on the cross pair of the British pound and the euro chart. On the charts, a counter-flat correction has been forming since the beginning of November, but it still needs to be finished.

Forecast for the coming week:

The descending vector is anticipated to be finished at the start of the upcoming week. You can anticipate the formation of a reversal and the start of a price rise in the vicinity of settlement support. By the end of the week, there will be the most activity.

Potential zones for reversals

Resistance:

- 0.8760/0.8810

Support:

- 0.8550/0.8500

Recommendations

Sales: They won't matter in the coming days.

Purchases: Short-term transactions can be carried out following the appearance of reversal signals in the vicinity of the support zone.

EUR/CHF

Short analysis

A descending wave on the euro/Swiss franc cross chart indicates the trend's direction since the start of May. On September 26, a counterwave toward the main course began. At this point, it has not risen above the correction level. The wave structure still needs to be finished.

Forecast for the coming week:

The price of the pair anticipates a downward trend in the coming days. The boundaries of the support zone can be anticipated for the decline. There is a strong likelihood that the price rise will reverse course and resume in the second half of the week, continuing up to resistance levels.

Potential zones for reversals

Resistance:

- 0.9960/1.0010

Support:

- 0.9760/0.9710

Recommendations

Sales: possible with a reduced lot within the intraday.

Purchases: This will become possible only after confirmed reversal signals appear in the support area.

Explanations: In simplified wave analysis (UVA), all waves consist of 3 parts (A-B-C). At each TF, the last incomplete wave is analyzed. The dotted line shows the expected movements.

Attention: The wave algorithm does not consider the duration of the movements of the instruments in time!